In a sideways or uncertain market, one of the most important things you can do as a trader is manage your cash flow while reducing directional risk. It’s not about chasing the big breakout or bottom-ticking the perfect reversal — it’s about staying in the game, keeping your buying power flexible and letting time work for you.

Right now, I’m using a blend of ratio spreads, covered calls and put credit spreads to generate income across a range of stocks. The idea isn’t to hit home runs. It’s to keep collecting base hits while the broader market churns through a period of indecision.

How I’m Building Income Positions

Take Apple (AAPL), for example. I’ve been managing a series of ratio spreads and covered calls that allow me to collect premium while keeping a bullish lean. These are trades I’m fine rolling week after week or even month after month. I’m not worried about being assigned — I’m happy to hold shares and continue generating income with calls.

I’ve got similar setups running in Amazon (AMZN), Google (GOOGL), Microsoft (MSFT) and Coinbase (COIN). In each case, I’m staggering expiration dates — some in May, some in June, some going all the way out to December or even January.

This spacing gives me more flexibility to adjust and scale in as prices move.

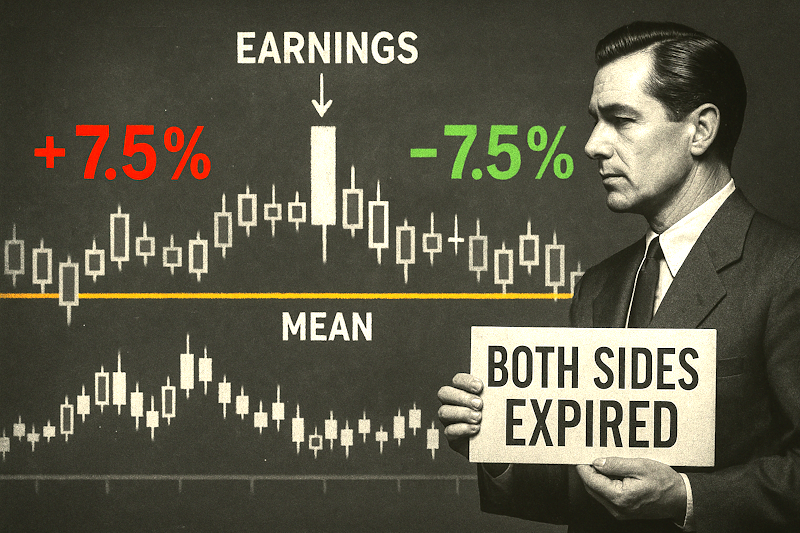

Ratio spreads are particularly attractive right now because of elevated volatility. I’ll buy one option, sell two farther out of the money and create a little “profit trap” — a sweet spot where the trade pays best if the stock drifts into that zone.

If it doesn’t, that’s fine too. These trades can still deliver strong returns even with modest moves or time decay working in your favor.

Why Time Is My Ally Right Now

This is not a market for max aggression. There’s too much headline risk — tariffs, Fed cuts, earnings guidance — and too many sectors struggling to find leadership.

The best approach I’ve found lately is to keep a steady rhythm: Sell premium, manage deltas, and use longer-dated trades to give the market time to make up its mind.

I’m mostly focused on stocks within the Information Technology (XLK), Financials (XLF) and Communication Services (XLC) sectors. These tend to have decent option liquidity and, in most cases, lower exposure to tariff disruptions.

But even then, I’m not going all in — just building layered trades with well-defined risk and letting the market come to me.

You don’t need to predict the next big move in a choppy tape. You just need to survive it — and if you can collect income while doing it, even better.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Snag Your Triple Threat Trader Membership Now!

As you may have seen during today’s live session with Jeffry…

“The 60-minute surge” isn’t just another random trading setup — it’s a proven system that booked over 1,500 wins in just nine months.

And now, you can start taking every one of these trades with him — targeting 50% gain or more in just 60 minutes!

Here’s the exciting part:

For today only, you can save when you lock in your membership to Triple Threat Trader!

Instead of paying the regular price of $3,995 for one year, you can lock in two years of uninterrupted access for just $2,495.

But don’t wait — this special offer vanishes at midnight tonight.

When you join the Triple Threat Trader, here’s what you’ll get:

- Triple Threat Trading Bot Unlimited Access

- 2-3 Auto Alerts Per Day

- Triple Threat Trader Masterclass

- 60-Minute Surge Official Trade Log

- 24/7 Triple Threat Trader Chatroom

- Options Bootcamp 101 Course

- Bonus: Triple Threat Trader Founding Discount

Naturally, we cannot promise future returns or against losses but this is your chance to level up your trading, follow a proven strategy, and aim for a milestone together.

The profits and performance shown today are not typical. We make no future earnings claims, and you may lose money. From 7/10/24 – 4/7/25 the win rate on 2112 published trade alerts has been 74% with an average hold time of less than 24 hours on the underlying stock.