As we head into election week, there’s no shortage of potential market volatility — especially with the FOMC meeting closely following on Thursday.

With events stacking up like this, it’s tempting to make big plays, but now’s the time to focus on income trades and keeping your risk in check. This is where having a steady approach really pays off — if markets offer a good entry, great.

But if they don’t, there’s no need to chase it. Let’s look at the stakes.

Historically, the day after the election, the S&P 500 tends to provide some guidance for market direction over the following two to four weeks. If Wednesday’s close is green, it suggests potential bullish momentum, while a red close could hint at more downside.

It’s been that way since 1996, so if that pattern holds, there’s an opportunity here. However, it’s crucial to keep your trades lean and targeted during this period.

When it comes to election night, the biggest concern is whether we’ll see a winner declared. If we get clarity Tuesday night, that’s one less thing for the market to worry about.

But if the outcome drags on — and especially if one side questions the process — we could see some significant sell-offs as uncertainty lingers.

With this in mind, I’m not looking to have too much money exposed until we get past Tuesday’s volatility. Instead, I’ll keep cash ready and lean into income trades and small stabs that make sense.

Income trades let me manage my exposure and capture gains from short-term moves without risking a major position. Think of it like pruning and refining the portfolio each week, lowering cost bases, and locking in profits when the market gives us the opportunity.

Look, we don’t need to let these events throw us off our game. Right now, I’m sitting on cash, patiently waiting for genuine opportunities. This approach allows me to be nimble and avoid getting caught up in any panic swings — I’m here for the long game, not for a one-night trade.

I’ll keep grinding through with my income strategies and reserve the buying power for moments that truly deserve it.

In a week like this, discipline is everything. Keeping our sights on steady gains while leaving room to pivot as things unfold will pay off. If the market provides a clean direction, I’ll deploy more capital — if not, I’ll just keep collecting income, managing positions, and staying ready for the next setup.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram: https://t.me/+av20QmeKC5VjOTc5

- YouTube: https://www.youtube.com/@ChrisPulverTrading

- Twitter: https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Think We’re Done With Inflation? Think Again…

America could be on the verge of an inflation surge even bigger than the ’70s…

A “second wave” that’s going to crash into everyday Americans like a tsunami…

It’s coming no matter if Trump or Harris wins the election.

And I believe this “second wave” will be even more devastating than 2020 when inflation skyrocketed nearly double digits…

Eroding our purchasing power…

And sending the cost of living even HIGHER.

That’s why I’m on a mission to show everyday people how to offset the rising cost of living by targeting $1,000 every Monday (based on a $5K starting stake) — essentially hands-free!

All by placing ONE trade… On ONE ticker… ONCE a week.

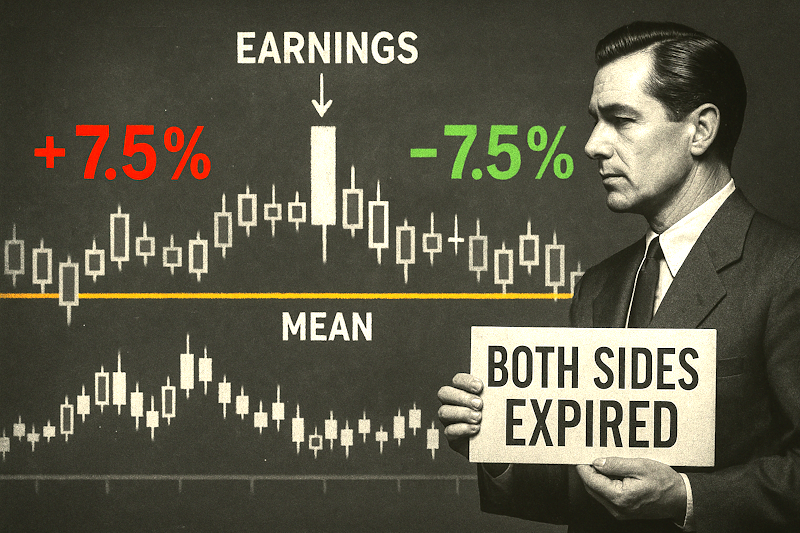

Like our backtests show on March 11, 2024…

Anyone could have placed a trade using my little-known strategy at 11:59 a.m.

A few days go by…

And the trade would have closed out automatically, adding $1,186 to the brokerage account!

Naturally, as always, some wins are smaller and some trades don’t work out. And I can’t promise future wins or prevent losses…

But if you’d like to see how I’m preparing my portfolio in the months ahead…

And what YOU can potentially do to help protect your family’s finances…

Check Out This Exciting Alternative

The profits and performance shown are not typical, we make no future earnings claims and you may lose money. The results shown are from an 11 year backtest on 550 trades. The result was a 97.1% win rate, 17% average return (winners and losers) with an average hold time of 11 days.