JOIN ME LIVE AT 9 AM ET FOR: TRENDING THURSDAYS

I’ve been hearing some interesting chatter in the rumor mill lately, and if what I’m hearing is true, we could be looking at a massive shift in how retail traders operate by early 2026.

There’s word that pattern day trading rules may be removed from margin account trading, and honestly, it’s about time. This news is based on research that Tasty Trade has been conducting for years, and if it comes to fruition, it could completely change the game for traders using margin accounts.

Right now, the system makes absolutely no sense. If I trade forex, I can trade 100 times a day. But the moment I want to trade stocks with a margin account, I’m suddenly restricted to three day trades per five trading days if your account has less than $25,000. It’s one of the silliest rules in trading, and the inconsistency is mind-boggling.

The Current System’s Glaring Inconsistencies

Here’s what doesn’t make sense about the current setup…

Cash account holders can trade freely if they have the funds, but margin accounts face these artificial restrictions. You’ve got complete freedom in other markets, but stocks?

Suddenly there are these arbitrary limitations and roadblocks that don’t exist anywhere else.

The pattern day trading rule has been a barrier for countless traders who want to be more active in the stock market, especially people who are trying to grow smaller accounts.

It forces people into longer holding periods they might not want or pushes them toward other asset classes just to avoid the restrictions.

That’s not helping anyone — it’s just creating inefficiencies.

What This Could Mean for Traders

If these rules get eliminated, it could benefit good traders significantly, but might also lead to more gambling and poor decision-making.

That’s the double-edged sword we’re looking at here.

For disciplined traders who understand risk management, this would be a game-changer. You’d have the flexibility to trade your setups when you see them, not when the calendar says you’re allowed to.

But here’s the thing — success still comes down to being a disciplined trader with proper risk management and calculated decisions.

More freedom doesn’t automatically mean more profits. If anything, it means you need to be even more disciplined because the temptation to overtrade will be right there in front of you every single day.

This is still rumor mill territory, but given the research backing it and the obvious inconsistencies in the current system, I wouldn’t be surprised if we see movement on this sooner rather than later.

I’ll keep you posted as I hear more, and I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Stop Chasing Big Moves That Rarely Pay Off

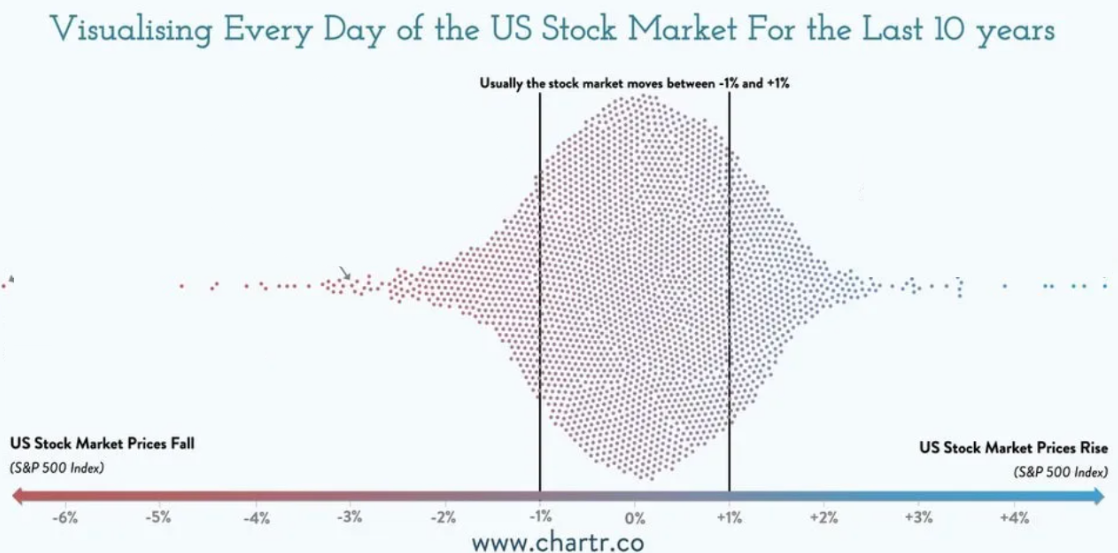

Most trading days are dead flat…

But a new type of setup by the CBOE means that’s a GOOD thing.