In the past few months, we’ve seen gold take off like a rocket.

This took a lot of the market by storm, but for anyone who’s been paying attention, it was practically bound to happen.

Last year around this time, Tom Busby and I had been discussing how gold was poised for a breakout, and here we are, watching that prediction come to life.

Why is Gold Surging?

Gold is often called the “safe-haven” asset for a good reason.

When the economy starts looking shaky, people flock to gold as a way to protect their wealth. But what’s driving this latest surge?

Let’s look at the forces at play:

- Inflationary Pressures: Inflation has been rearing its ugly head, and while the Fed has been doing its best to keep it in check, the reality is that inflation erodes purchasing power. When people feel their dollars won’t stretch as far, they turn to gold. Gold has historically been a hedge against inflation, and we’re seeing that play out now.

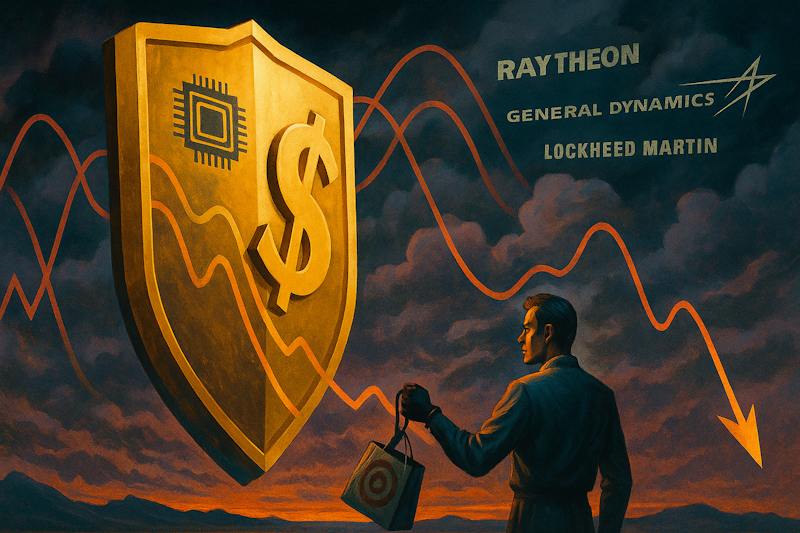

- Economic Uncertainty: The global economic climate is anything but stable. Between geopolitical tensions, supply chain disruptions, and fluctuating markets, there’s a lot of uncertainty. And uncertainty drives people to seek out stability — something gold has consistently offered over time.

- Long-term Trends: This latest rise in gold isn’t a short-term blip. The trends we’re seeing could suggest a longer-term bull market for gold. This isn’t just about the next few weeks or months — this could be a multi-year run.

So, where does gold go from here? Well, if you’re expecting this rally to fizzle out soon, you might want to reconsider.

Gold’s recent acceleration is building momentum, and while no one has a crystal ball, the indicators suggest this could be the beginning of a sustained uptrend. The economic factors pushing gold higher aren’t likely to disappear overnight.

Gold’s role as a safe-haven asset means it will always have a place in the market, but right now, it’s front and center.

So, what should you do? Keep an eye on gold prices, watch how the economic landscape evolves, and be prepared to jump in if you see an opportunity.

As much as I dislike all the attention being paid to potential Fed rate cuts, one key thing to watch will be rate cuts.

Any rate cut is sure to send gold soaring.

And with the Fed’s Jerome Powell recently changing his tone on the possibility of rate cuts, they could come sooner than expected.

The rally may just be getting started.

— Geof Smith

P.S. Jack Carter has figured out a way to automate his best trade alert every morning, right at 10AM sharp, straight to his phone. If you’ve been craving a high-probability trade every single morning, your prayers have been answered.