Last week, we talked a bit about the big events happening this week, and today I want to dive into what’s going on in the grain markets following the World Ag Index release.

Right now, farmers are offloading their old crop soybeans and corn at any price they can get because they’re not profitable anymore.

We’re looking at a record crop this year, but unfortunately, that comes with a bearish tone as producers are betting on prices to fall further.

Soybeans are now trading below $10, a level we haven’t seen since before COVID.

On a somewhat “positive” note for U.S. and other farmers, France just had its worst wheat harvest in 40 years. They’ve had a ton of protests, so that probably didn’t help their harvest much.

For countries that have managed a good wheat harvest, this creates a chance to step in and meet the global demand, possibly fetching better prices.

What Does This Mean for Us?

The big picture here is that China, the world’s largest importer of oil and grain, hasn’t placed new crop orders yet.

With a bumper crop and no new demand from China, prices will likely continue to drop. Ideally, this should lead to lower prices in stores and restaurants, but there’s a risk businesses might keep prices high to balance the rising costs of beef.

Here’s how it usually goes: when corn prices are low, beef prices go up because you’re getting better quality, corn-fed beef. On the flip side, when corn prices are high, beef prices tend to go down because you’re getting lower-quality, grass-fed beef.

Just a year and a half ago, corn was trading at $8, and now it’s at $4. Wheat went from $11 to $5.40.

Soybeans are the only ones not cut in half yet, but if they drop another $1.50, they will be. Grains led the way up during the commodity rally, and now they’re pointing the way down.

So, what does this mean for the future?

If these trends keep up, we might see some changes in the market dynamics.

Keep an eye on grain prices, as they can impact other sectors, too.

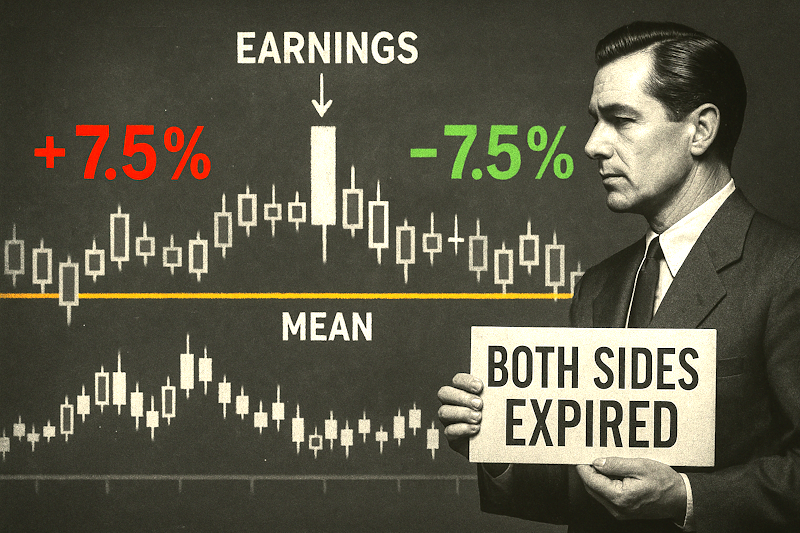

Tomorrow morning, one of the bigger pieces of news for this week comes out: Producer Price Index (PPI) hits at 8:30am Eastern.

With markets still lacking a clear direction after last week’s chaos, keep your eye on that release and how markets react after.

Then it’s Home Depot (HD) earnings at 9am Eastern.

As a major retailer in the Consumer Discretionary sector, it’ll tell us a lot about the state of the American consumer.

Stay tuned!

— Geof Smith

P.S. Forget red states. Forget blue states. In August of an election year, this one ticker has an eerie track record of pointing to green. Register your spot here to see what I’m hinting at.