The stock market is giving us a familiar setup, and if history is any indication, the next 90 days could be very interesting. We just saw a classic post-earnings flush in Nvidia (NVDA), which dragged the broader market down, including the S&P 500 and Nasdaq.

But rather than panic, I see this as a setup for a strong seasonal buying opportunity.

This kind of volatility isn’t unusual. Back in April 2024, we saw a similar shakeout before the market found its footing and rallied. I believe we’re approaching another one of these moments. A temporary pullback, followed by stabilization, could lead to a solid buying window for the S&P 500.

Big money isn’t ignoring this dip either. Bitcoin whales made major purchases overnight, hinting that smart money is stepping in while the market looks shaky.

Meanwhile, economic data like GDP and jobless claims came in relatively stable, keeping the backdrop supportive.

Looking ahead, next week’s unemployment report will be a key event, but overall, I expect strong market performance into the next quarter. The setup looks eerily similar to previous seasonal buying opportunities. If you’ve been waiting for a dip, this might just be it.

Remember, the seasonal tendency is bullish momentum for March…

So keep your eyes peeled for potential opportunities.

Of course, I’ll share what I see in this newsletter, on my “Opening Playbook” livestreams at 10 a.m. ET on Tuesdays and Thursdays, and during my special events!

February Market Turmoil: Inflation, Tariffs and Tech Troubles

It’s been a rough ride for stocks, and February is wrapping up with a thud. The Nasdaq is set to drop over 5% this month, while the S&P 500 and Dow are both looking at losses around 3%. Big Tech has been hit especially hard, with tariff drama adding another layer of uncertainty.

On the bright side, the latest Personal Consumption Expenditures (PCE) index — the Fed’s go-to inflation gauge — came in as expected. “Core” PCE cooled to 2.6%, which at least didn’t add more fuel to the inflation fire.

But consumer spending? That dropped 0.2% last month, missing expectations for a small gain.

And then there’s the tariff wildcard…

Beijing isn’t happy, vowing to retaliate after Trump announced new 10% tariffs on Chinese imports starting next week. He’s also eyeing more duties on Mexico, Canada and the EU, keeping global trade tensions high.

Meanwhile, Bitcoin is in free fall, plunging 7% to its lowest level since November. It’s now down 25% from its record high, caught in a broader crypto rout — though rallying some today.

So, what’s next?

With volatility high and tech under pressure, rotation into other sectors could be the key theme ahead. Stay nimble — because this market isn’t giving anyone an easy ride.

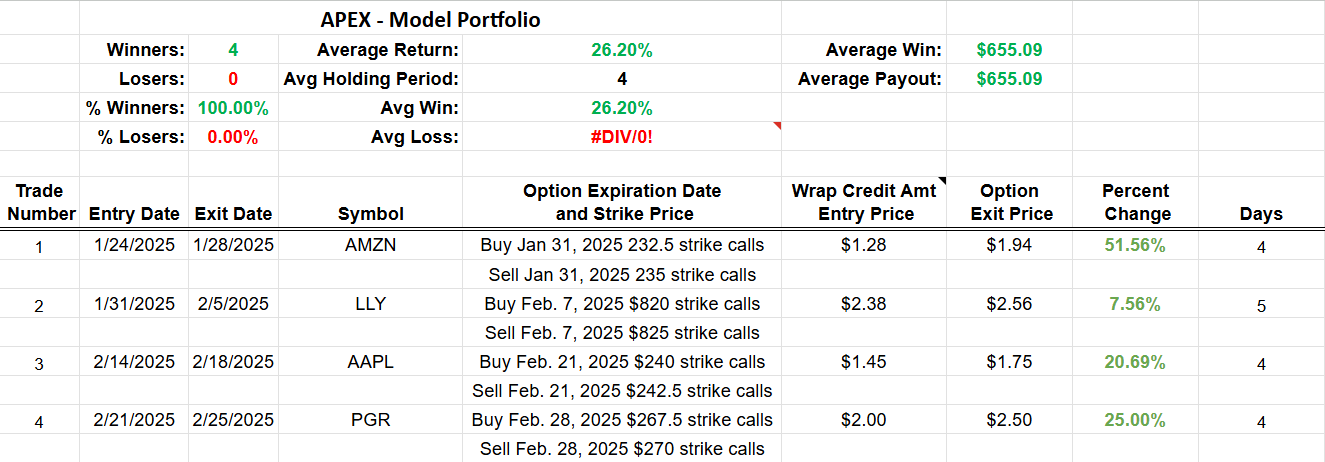

Apex Indicator: PGR

Last week, we sent out a signal on Progressive (PGR)…

We had a target on the stock of $275.73 and it got there on Tuesday. So that would’ve been the exit for a nice win!

Here’s our model portfolio for these free signals I share each week:

That 100% win rate won’t last forever, of course, but it’s great to see early success! There are no guarantees in trading, so trade at your own risk. But we’ll keep these signals coming because I want to show off the power of my Apex Indicator.

And here’s the new Apex signal on…PGR again!

It busted right through our previous target and just turned blue again. That’s another entry…

And here’s a Wrap Order to play this signal.

Ticker: PGR

- 7 MAR 25 EXP.

- Buy to Open $277.5 Call.

- Sell to Open $280 Call.

This should give you a net debit around $1.40 (as of 9:52 a.m. ET)! Our target on the chart is $292.71 and our stop loss level is $245.32.

Keep in mind that the underlying stock will move by the time you read this, so you may need to adjust your strikes, the idea of a “Wrap Order” being to wrap the two strikes around the current price of the stock.

For more training on how to place wraps… go here!

The Monthly Breakout

During Thursday’s “Opening Playbook” session, we gave our usual Monthly Breakout trade.

Just as I said above, the stock price will move so you may need to adjust your strikes depending on where the price is when you read this…

The strikes are the same but I updated the Net Debit to reflect this morning’s prices.

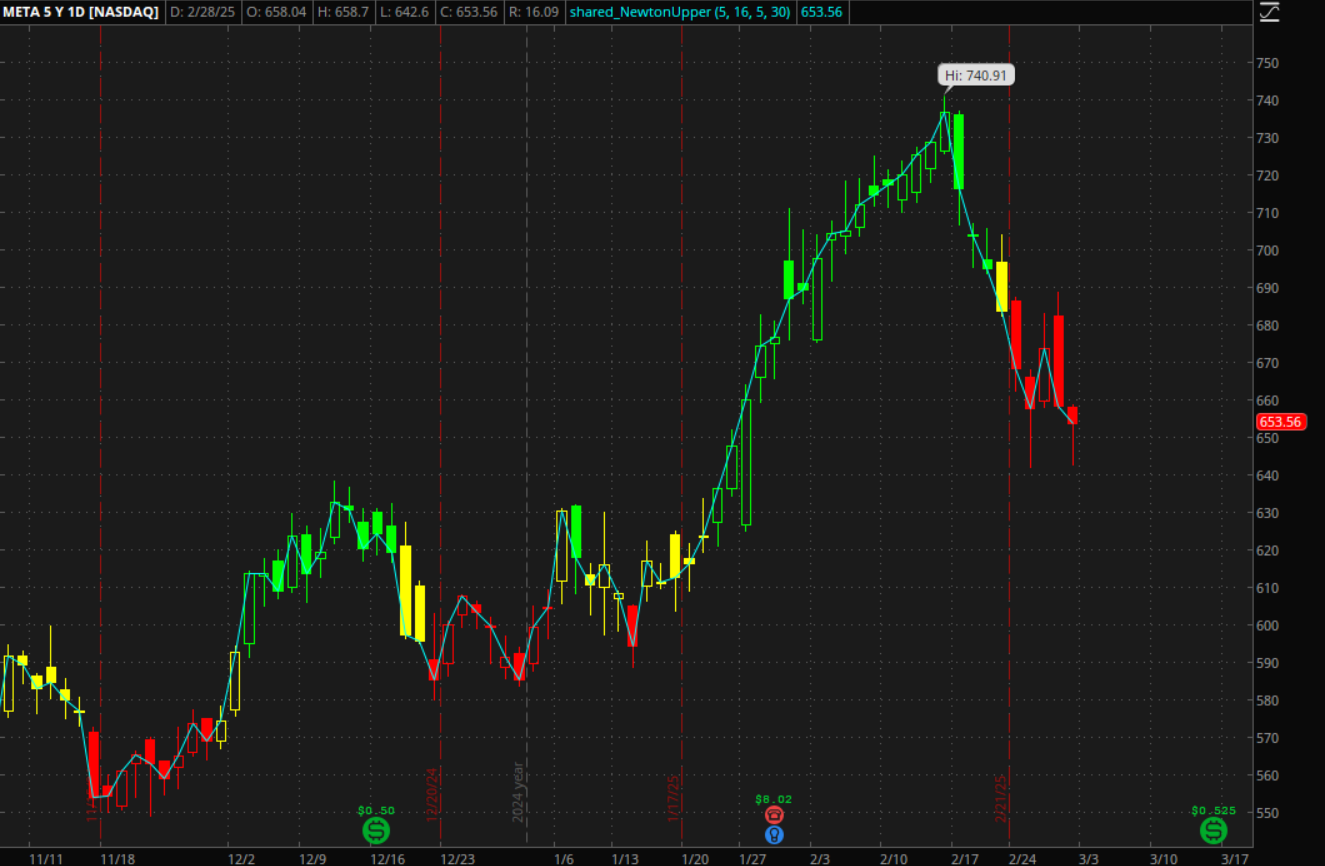

And here is our Monthly Breakout. It’s still Meta Platforms (META). Here is the chart and the option details once again.

Ticker: META

- Options: 21 MAR 25 EXP.

- BUY $650 CALL.

- SELL $655 CALL.

Price: $2.69 debit.

That’s all for this week, but we’ll be back at it on Monday!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Leverage the Market’s ‘Rush Hour’ for Next-Day Payouts!

When closing-hour liquidity floods the market between 3-4 p.m. ET…

Some traders are cashing in on this timeframe to target next-day payouts on a specific kind of trade…