When it comes to dividend stocks, reliable names like PepsiCo (PEP) and Coca-Cola (KO) often top the list for income-focused investors.

Right now, both stocks are pulling back, and that dip could be a good spot to start considering them for a longer-term income play. Here’s what I’m watching — and why these stable names can be a solid addition for anyone seeking steady returns over time.

For Pepsi, I’m watching a key support range between $155 and $160.

This level dates back to 2023 and presents a solid entry if prices continue to drift lower. Pepsi has a decent dividend yield of around 3.26% — which isn’t bad considering it’s a low-beta stock that tends to remain steady, even in volatile markets.

The low beta means it isn’t highly correlated to broader market swings — a nice buffer when you’re looking for a more defensive play. Rather than forcing a position, I’d be willing to wait for Pepsi to dip into that attractive $155 to $160 range to get in at a better price for long-term growth and income potential — it’s near $165 today.

Coke, another dividend stalwart, has also seen a recent, more sharp pullback.

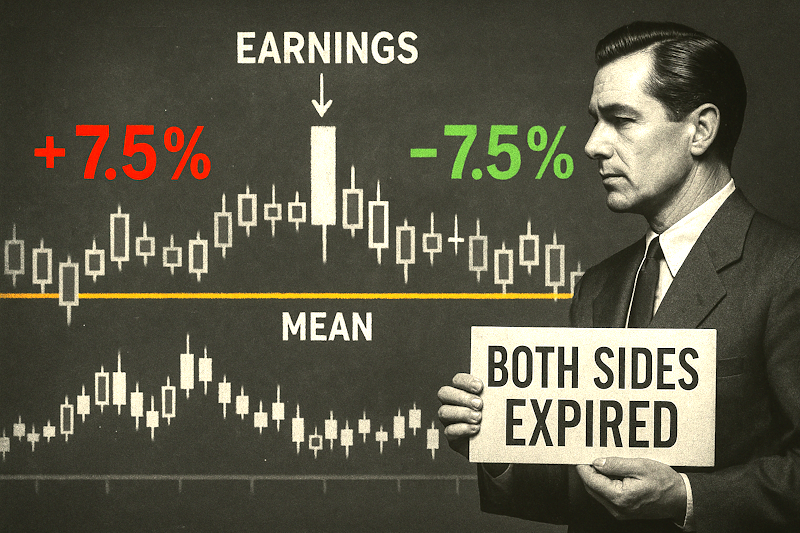

I took a small loss last week on a bull call spread I held on KO, where I aimed to profit if it stayed in an uptrend. I’m taking another shot, though, by positioning myself with a 67.50/65 spread out to the end of the year.

If KO manages to climb back up to the $70 mark, I’ll recover that loss and likely come out with a decent profit. Should KO pull back further, I’m looking to add around another attractive level.

My plan is to increase my contract size if the price falls into the lower range, likely with five or ten contracts. That way, even if I end up with two small losses, a single win at the right level could offset those losses, resulting in a net profit.

Both Pepsi and Coke have proven to be low-volatility, income-generating assets over the years. They won’t offer the excitement of high-growth tech stocks — but in a market that sometimes takes dramatic turns, there’s value in holding positions that are less likely to swing wildly.

With attractive entry points on the horizon and steady dividend yields, these two companies could be well worth a look for anyone seeking a more defensive income strategy in the current environment.

Keep in mind — these aren’t set-it-and-forget-it plays…

Like any investment, they require monitoring and strategic adjustments to maximize returns. But as far as dividend plays go, PEP and KO make sense for the portfolio right now if prices dip into those key levels. Let’s see if we get the right setups. If so, I’ll be ready to make the most of the opportunity.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram: https://t.me/+av20QmeKC5VjOTc5

- YouTube: https://www.youtube.com/@ChrisPulverTrading

- Twitter: https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. We’re Not Done With Inflation Yet. In Fact, a Second Wave Is Coming

We’re standing on the brink of an economic storm unlike anything since the wild, inflationary ’70s.

Not just a ripple, but a massive tidal wave of inflation is heading our way — and it doesn’t care who sits in the White House come November.

With nearly 30 years of experience trading stocks, options, futures, forex and cryptos, and more than 10,000 hours spent trading and teaching…

I know a thing or two… But this is different.

It’s bigger, it’s badder, and if 2020 taught us anything, it’s that we can’t afford to sit on our hands.

Inflation’s coming back with a vengeance, possibly hitting double digits again.

Meanwhile, the price of literally everything has gone up in the last few years…

And now, many Americans can barely afford to save any money at all.

But Here’s Where Things Get Interesting

The profits and performance shown are not typical, we make no future earnings claims and you may lose money. The results shown are from an 11 year backtest on 550 trades. The result was a 97.1% win rate, 17% average return (winners and losers) with an average hold time of 11 days.