“Say it with me: To control inflation, we must take aim at corporate profits, not working people.”

Those were the recent words of lefty economist Robert Reich. Or as I like to call him Commie Bobbie.

Now, I’m not an “ends justify the means” type of guy so I’m not going to join his chorus. But I will say how he can improve his economic reasoning. In fact, were he to reason based on the following assumptions he might become a decent economist.

The first assumption is this — incentives matter. Diminishing the profit incentive piles a motivation problem onto the existing inflation one.

The second — to choose is the ultimate moral imperative. As I see it, to choose is the single, most unavoidable criteria for conscious beings. Choosing is every individual’s responsibility. Since incentives motivate choice, it is therefore unjust to fiddle with incentives artificially.

The third — the ends never justify the means — is my go-to moral heuristic. It’s how I choose. So, with that as my guide, you can’t justify the means of constraining choices through profit controls to achieve the end of saving jobs.

Call it pro-choice reasoning. And since choice is essential to human life you can call it pro-life reasoning as well.

See, everybody wins…

Moreover, since no one has enough information to steer the ship towards the end Commie Bobbie seeks, the only end is unpredictable (and most likely undesirable) outcomes. Plus, a heaping side of corruption always comes along for the ride.

Unfortunately, most economists do not reason from these assumptions. And we all bear the cost of the unintended and unwanted results through recession and inflation.

Now, I’ve spent the last couple of months talking about recession assumptions that the market seems to be missing.

And today I want to address what that same market is assuming with respect to inflation.

What’s That They Say About Assumptions?

The common assumption is that inflation eases as the Fed hikes rates. And this morning’s 6% CPI print is proof to a lot of market players that this assumption is valid.

And it is a valid assumption when all is equal. But all else is not equal.

You also have 4 additional factors working to accelerate inflation independently no matter what course of action the Federal Reserve pursues.

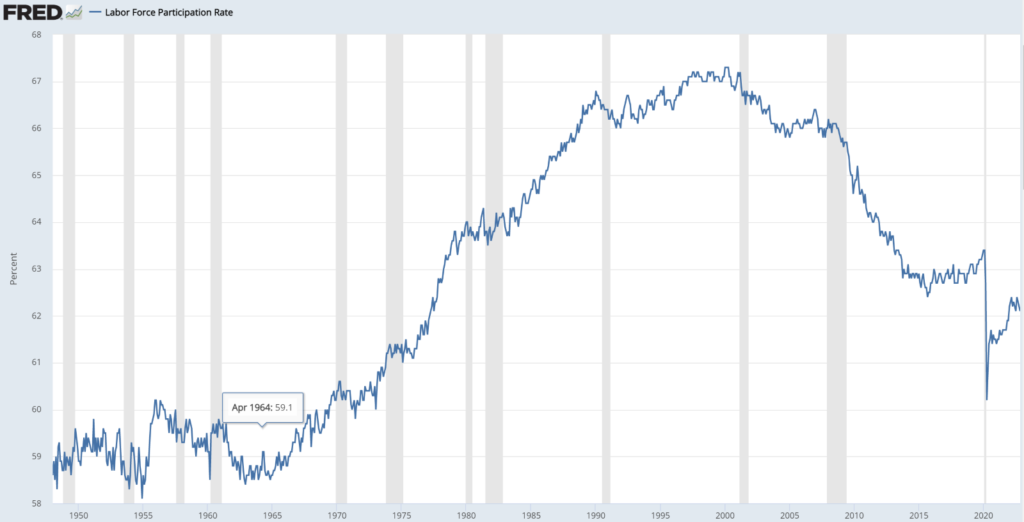

The first is an aging workforce. People are retiring faster than they can be replaced and this dynamic goes a long way toward explaining why labor force participation has been steadily declining since 2000.

The second is a fragmenting dollar trade bloc and unwinding hyper-globalized supply chains — which I have referred to many times over the past year-and-a-half.

The third — massive underinvestment in resources and infrastructure over the last two decades, particularly in oil and gas. Now, ESG policies are part of this dynamic, but the trajectory has been clear for two decades — much like the aging workforce that I mentioned above.

You can read more about all these factors in this excellent Global Outlook report from Blackrock. But the bottom line is all three create production constraints, which means it costs more (i.e. prices rise) to produce the same amount of goods as before. And yes, I get the irony of Blackrock identifying ESG policies as a Macro risk when they are the biggest peddlers of that crap…but I digress.

And the fourth is a paradox I’ve identified brought about by the rate hikes themselves.

Playing the Wrong Game

One key justification for the Fed is to promote price stability.

But price stability in their book doesn’t mean prices stay the same. They want prices to rise, just not too much.

For them, that sweet spot is about 2%.

The logic goes like this. Inflation encourages people to spend because if they wait, they will only pay a higher price. This drives production which, in turn, creates economic growth.

When prices don’t rise or, heaven forbid, they fall, economists — those that hold onto poor assumptions anyway — assume the reverse. They think that falling prices will put consumers on the sidelines and economic growth will be severely hampered. Which is, of course, absurd because of the following fact of life — people like stuff and they pay for it.

Now, the assumption that falling prices sideline consumers may hold if we’re in a one move game.

We’re not.

We make spending choices every single day and eventually what looks like delayed gratification at first simply becomes the rolling gratification we all know as a consumption-based society. Though granted, the incentives of persistent deflation means less spending and more saving. But I have a hard time seeing how that’s a bad thing.

In any case, it’s that “rising prices encourages more spending” assumption that plays into the paradox I’ve identified.

Not only do rising prices encourage people to spend today, but so can the expectation of rising interest rates. It can drive people to borrow now to avoid borrowing higher tomorrow. And with the trillions of dollars the Fed printed over the last several years — most of which is just sitting around waiting to be borrowed — the Fed’s rate hikes could actually be encouraging more spending, driving prices higher in the first place and compounded by the production-constraining factors mentioned above.

Talk about not achieving the end they seek…

This is all just my hypothesis driven more by reason than empirical data. But we may be seeing clues of this dynamic at work.

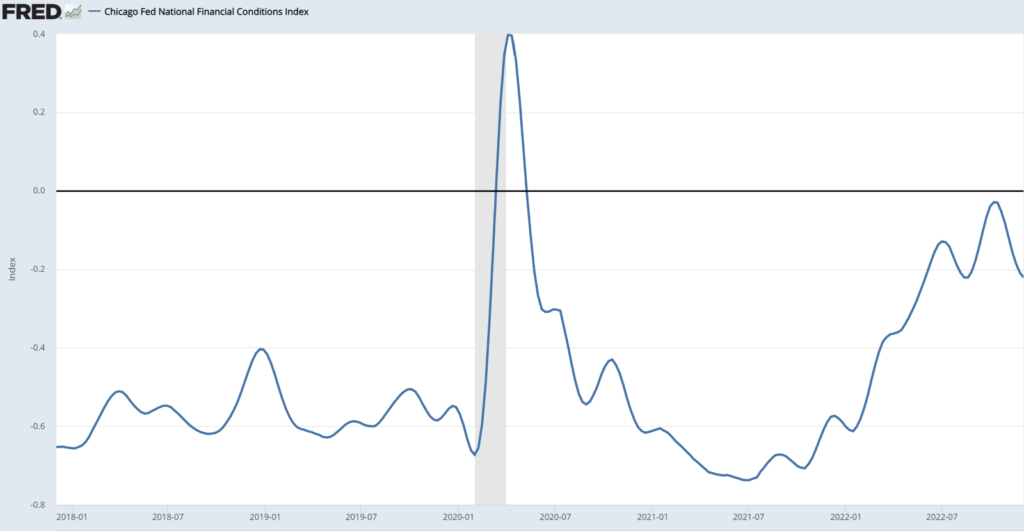

One is the mysterious improvement of financial conditions in the face of the most aggressive Fed rate hiking campaign in history.

After falling (getting worse) during the first half of the year, financial conditions (i.e., liquidity) have improved dramatically since July. Debt is easier to obtain now than it was, even for most of last year.

Suffice it to say, central banks have a lot of work to chop. By choosing to cut rates and buy bonds to save jobs over a decade ago they stacked all that wood on the wood pile by making choices about the price of money that they should have left to markets to make for themselves.

To quote Ron Paul, “The most basic principle to being a free American is the notion that we as individuals are responsible for our own lives and decisions.” Those decisions can easily include compassion.

They often do.

But whether you are capping profits or cutting rates in the name of saving jobs, dictating how that compassion is expressed from above in a one-size-fits-all policy never actually eases suffering. It only exacerbates it.

And that’s a lesson that Commie Bobbie and most economists, all politicians, and a heckuva lot of voters need to work into their assumptions.

Think Free. Be Free.

P.S. In my FREE Prosperity Pub Telegram channel, I look at the market’s possibilities every single day with a group of like-minded traders. Join us and see how we’re making these markets work for us.