LIVE AT 4 PM ET: Roger reveals Alpha Zone Pro’s next daily options targeting 50%+ gain potential

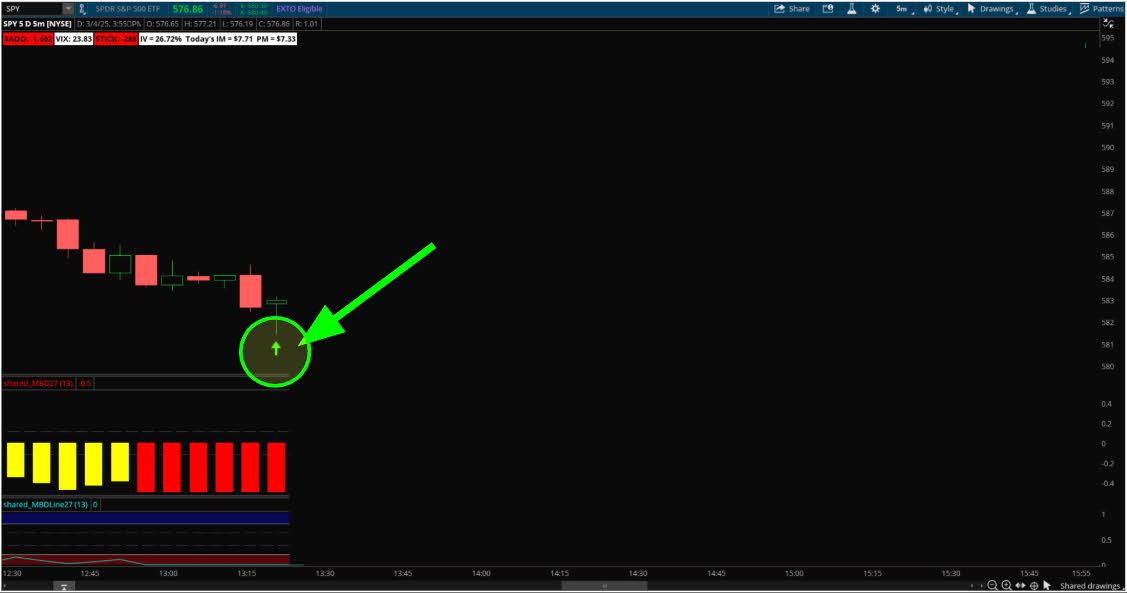

Market snapbacks present a unique trading opportunity if you know what to look for. When a pullback occurs — often sharp and seemingly paralyzing — a quick rebound might follow, setting the stage for an attractive entry point.

I’ve seen this time and again, and I want to share some insights on recognizing and trading these snapbacks.

Identifying the Opportunity

The key is to watch for those rapid dips that aren’t followed by a sustained downtrend. In many cases, you’ll notice a series of quick pullbacks — a sudden drop move followed by a swift recovery that signals short-term exhaustion in the sell-off.

I pay close attention to technical levels, such as support around the 50-day moving average, which often acts as a pivot point for the market. When I see the market falling sharply then bouncing back to these levels, I know that conditions are ripe for a snapback.

Keep an eye on broader market sentiment.

Often the S&P 500’s sectors — like Financials (XLF), Utilities (XLU) and Communication Services (XLC) — will show resilience during these moments, suggesting that underlying fundamentals remain strong.

If a heavy sell-off isn’t supported by deteriorating fundamentals, a rebound is likely to occur.

Executing the Trade

Once you’ve recognized the telltale signs of a market snapback, timing is critical. I like to wait until the immediate panic subsides and price begins to stabilize.

This pause is your cue to enter on strength before the full reversal plays out. Tools like options can give you the flexibility to ride the snapback — even a short-dated call option can capture much of the upside.

For those trading stocks, I watch for evidence of capital injections at the close, which will often lead to a strong morning the next day — evidence that smart money was ready to step in.

I always remind myself — and fellow traders — not to get caught in the fear but to follow the data. Snapbacks are a natural part of market behavior, and with proper analysis, you can capitalize on these short-term rebounds.

Whether you’re using a traditional brokerage or a platform like Thinkorswim, the fundamentals remain the same: recognize the pattern, confirm the support levels, and act swiftly once the market signals a reverse in sentiment.

The dream is to turn what appears to be a dire dip into a well-timed entry — a classic example of buying low amid temporary panic. Stick to your plan, execute with precision, and always keep a keen eye on market dynamics.

That’s the approach that has consistently paid off when trading market snapbacks.

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

Roger Scott is about to reveal the exact ticker Alpha Zone Pro is flagging what could be the next big daily options win…

And it’s going down at 4 p.m. ET!

Using the same methodology that’s achieved a 94.1% win rate, Roger is now revealing the precise Alpha Zone Pro setup to target the next potential daily options winner.