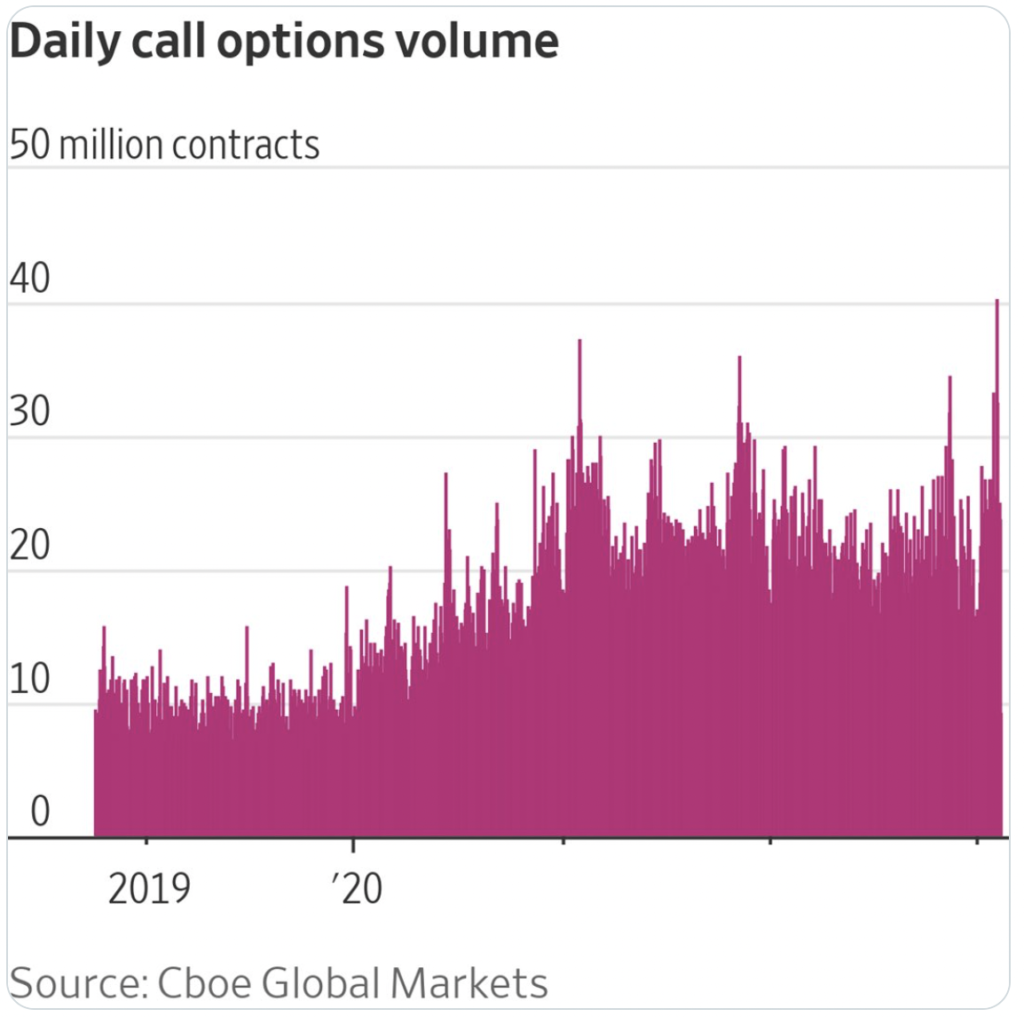

I was talking to trading ace Jack Carter yesterday and he shared this chart.

It shows how daily call options volume recently hit a 5 year peak. We spent some time wondering if stocks still lead option prices or whether all this crazy volume we’ve seen of late has given options the reins.

It’s an important question. Especially given all the attention surrounding zero-day to expiry options, or 0DTE.

Traders are building massive positions in options that expire by the end of the day.

All this focus on extremely short-term positioning is having a profound effect on longer-term volatility measures. So much so, that the VIX Index could be sending out false signals regarding the market’s perception of risk.

It reminds me of a dynamic that develops about every four years in bond markets. Once this dynamic takes hold, treasury markets take a back seat to mortgages, with both markets typically ending up in the ditch.

In any case, I’m going to unpack this with Jack in tomorrow’s weekly “Roundtable” session at 10am ET.

Commodity expert Geof Smith will also be there, and I can’t wait to talk to him about how drought in the Midwest could spell trouble in cattle markets over the coming months.

These are heady topics. But topics you need to familiarize yourself with as we go deeper into what I believe to truly unprecedented territory for markets, economies, and geopolitics alike.

“Roundtable” is for everyone so you’re free to attend. Set yourself a reminder for 10am tomorrow and Click This Link to Join.

Take What the Markets Give You