I just wrapped up another edition of “Opening Playbook” — don’t forget to join me at 10 a.m. ET every Thursday for a juicy hour-long session full of actionable info and… yes, trade ideas!

It’s been a monster week of earnings with Tesla (TSLA), Meta Platforms (META) and Microsoft (MSFT) behind us, but we still have Apple (AAPL) and others ahead.

Apple’s been taking a beating since right after Christmas, but things are looking great ahead of today’s report, up about 6.5% the past week — I’m getting very bullish again.

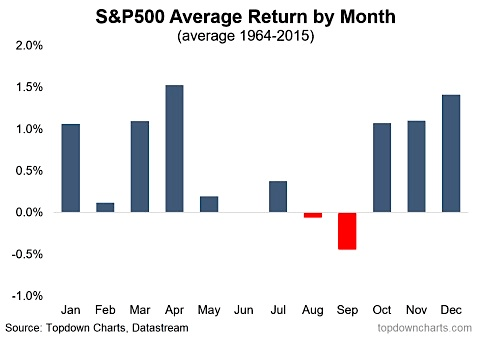

Something else has me feeling a little less bullish for the broad markets, and that’s seasonality…

February is almost upon us, and thankfully it’s one of the shortest months because seasonality shows it’s the fourth-worst of the year on average for S&P 500 returns.

Post-election years after the incumbent party loses also don’t look so great compared to when the incumbent wins…

And just four of the 11 major S&P 500 sectors generally perform well in February. Again, thankfully February is the shortest month, because look what usually happens in March, April and May!

That’s a lot of green…

We’re also starting to see some notable shifts among the sectors, with Health Care (XLV) and Consumer Staples (XLP) moving up three spots and Energy (XLE) moving up two. Meanwhile, Technology (XLK) fell four spots, Basic Materials (XLB) two, and Utilities (XLU) and Real Estate (XLRE) each dipping one spot.

My top picks are Consumer Discretionary (XLY) and XLE, with XLRE being my worst projected sector.

Hotsheet Pick of the Week

My newest Hotsheet pick is Cal-Maine Foods (CALM), which is trading around $113 a share this morning and it’s in that surging XLP sector I mentioned above.

Beginning on Jan. 31 and stretching over the next 26 days, you can get an average 3.5% gain — remember, this is just a strong seasonal average and no guarantee.

CALM

- 21 Feb 25 EXP

- Buy the $110 Call.

- Sell the $115 Call.

Be sure to use a limit order for $2.80 and let it sit for a while until you get filled — this can take a while sometimes, even like an hour. If you use a market order, you’ll get a bad fill, so just be patient.

You can also up the risk, meaning you’d need a bigger move in the stock, by going with the $115-$120 vertical spread. This stock is moving fast today so you may need to go to the higher set of strikes by the time you read this.

I have a strategy where I share these plays each week, so be sure to check that out here!

And finally, let’s discuss some free trade alerts!

The Weekly Breakout

Lululemon LULU is our free weekly trade idea, a stock that I really like and have traded many, many times. It’s also in the seasonally strong Consumer Discretionary sector I mentioned above.

LULU

- 7 FEB 25 EXP.

- BUY $417.50 CALL.

- SELL $420 CALL.

This is a bullish wrap order — a “vertical spread” in Thinkorswim — and I was filled instantly at $1.25 a contract. You may need to adjust since you’re reading this after we entered the trade. But don’t chase…

I would rather miss a trade than get filled at a bad price.

We just need LULU to reach $420, a tiny move from our entry during the stream, to double our money. If the stock is between the two strikes, then I’ll close it out at the mid-point price next Friday morning (the day of expiration).

Since we’re buying and selling a call, there’s no chance of getting assigned shares of the stock.

If it falls below our two strikes, it will be a 100% loser, so it’s very important to know where you stand and what you can lose — the premium you pay to enter the trade.

The Overnighter

This is of course an overnight trade, and we’ll do this one in Arista Networks (ANET).

ANET

- 31 JAN 25 EXP

- Buy $113 CALL

- SELL $114 CALL

I got filled at $0.50.

If ANET closes above $114 tomorrow, which is a tiny move in the stock, we can double our money overnight.

And again, if it closes below the two strikes, you’ll lose your price of entry.

We cover a ton of trade ideas each and every week, so be sure to tune in next week!

Finally, I’ll be live again at 1 p.m. ET to reveal a trade that I’m putting $100k of my own money into as soon as the buy signal flashes — which I expect should be on Friday!

You’ll see the exact details behind the setup…

And why I’m so confident that I’m willing to put a cool $100k into it — join me here at 1 p.m. ET for more good stuff!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. My $100k Trade: The Final Buy Signal Could Fire on Friday

It’s finally time!

I’m in the LIVE room right now with regular traders like you, where I’m sharing details of my $100k trade…

You see, if you had tagged along with me the last two times we spotted an opportunity on this stock…

You could’ve clocked in solid triple-digit moves — on two different occasions!

And now that the opportunity is building again on this stock, we could be looking at an even bigger opportunity — when the buy signal fires up like the past two times.

Naturally, I can’t guarantee wins or prevent losses…

But when you join the live room, you’ll get the ticker symbol… the entry and exit trigger… and more importantly, the indicator to use.

But you need to hurry, the LIVE room is getting filled up fast — and you don’t want to miss out!