The earnings season shortcut…

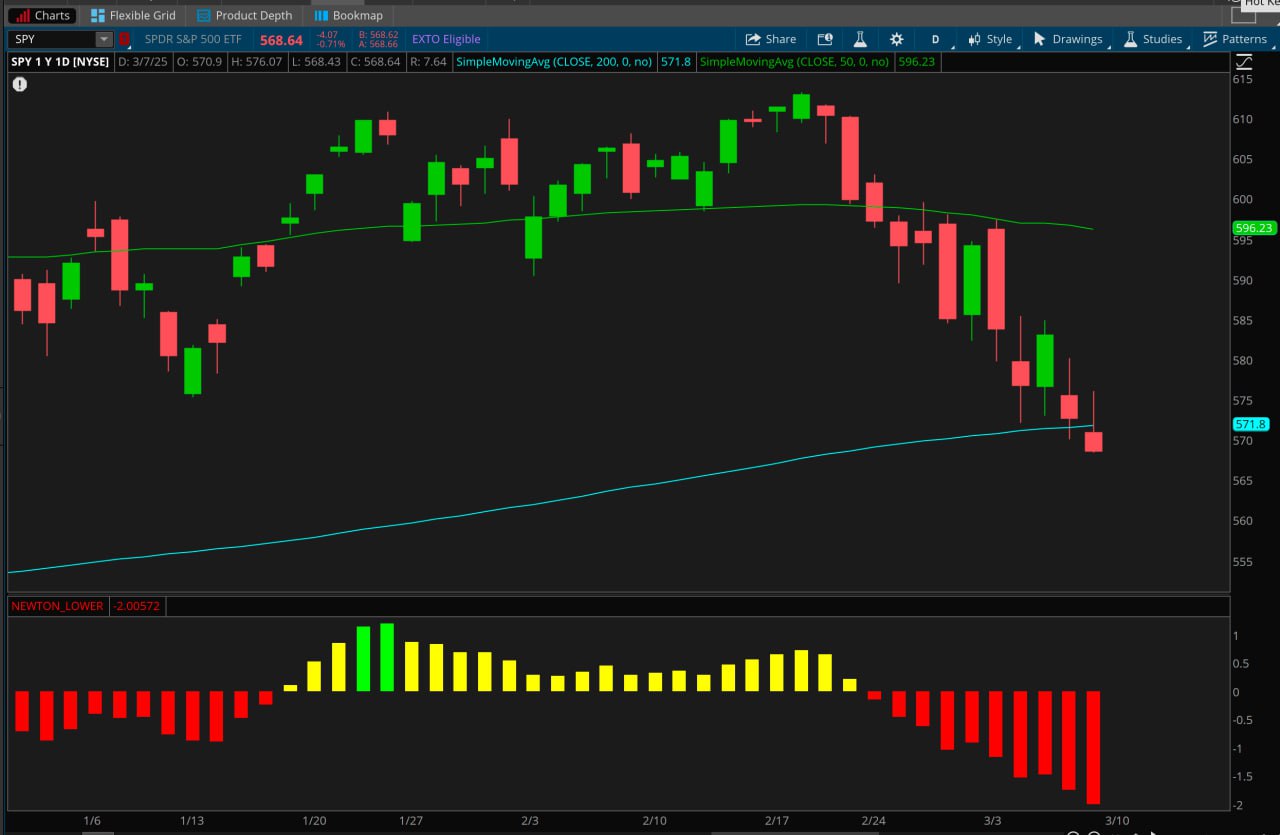

Seasonality in the stock market isn’t a perfect science, but history does give us some useful clues. And right now, if you’re looking at where the S&P 500 stands heading into March… which isn’t great as we fall below the 200-day moving average…

But there actually is some good news — and some perspective on what to expect going forward.

Over the past 25 years, when the S&P 500 was up less than 5% through February, March tended to be positive. The median gain was 0.8%, with the index finishing higher 68% of the time. That’s a solid batting average, but the gains weren’t huge compared to other scenarios.

But here’s the real takeaway…

When the market was positive in the first two months of the year — even by a small margin — it tended to build on those gains throughout the rest of the year. Historically, when the S&P 500 was up less than 5% through February, it finished the year higher 80% of the time, with a median gain of 10.8%.

That’s the kind of seasonal trend that makes a strong case for staying the course rather than trying to outguess short-term swings. While March itself may not always deliver fireworks, history suggests that as long as the market starts the year on a positive note, the odds are in favor of more gains ahead.

Will this year follow the same pattern? As always, there’s no such thing as a guarantee in trading, and past performance is not indicative of future moves.

But if you’re trying to decide whether to stick with a bullish outlook, history says that patience tends to pay off.

Of course I’ll share what I see in this newsletter, on my “Opening Playbook” livestreams at 10 a.m. ET on Tuesdays and Thursdays, and during my special events!

Stocks Climb as Wall Street Watches Jobs Report and Trade Moves

Investors are digesting the latest jobs report and keeping a close eye on trade policy shifts.

The Employment Situation report came in a little weaker than expected, with 151,000 jobs added last month instead of the projected 160,000. The unemployment rate nudged up to 4.1%, sparking more speculation about Federal Reserve rate cuts.

Fed Chair Jerome Powell is set to speak later today, and investors will hang on every word — especially his thoughts on Trump’s tariffs and the growing risk of stagflation.

Trade tensions of course are still stirring things up. Trump hit pause on tariffs for Mexico and Canada, prompting Canada to delay its retaliatory measures. Mexico hasn’t reacted yet, but markets are watching.

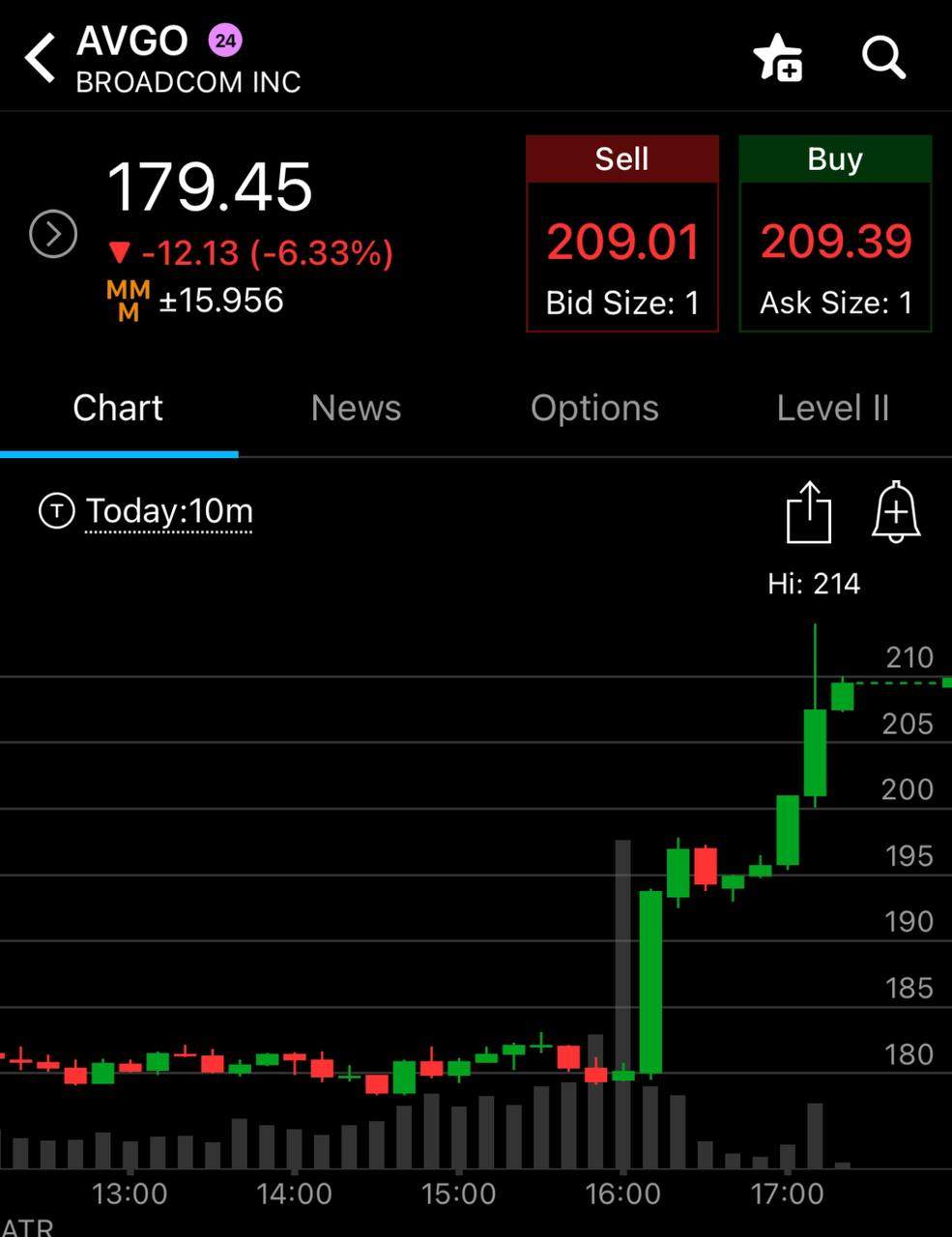

On the earnings front, Broadcom (AVGO) jumped after delivering a strong second-quarter forecast, a good sign for AI-driven chip demand. Finally some good news!

And in the crypto world, bitcoin plunged below $90,000 after Trump announced plans for a strategic U.S. Bitcoin reserve ahead of his upcoming crypto summit.

With all the moving pieces — jobs data, trade talks and Fed speculation — volatility isn’t going anywhere…

Buckle up!

Apex Indicator: AAPL

Last week, we sent out another signal on Progressive (PGR)…

We had a target on the stock of $292.71 and it got there on Tuesday. So that would’ve been the exit for another nice win!

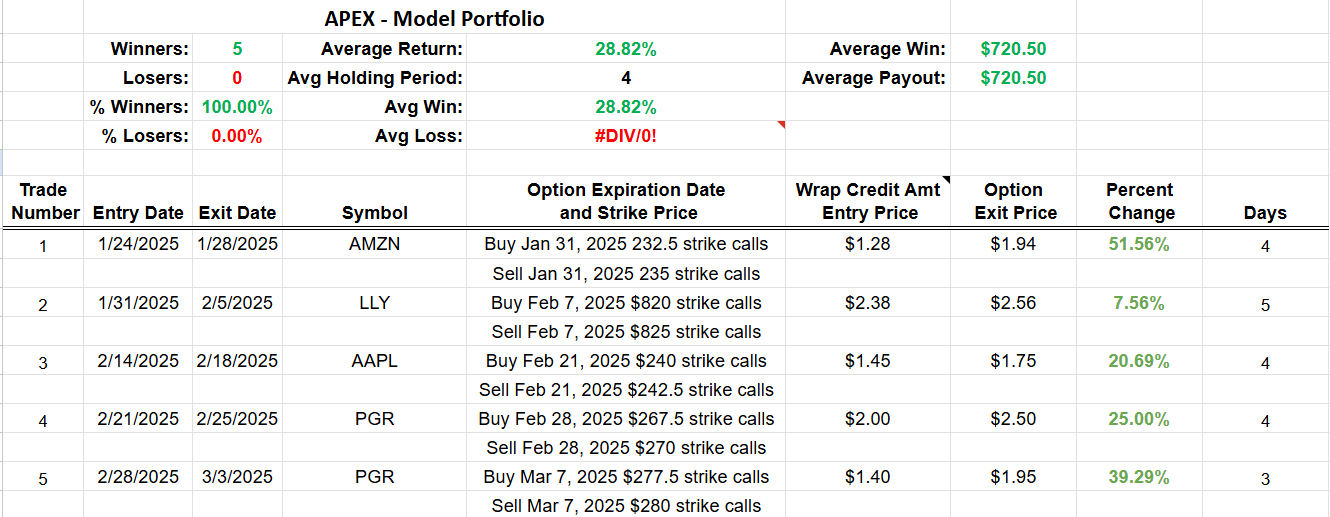

Here’s our model portfolio for these free signals I share each week:

That 100% win rate won’t last forever, of course, but it’s great to see early success! There are no guarantees in trading, so trade at your own risk. But we’ll keep these signals coming because I want to show off the power of my Apex Indicator.

We’ve had a big sell-off this week, which has put our entry signals on a delay.

The one I’m watching for our next trade is Apple (AAPL).

We had an entry a few weeks ago and it looked like we were charging toward the target.

But then the sell-off came and pushed AAPL back down. If we get the seasonal bullishness from the market, we could see an entry signal soon for the tech giant.

Our target would be up at $256.83 and our stop would be down at $210.36.

We enter these trades using wrap orders, and for more training on how to place wraps… go here!

That’s all for today. I hope everyone has a great weekend — we’ll be back at it on Monday, and then at 10 a.m. ET on Tuesday for “Opening Playbook”!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. The Earnings Season Shortcut…

During earnings season, you need to be extra precise with your trading…

And this NEW way to buy and sell stocks could be the answer.

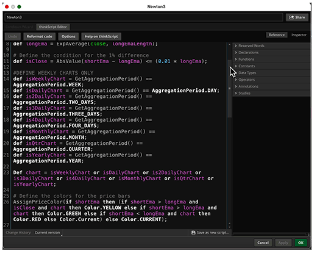

Take a look at this:

Those 117 lines of code are the heartbeat behind my Newton Indicator…

And over the next month-plus, I’ll be watching this tool like a hawk to find the best entries on trending earnings stocks.

NVDA? AMZN? TSLA?

Newton covers it all…

Join me here to learn how to get your hands on this tool immediately