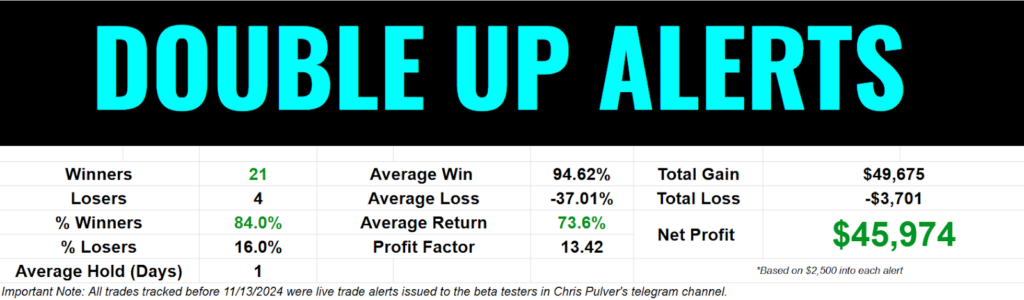

First, I briefly discussed a trade in Walmart (WMT) that we added to our Double Up Alerts strategy in Wednesday’s edition of this newsletter…

The results?

How about a 59.3% and a 70.2% gain on two trades — holding for just one and two days, respectively!

We launched this strategy on Monday and we are 6 for 6 on closed trades so far, and 21-4 including trades launched during the beta period…

In fact, we scored our biggest win yet today (after the beta period), a 214.3% moonshot in CLSK! Needless to say, I couldn’t be happier with how things are going out of the gate — and we’re just getting started!

If this performance looks enticing to you, and I hope it does, I’ll be live at 4 p.m. ET today…

Now for today’s content…

It’s no secret that Utilities (XLU) — a sector traditionally known for high debt, high dividends and low beta — rarely leads the charge in market performance.

Yet, 2024 has been a surprising year…

For a brief moment, Utilities stood out as the top-performing sector, defying expectations and turning heads. And as of today, it’s up almost 30% year to date.

So what’s driving this unexpected surge, and is there more upside on the horizon?

One theory gaining traction is the intersection of AI and infrastructure. The AI arms race is adding layers of complexity and opportunity to industries far outside the usual suspects of Tech (XLK) and Communication Services (XLC).

Large-cap tech players are partnering with utilities to develop energy plans that align with growing data demands and infrastructure expansion. While details on these partnerships remain murky, the implications are clear: Utilities could play a pivotal role in supporting the energy needs of tomorrow’s AI-driven economy.

For investors, this raises a critical dilemma…

Utilities stocks, by nature, are often frustrating to trade. Their option chains are thin, lacking the kind of liquidity that attracts active traders. Yet their performance this year can’t be ignored.

The broader market has been ripping higher, with standout contributions from sectors like Communication Services — led by Netflix (NFLX) and Meta Platforms (META) — and Financials, which have defied expectations with double-digit gains across names like JPMorgan Chase (JPM) and American Express (AXP).

In comparison, Utilities’ rise seems almost an afterthought, yet its significance may be much greater in the long run.

If AI continues to drive infrastructure expansion, it’s possible that Utilities could shift from their typical role as a slow-growth dividend play to a more dynamic piece of the economic puzzle.

However, investors should be cautious.

High debt levels remain a hallmark of the sector, and the timing of any AI-related benefits remains uncertain.

For now, it might make more sense to approach Utilities as a watch list sector rather than an immediate trading opportunity. Yes, there are gains to be had, but the challenges of trading low-beta names with limited options activity can make it tough to profit consistently.

That said, the broader trend is worth keeping an eye on.

As AI and infrastructure continue to evolve, the Utilities sector could surprise us yet again. Whether these partnerships with Tech giants translate into long-term growth or simply provide a short-term boost remains to be seen.

But one thing is certain: There’s more going on under the surface of this typically quiet sector than meets the eye.

So, don’t count Utilities out just yet. Keep watching — and don’t be afraid to adjust your strategy if the sector finds its next wave of momentum.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram: https://t.me/+av20QmeKC5VjOTc5

- YouTube: https://www.youtube.com/@ChrisPulverTrading

- Twitter: https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. 7-0 This Week — and We’re Just Getting Started!

Geeesh! I taught traders this week how I leverage “Liquidity Levels” to jump in front of what could be massive 24-hour moves…

And we’ve already booked some serious wins so far — we are 7 of 7!

If you want to see the stock I’m targeting for our next setup, how I spot these “Liquidity Levels,” and have a shot at our next trade alert…

Login and join my 4 p.m. ET class, where I’ll give you everything, for FREE!

The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. The majority of trades expressed are from backtested data in order to demonstrate the potential of the new system. From 9/18/23 – 12/5/2024 we have seen a 83% win rate on LIVE trades with a 73% average return of winners and losers and a 96% average winner with a hold time of less than 24 hours.