Prep for what I believe will be a massive second wave

of inflation by targeting $1,000 each Monday!

Options trading is one of the most powerful tools a trader can have in their arsenal.

It’s versatile, and when used correctly, it allows you to manage risk and maximize returns with a fraction of the capital you’d need to trade stocks outright.

Over the years, I’ve shifted more than 80% of my trades into options — because once you understand how they work, you’ll see why they’re the superior choice for almost any market condition.

Here’s why I love options…

They provide leverage when you need it, risk-to-reward flexibility, and the ability to manage risk and profits with precision. Whether the market is moving up, down or even sideways, there’s an option strategy that can generate returns.

I know that a lot of people shy away from options because of the complexity — terms like “calls,” “puts” and especially “spreads” can seem confusing at first — but once you break it down and learn the practical side of it, you’ll realize how much more control it gives you over your trades.

And like I said, this especially applies to spreads!

Let me give you a simple example…

If you’re bullish on a stock like Nvidia (NVDA), you don’t need to shell out tens of thousands to buy 100 shares — you can use options to control the same amount of stock for a fraction of the cost.

Let’s say you buy an in-the-money call option with a 0.75 or 0.80 delta. That option is going to act similarly to owning the stock, but instead of risking $10,000, you’re risking a much smaller amount.

If the stock moves in your favor, that delta will move closer to 1.0 — meaning your option is effectively acting like the stock itself, just with far less capital at risk.

This is where the magic of options lies.

Not only can you capture the upside of a stock’s move, but you can also set defined risk on each trade — you know exactly what your maximum loss is before you even place the trade. That’s a huge advantage compared to holding shares, especially in volatile markets.

And if the trade doesn’t go your way?

You can use various strategies — like spreads or butterflies — to either hedge your position or even generate income from a stock that isn’t performing as expected.

Options aren’t just for professionals — they’re for anyone who wants to trade smarter, and generally much faster.

With a bit of education and the right approach, you can drastically improve your trading performance and reduce your overall exposure to risk. It’s about trading smarter, not harder — and options give you the flexibility to do exactly that.

Stick around and I’ll share all of my options trading strategies here and during my “Final Hour” livestream, weekdays at 3 p.m. ET!

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram: https://t.me/+av20QmeKC5VjOTc5

- YouTube: https://www.youtube.com/@ChrisPulverTrading

- Twitter: https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

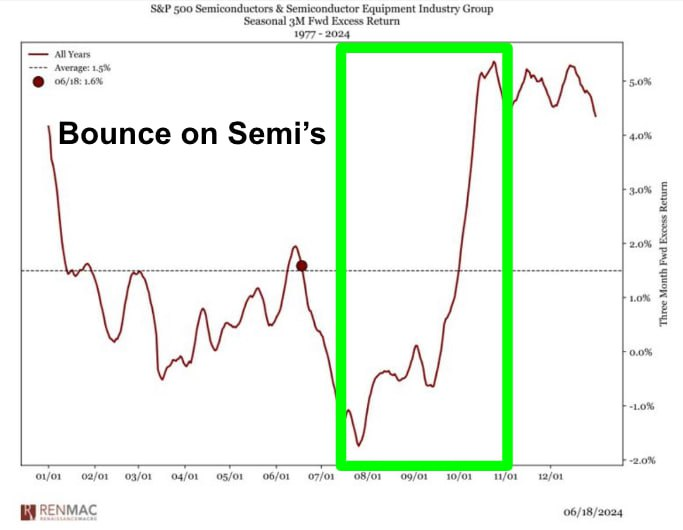

What you’re looking at is part of the reason why I’ve been so bullish on Nvidia.

And with tech stocks ripping and Nvidia leading the pack as always, I believe this is the perfect time to to bring in one of the best Nvidia traders I know to show you what could be the best way to trade the stock this week

He calls it the Nvidia Elite trade.

Now, I don’t want to spill all the beans here but…

The Nvidia Elite trade allows us to tap into fast-paced Nvidia options… for pennies on the dollar

The best part?

When these setups work out… they’ve shown the power to pay double, even triple… time and time again.

We cannot promise future returns or against losses but if you want a front-row view on how the Nvidia Elite trade works at 1 p.m. ET on Thursday, Oct. 17…

How we’re using it to trade what could be the next Nvidia breakout…

And more importantly, the newest Nvidia entry and price target from the mouth of one of the best Nvidia traders I know…

The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. The trades expressed are from live trades issued between 6/02/2024 and 10/11/2024. The result is a 80% win rate over a 5 day average hold period.