The Russell 2000 (IWM) is a popular benchmark for small-cap stocks, but it’s not the only game in town.

If you’re looking to narrow your focus within this index, ETFs like the iShares Russell Top 200 Value ETF (IWX) and iShares Russell Top 200 Growth ETF (IWY) can be excellent tools that offer the chance to trade divergences between the index’s growth and value sub-sectors.

Right now, the performance difference between these ETFs is striking.

The IWX value ETF has been pulling back, while the IWY growth ETF is hitting fresh all-time highs. This divergence creates a clear decision point: Do you position for a continuation of growth leadership, or anticipate a shift back toward value?

From a technical perspective, both ETFs are currently stretched above their moving averages.

IWY is particularly notable, sitting around 12.5% above its averages. For comparison, during the July and August corrections, the market stretched as much as 16.5% before pulling back. While this doesn’t make me outright bearish, it does suggest we’re approaching levels where caution is warranted.

For traders, these pullbacks offer prime opportunities.

When the market becomes overextended — whether in growth or value — dips often lead to favorable setups for options trades. If IWY continues its run higher, I’d look for pullbacks to key support levels, especially around moving averages, to start building long positions.

On the flip side, if IWX begins to outperform, value-focused opportunities could come into play.

One challenge when trading ETFs like these is liquidity. Trading the Russell 2000 (IWM) straight up offers plenty of volume and tight spreads, making it a solid choice for options traders. However, IWY and IWX are less liquid, with wider spreads and $5 strike intervals — not exactly ideal for precise trading.

This means you may need to adjust your approach, sticking to at-the-money options or focusing on longer-term strategies where the spreads are less impactful.

Despite these challenges, I still keep IWY and IWX on my watchlist because they help identify trends within the broader Russell 2000. They also act as signals for the Health Care, Technology and Consumer Discretionary sectors, which often dominate growth-focused ETFs.

Whether you’re a swing trader or looking for longer-term plays, these ETFs provide valuable insights into market leadership. Watch for pullbacks, monitor moving averages, and don’t let liquidity challenges discourage you.

The divergence between value and growth isn’t just an academic concept — it’s a real-world opportunity to trade smarter.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram: https://t.me/+av20QmeKC5VjOTc5

- YouTube: https://www.youtube.com/@ChrisPulverTrading

- Twitter: https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

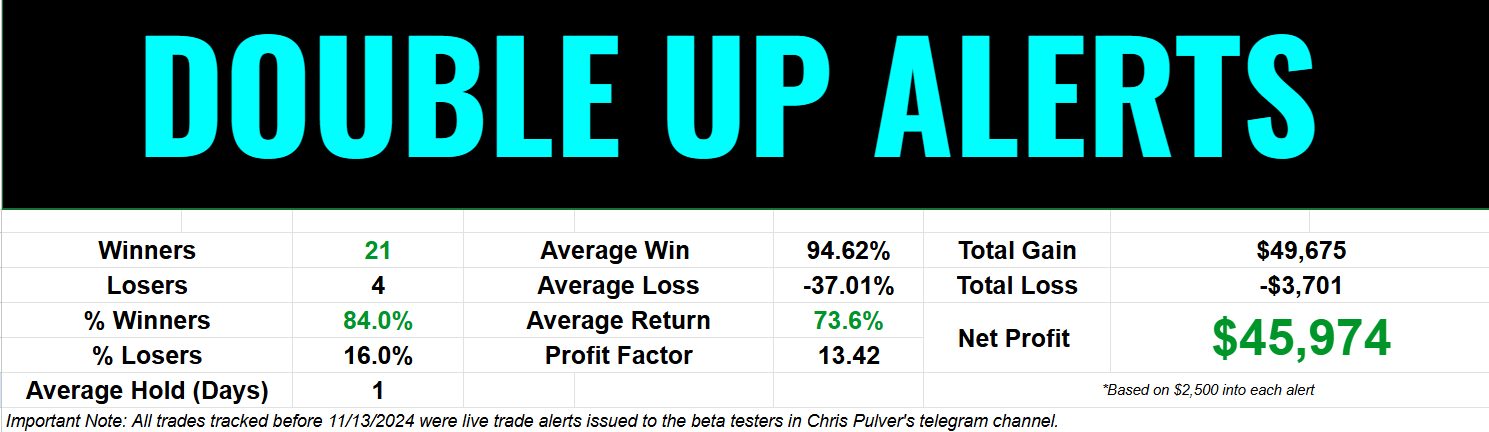

P.S. 7-0 This Week — and We’re Just Getting Started!

Geeesh! I taught traders this week how I leverage “Liquidity Levels” to jump in front of what could be massive 24-hour moves…

And we’ve already booked some serious wins so far — we are 7 of 7!

If you want to see the stock I’m targeting for our next setup, how I spot these “Liquidity Levels,” and have a shot at our next trade alert…

Login and join my 4 p.m. ET class, where I’ll give you everything for FREE!

The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. The majority of trades expressed are from backtested data in order to demonstrate the potential of the new system. From 9/18/23 – 12/5/2024 we have seen a 83% win rate on LIVE trades with a 73% average return of winners and losers and a 96% average winner with a hold time of less than 24 hours.