JOIN ME LIVE AT 9 AM ET FOR: WATCHLIST WEDNESDAYS

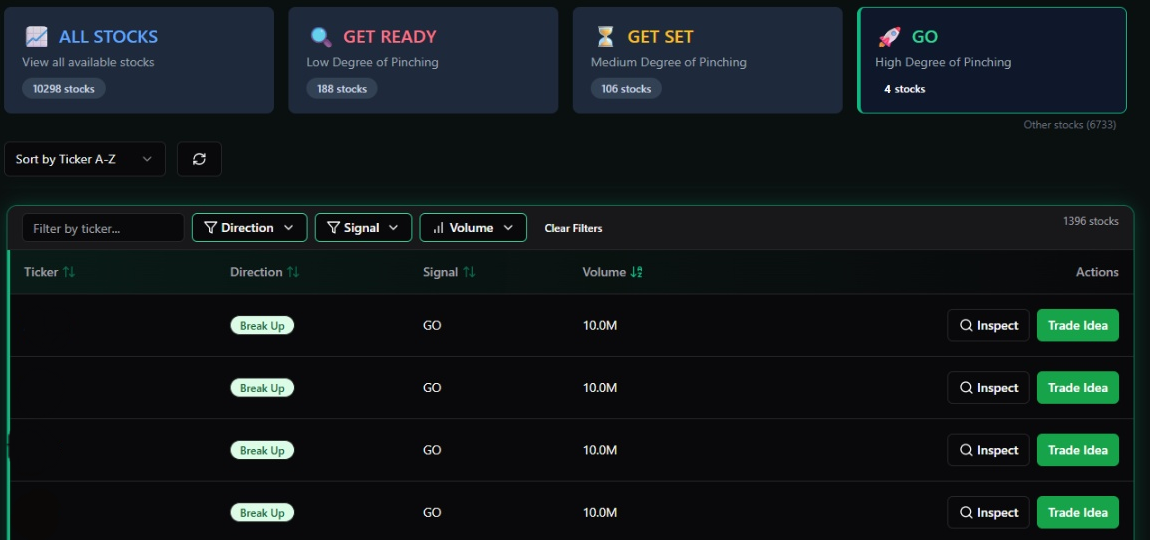

We’ll scan through over 9,500 stocks using my custom tool, the Pinch Point Scanner, to find high-probability setups. I’ll highlight which names are actionable and how I’m pricing those trades in real time.

I’ve been watching something unfold over the past few weeks that I think a lot of traders are missing.

While everyone’s fixated on which AI stock is going to rip next, Health Care (XLV) and Utilities (XLU) quietly posted some of the best sector performance we’ve seen.

And before you dismiss these as “old economy” plays, hear me out — because there’s a real case for why these boring sectors could actually outperform the AI bubble everyone’s chasing.

The AI Infrastructure Thesis Nobody’s Talking About

Here’s the thing that keeps coming back to me: If this AI boom is going to be as incredible as everyone believes, we’re going to need massive amounts of power infrastructure.

I’m talking about gas turbines, nuclear, solar, wind, water, natural gas — literally every ounce of energy we can generate.

The reality is we don’t have enough capacity right now to support the AI data centers being built. Companies aren’t just investing billions into chips and software — they’re simultaneously creating enormous demand for the utilities that power all of it.

So while Utilities (XLU) might seem boring, they’re actually the picks-and-shovels play for AI infrastructure. These are low-beta stocks that don’t move with the same volatility as tech, but they’re positioned to benefit from the same spending wave without the concentration risk.

The Concentration Risk in Tech That Worries Me

Look, I get it. Technology is leading the market year to date. But here’s what concerns me: Tech is highly concentrated, which means you’ll have huge winners and massive losers.

You’ll see some names rip hundreds of percentage points, and others that fall 60% or 70% on any market hiccup.

That’s not the kind of volatility I want in my portfolio right now. If this AI boom is real, I’d rather participate through diversified sectors like Energy (XLE) and Utilities (XLU), where the volatility stays quiet.

I’m not saying to avoid tech entirely. I’m saying don’t chase it blindly. The companies building AI infrastructure need power. The utilities providing that power offer exposure to the same trend without the concentration risk of betting on individual tech names.

Sometimes the best trades aren’t the flashy ones everyone’s talking about. Sometimes they’re the boring infrastructure plays that nobody notices until they’ve already moved.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. I’ll Be Surprised If You Find These Stocks Being Paraded on the News

But they are, however, flashing signs I love to see…

And one of them is already priming for a potential parabolic move!

If you’d like to see what they are and how I’ll go after them…