While everyone’s panicking, experts Nate Tucci, Geof Smith, Kane Shieh, Lance Ippolito and Chris Pulver are hosting an emergency roundtable at 3 PM ET — be sure and join the guys here as they discuss navigating the crash. They’ll also have a “tariff tracker” for everyone in attendance!

Capitulation is one of those buzzwords traders throw around when markets get ugly. But spotting real capitulation — not just another rough day — can help you avoid some costly mistakes and even set up your next winning trade.

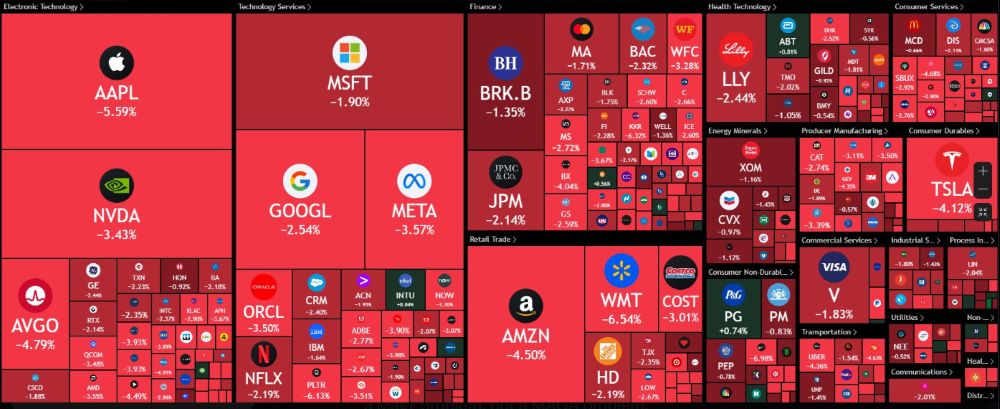

Right now, we’re seeing a lot of fear.

The Nasdaq 100 (QQQ) is down more than 20% from its highs, the S&P 500 (SPY) is closing in on an 18% drop, and volatility is flashing some of the highest readings since COVID with the VIX popping above 50 today.

If you’re feeling the urge to panic, you’re not alone. But true capitulation is more than just fear. It’s that total, final flush when the last sellers finally give up.

Signs of Capitulation You Need to Watch

First, look at volume. True capitulation tends to come with a surge in trading volume — not just a little bump but a massive spike that rivals major pivots like COVID in 2020 or the financial crisis in 2008. It’s the kind of day where everyone is selling everything, no matter what sector it is.

Second, check market internals. When you see 90% of stocks declining and only a handful advancing — even across traditionally defensive sectors like Consumer Staples (XLP) and Utilities (XLU) — that’s a clue the sell-off has hit exhaustion. It’s the market saying, “We’re throwing in the towel.”

Third, watch for major technical levels. Capitulation doesn’t usually happen in the middle of nowhere. It tends to find footing around big support levels — former all-time highs, major Fibonacci retracement zones or long-term moving averages. Right now, the S&P 500 is flirting with key levels around 4,800 to 4,600. If we flush into that zone and see a violent bounce, that’s worth paying attention to.

Finally, sentiment indicators like the CNN Fear and Greed Index, AAII Sentiment Survey and volatility indexes are important. Extreme fear doesn’t guarantee a bottom — but real capitulation rarely happens without it.

What It Means for Your Money

It’s tempting to think capitulation is a green light to back up the truck and load up on stocks. It’s not. Capitulation usually sets the stage for a bounce — but it doesn’t mean the bear market is over. In fact, most bear markets have multiple waves of selling after that first big flush.

I’m looking for a technical bounce here — maybe a rip higher of 4% to 6% over the next week or two — but I’m not confusing that with a new bull market. I’ll be using any rallies to take profits on existing trades, de-risk my portfolio and reload some hedges.

The real opportunity will come if we see a final panic flush that breaks major trend lines or tests the 200-week moving average. That’s when you start seeing generational buying opportunities.

Until then, keep your trade size small, stay mechanical and avoid chasing every little move. If this market teaches you anything, it should be how to survive, stay patient and wait for the big trades to set up.

Capitulation is ugly. It feels terrible. But it’s also where some of the best trades of your career can begin — if you’re ready for them.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. We’re Now in a Bear Market

It’s time to learn how to leverage “weekly windfalls” to target extra income each week…

No matter what happens in this crazy market.