No doubt about it — this has been one of the wildest week and a half the market’s seen in years.

The back-and-forth moves have been so extreme it feels like we’re trading headlines, not stocks. But when the tape gets this chaotic, I like to zoom out and check a few big-picture signals.

First — we’ve now got a very small number of stocks trading above their 200-day moving average. Historically, that kind of low number tends to show up right before a bounce.

Second — the fear gauge (aka the VIX) is flashing extreme readings. When fear gets this high, it usually marks the end of a panic, not the beginning.

And third — whenever the VIX closes above 45 for the week, forward returns tend to look surprisingly strong.

And, remember, seasonally speaking, April is one of the most bullish months of the year.

So, yes, the news cycle is still wild. But panicking now would mean ignoring some pretty compelling signals that a short-term rebound could be brewing.

So stay focused and stay calm.

And stay tuned! I’ll share what I see in this daily newsletter, and on the “Opening Playbook” with Nate Tucci at 10 a.m. DAILY now! That’s right, instead of twice a week, Nate is joining me and we’re going live each and every day to have to some fun and share actionable insights each and every weekday!

Markets Whipsaw Again as Tariff Tensions Spike

As we discussed above, markets have been on an absolute roller coaster, though Friday is bringing a little relief heading into lunchtime on the East Coast with the three major indexes up a bit.

Stocks whipped back and forth after China announced a hike in tariffs — from 84% to a whopping 125% — in direct response to President Trump’s ballooning “reciprocal” duties.

But here’s the twist: They also said they’re done retaliating for now. That bit of restraint has kept the market from falling off a cliff — though it’s still fluctuating quite a bit.

Meanwhile, Wall Street was busy digesting earnings from JPMorgan (JPM), Wells Fargo (WFC) and BlackRock (BLK), trying to figure out just how much the trade chaos is affecting the Financial sector (XLF).

JPMorgan CEO Jamie Dimon didn’t mince words, calling the economy “extremely turbulent.”

Still, despite the mess, the major indexes are probably going to finish up on the week — thanks mostly to Wednesday’s historic rally.

In other words… buckle up.

This market’s still in whiplash mode.

Apex Indicator: COST

Well, the huge market move up on Wednesday has stopped the bleeding on several stocks.

And while we don’t have a clear signal yet, it looks like we might be getting one soon.

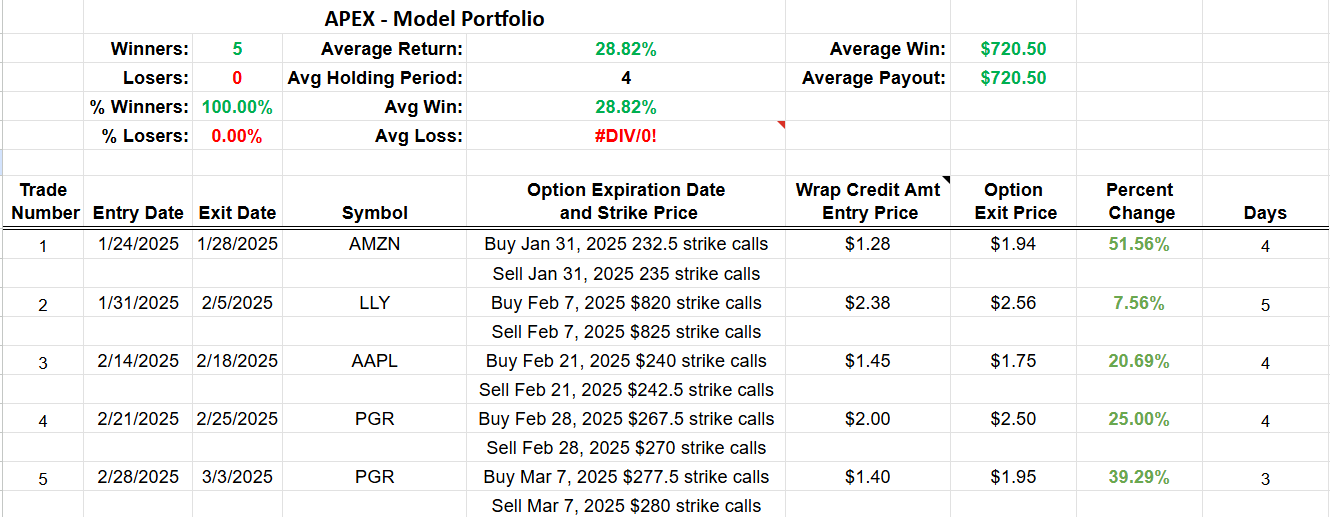

First, here’s our model portfolio for these free signals I share each week:

That 100% win rate won’t last forever, of course, but it’s great to see early success! There are no guarantees in trading, so trade at your own risk. But we’ll keep these signals coming because I want to show off the power of my Apex Indicator.

So, what stock is still looking positive?

The same one as last week: Costco (COST). Here’s the chart:

It’s rising off the lows today and could be a buy next week if the panic subsides. Our target would be up at $1,085.56, and our stop would be down at $855.92.

We enter these trades using wrap orders, and for more training on how to place wraps… go here!

That’s all for today. I hope everyone has a great weekend — join me and Nate at 10 a.m. ET weekdays for “Opening Playbook”!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. What Chuck Hughes Is Leaving Behind — Get In Before It’s Too Late!

Former jet pilot in the Air Force, moved on to fly commercial planes, then became a 10X trading champion with his Trading Service live signals producing 25 years of profits with no down years! All I’ve described above is Chuck Hughes. You see, not many traders alive I’ve seen can boast of the same track record this man has.

He’s been in this game for 40 years, that’s more than most of my buddies have been alive…

He’s been in this game for 40 years, that’s more than most of my buddies have been alive…

I first met Chuck five years ago, and I couldn’t believe his story.

Started with just $4,600 while working as an airline pilot.

Made over $460,000 in his first two years of trading.

Profited through FIVE major market crashes without a down year.

Generated $3.4 million in verified trading profits.

This guy is the real deal… The kind of trader others tell stories about.

And he became my mentor.

Under his guidance, I doubled my trading account in six months… Then did it again last year.

But last month, Chuck told me something that shocked me.

“After 40 years, I’m ready to give it all away,” he said.

When he first told me this, I wasn’t sure what to think.

“Are you sure?” I asked.

“Yes,” he told me. “I think it’s time.”

Chuck explained that at this point in his life, he’s thinking about his legacy.

His family… The mountains in Hawaii he wants to explore… The expeditions in Australia he’s planning.

He won’t be doing this forever.

And he wants to share something extraordinary before he steps away.

Something that could allow everyday traders to target $1,000+ profits, on a $5k starting stake with just minutes of effort.

From anywhere in the world… Using just a smartphone.

Even during market crashes like we are seeing right now.

And coming from someone who’s traded every kind of market you can imagine for the last 40 years, there’s nobody more qualified that I know of than Chuck Hughes.

That’s why this Monday at 1 pm Eastern, Chuck is making a public unveiling – and he’s asked me to join him.

And there was NO WAY I was turning down that opportunity.

Of course, while I cannot promise future returns or shield against losses…

If you’d like to join us to see what Chuck Hughes is saying might be his final legacy project, tap this link to reserve your seat for Monday.

If you’ve been struggling to make consistent income in the markets…

If you’ve watched your portfolio get hammered by volatility…

If you want to learn from someone who’s actually done it, not just talked about it…

This is your chance.