Happy New Year!

I hope you had a fantastic holiday season and are ready to tackle the markets in 2025.

But before you jump in headfirst on this first trading day of the year, I want to share why I’m not rushing into anything just yet.

For me, the first day of the trading year is a lot like the first ten minutes after the opening bell each morning: it’s a time to observe, not act.

Let me explain why.

A Flaky Start

January is often a “flaky” month. It’s a time when traders and investors are feeling out the market. Everyone’s trying to gauge the sentiment, direction, and potential trends for the year ahead.

And just like I don’t usually trade right at the market open each day — preferring to wait ten minutes or so to see where things are headed — I also wait three to five days into January before making any big moves.

Why? Because the first few days of the year often don’t reflect the true tone of the market.

Watching for Trends

What I’m really interested in are the broader trends that develop as the market settles.

- By waiting three to five days, I get a clearer picture of whether the bulls or bears are taking control.

- January often starts off choppy, but patterns usually emerge by mid-month, offering better trading opportunities.

This year, my speculation is that January will be down during the first two to three weeks, but we might see a turnaround after the inauguration of Donald Trump.

My Hedge for the New Year

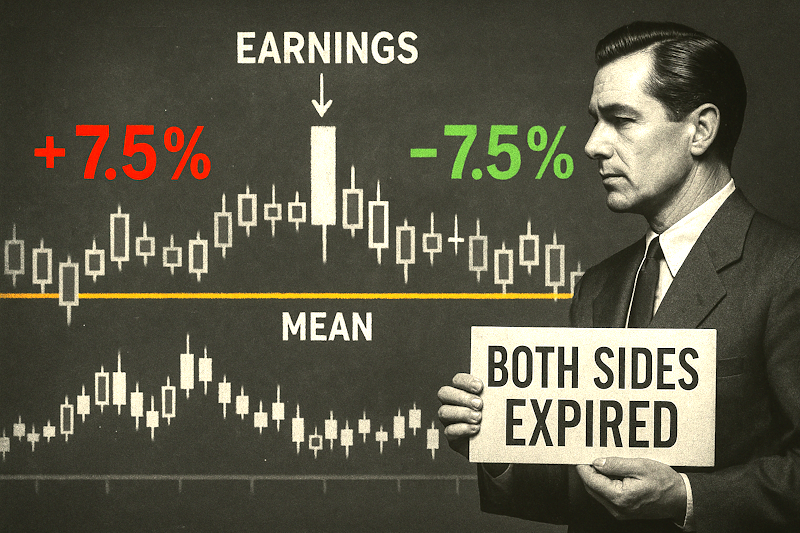

To prepare for the possibility of a rocky start, the Monday before Christmas, I bought SPY puts expiring 2/17 as a hedge.

What’s a hedge, and why did I do this?

A hedge is a way to protect your portfolio against potential losses. Think of it like insurance for your trades.

By buying SPY puts, I’m betting that the S&P 500 might go down in the short term, which can offset losses in other positions.

And so far, those puts have paid off nicely as we head into the new year.

What About Last Year’s Open?

You might be wondering if last year’s open still matters now that we’re in 2025.

The short answer? Not really.

At this point, the market is focused on new levels, new trends, and new opportunities. It’s basically a clean slate.

While last year’s data can provide context, I’m more focused on what’s happening here and now.

My Takeaway

If you’re feeling the itch to trade on this first day back, take a breath and remember: the market isn’t going anywhere.

The first trading day of the year is just the beginning. By waiting a few days to see where things are headed, you can set yourself up for smarter, more informed decisions.

So, let’s keep an eye on those trends and see how January shapes up.

Here’s to a successful and prosperous 2025!

— Geof Smith

P.S. If you missed out on my epic 2024 gold prediction, you’ve got to see what I’ve got my eye on in 2025!