As we move into the summer months, it’s time to talk about a dynamic that can catch a lot of traders off guard — surprise moves in low-volume markets.

I always remind myself that when markets get quiet, it doesn’t take much leverage or positioning to spark outsized moves. That’s especially true when volume starts to dry up around holiday weeks, which we’re about to hit.

Look at the calendar. We’ve got the end of the quarter coming up on June 30, followed by a holiday-shortened week as we head into July 4.

That creates an environment where institutions may be sitting out, leaving retail and algo flows to drive the action. Combine that with thinner liquidity and you’ve got the perfect recipe for summer whipsaws.

I’m not predicting disaster — but I am preparing for anything.

Why I Stay Cautious and Watch Price Closely

The key for me is to stay patient and let price do what it does best. I’m not forcing trades here. If this market keeps grinding up toward all-time highs, that’s fine — I’ll respect the trend. But I’m also well aware that these summer markets can flip on a dime when low-volume conditions collide with surprise news or positioning shifts.

It’s why I’ll be keeping an extra close eye on technical levels and market structure. For example, I’m watching my trend line closely. If we break that line with conviction and start taking out recent lows, I’ll be ready to adapt quickly. That’s when a low-volume pullback can turn into a more meaningful correction.

But if the market continues to drift higher and hold above key support, I’m also open to participating selectively — just not aggressively at highs when I know big players are largely on the sidelines. Summer melt-ups can be deceptive. I’ve seen too many retail traders pile in late, only to get caught when the inevitable fade hits.

Manage Risk, Stay Flexible

Ultimately, it all comes back to managing risk and staying flexible. I’m not going to get stubborn about any single outcome. If we get a dip, great — I’ll be ready to buy it. If we melt higher, I’ll trade accordingly but with caution.

The bottom line is this: Low-volume markets are tricky. I won’t let them catch me flat-footed. I’ll continue to monitor flows, respect key levels and focus on clean setups. And no matter what happens, I’ll make sure I’m trading with a clear plan and disciplined risk management every step of the way.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

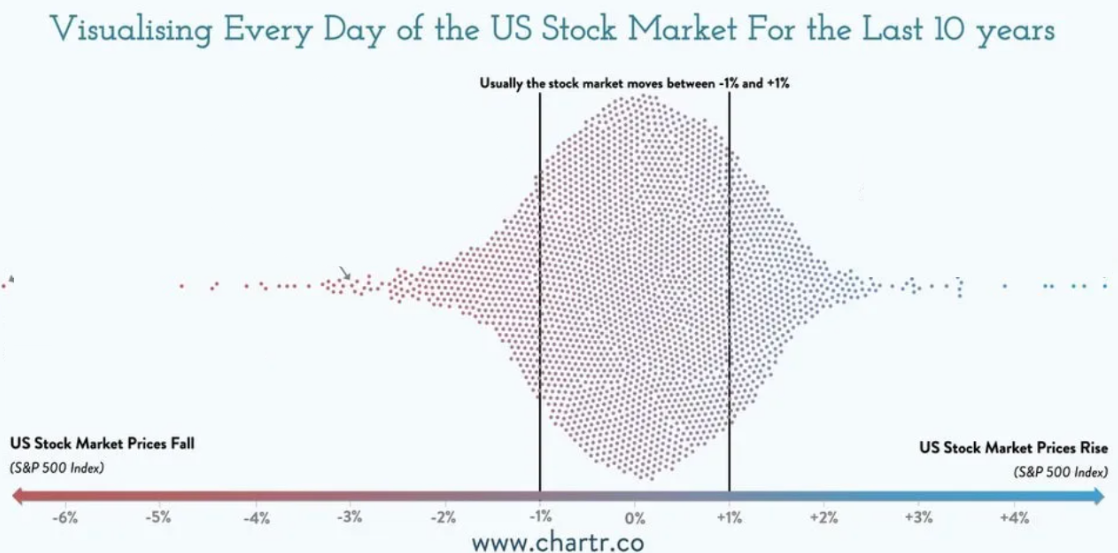

Most trading days are dead flat.

But a new type of setup by the CBOE means that’s a GOOD thing…