A bit of a late day selloff as all five economic data releases published today support the case of an imminent recession.

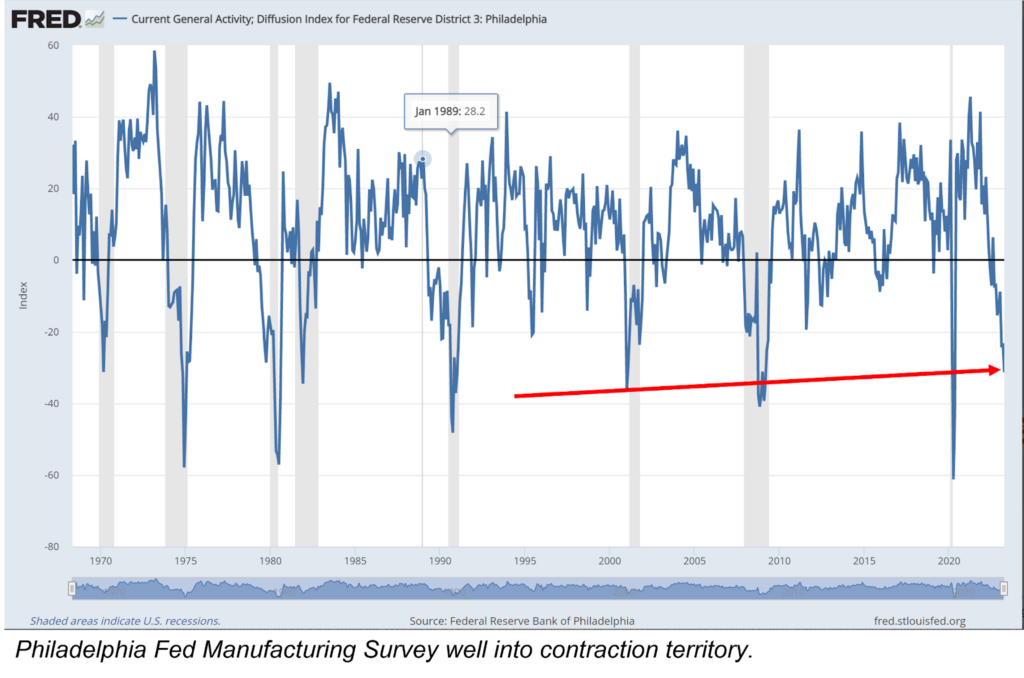

The Philly Fed Manufacturing Index continued its descent into contractionary territory, printing a negative 31.3 (anything below 0 signals contraction).

This was a material drop from last month’s negative 23.2 and well below the expected negative 20 reading and represents a steep drop from its peak reading of 45.6 one year ago.

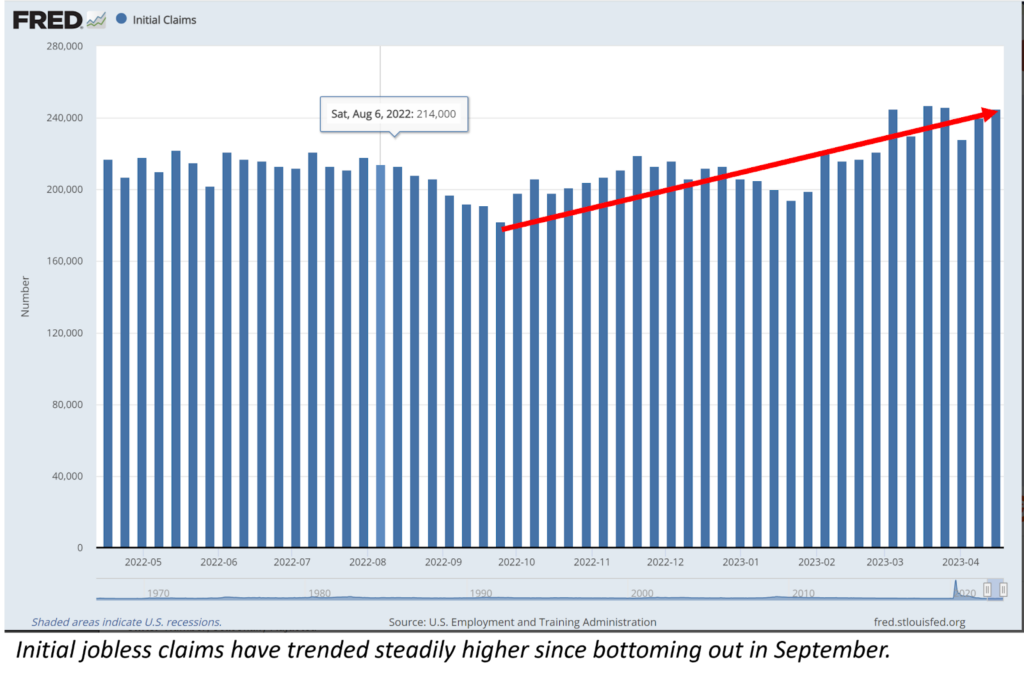

Employment numbers continue their slide as well.

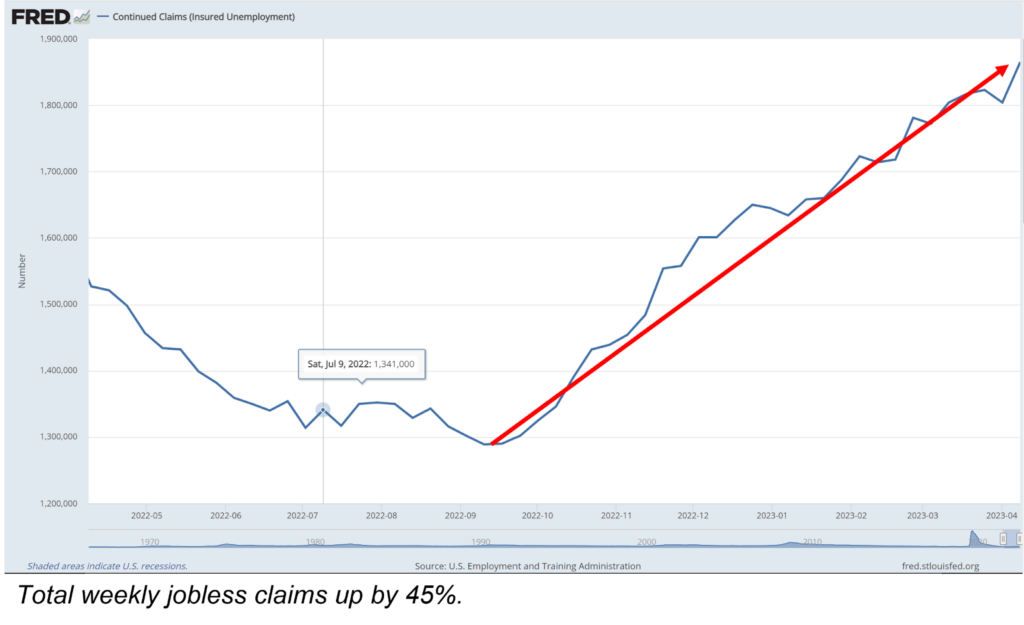

Since bottoming out last September, individuals filing initial unemployment insurance claims have advanced higher to 245,000, driving the total number of unemployed filing for insurance 45% higher from that September low.

Total claims now sit at 1.87 million.

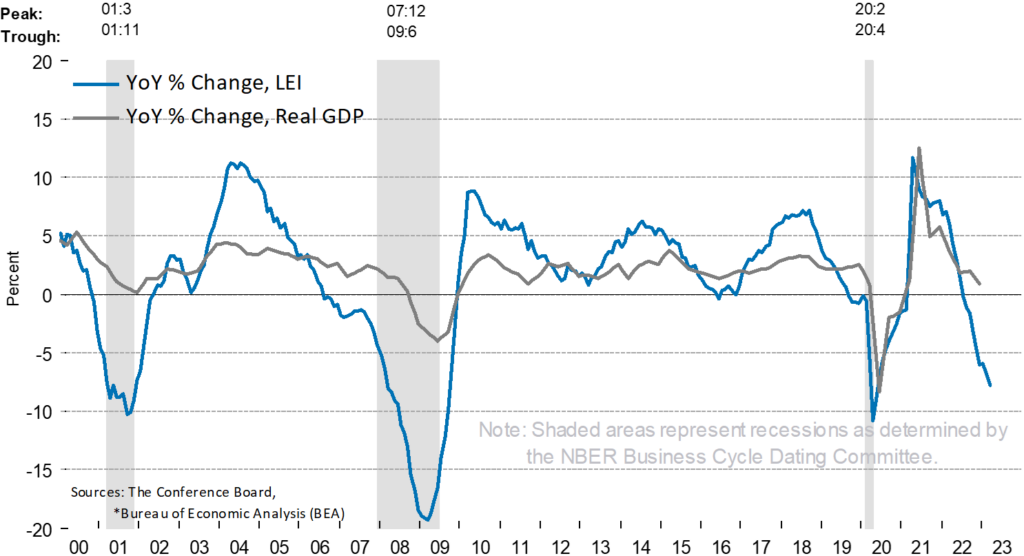

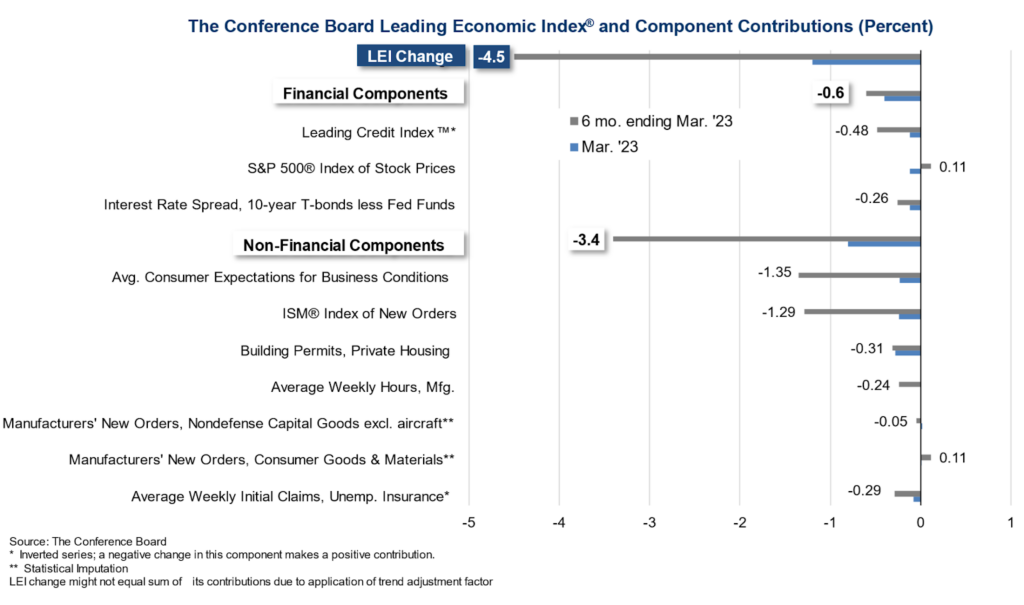

The Index of Leading Economic Indicators, or LEI, is also broadly signaling recession.

The index has dropped nearly 10% over the last year. And of the ten components comprising this broad measure of economic activity, only two, stock prices and consumer goods orders, demonstrated an increase over the last six months.

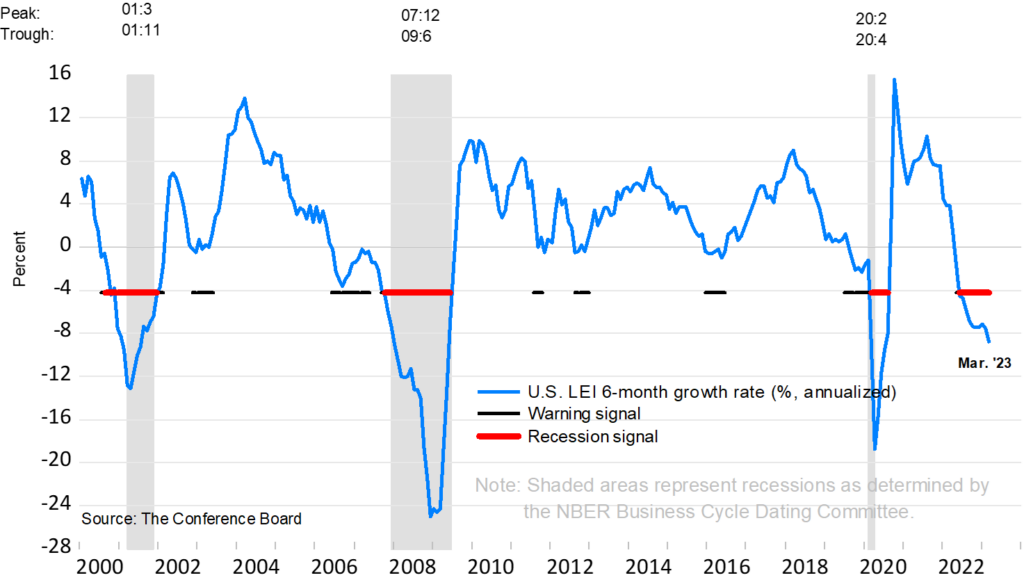

Notably, when the LEI falls below 50 and simultaneously drops by at least 4.2% over the past six months – indicated by the dashed black and red lines in the chart below – a recession is imminent.

Now, it’s often said, (and it’s true), that the stock market isn’t the economy.

And, with inflation still percolating, the Fed both raising rates while bailing out banks, and housing prices sending very mixed signals, it’s easy to see a higher stock market and sharply contracted economy six months out.

Indeed, inflated stock prices and stagnant growth is a pretty reliable indication of stagflation.

But it’s not an environment in which you want to blindly buy stocks.

You want to tread with light feet.

And my colleague Jeffry Turnmire has an approach that’s about as nimble as you can get.

Take What the Markets Give You