Navigating volatile markets is about more than picking the right stocks…

It’s about managing risk, protecting profits and maintaining flexibility. One of my go-to methods in these conditions is using options spreads, especially credit spreads like the bull put spread.

By setting up trades that take advantage of price movements while limiting downside risk, spreads allow you to stay in the game without taking on excessive exposure.

Let’s break down a recent example where I used a bull put spread on Ralph Lauren (RL).

Why a Bull Put Spread?

I’m eyeing RL as a potential play based on its technical setup if it pulls back to support. The stock recently hit all-time highs, and I’m not looking to buy it at these elevated levels.

Instead, I’d prefer to catch a dip to a solid support level around $165. Here’s where the bull put spread comes in — it allows me to profit from the stock staying above that key support without requiring me to buy shares outright.

I set up a $160 by $165 bull put spread for both November 2024 and January 2025 expirations. This spread involves selling a $165 put and buying a $160 put, collecting a premium up front. As long as RL stays above $165 by expiration, I keep the full credit — which in this case is $2.25 per contract.

My max risk is about $275 if RL drops below $160, but this setup gives me a solid balance of risk-reward.

The Benefit of Staggering Expirations

By staggering the expiration dates — Nov. 15 and Jan. 17 — I give myself flexibility. If RL drops to that support level, I have a chance to profit from both timeframes. But even if only one fills, I still stand to make a nice return.

I’m not in a rush with this one — it’s all about waiting for the right price action. If RL comes down to that $165 area, I’m happy to let the spread work in my favor. If it doesn’t, I simply don’t get filled and I look for the next opportunity.

This is the beauty of options spreads — they give you flexibility and control in volatile markets.

Whether it’s waiting for the right pullback or setting a line in the sand with a spread, you can still generate income while limiting risk. It’s not always about hitting a home run…

Sometimes, it’s about collecting steady profits while staying nimble.

If you’re not using options spreads in your trading, you’re leaving a powerful tool on the table.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram: https://t.me/+av20QmeKC5VjOTc5

- YouTube: https://www.youtube.com/@ChrisPulverTrading

- Twitter: https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Trump Dropped a ‘Liberation Day’ Bombshell on the Market

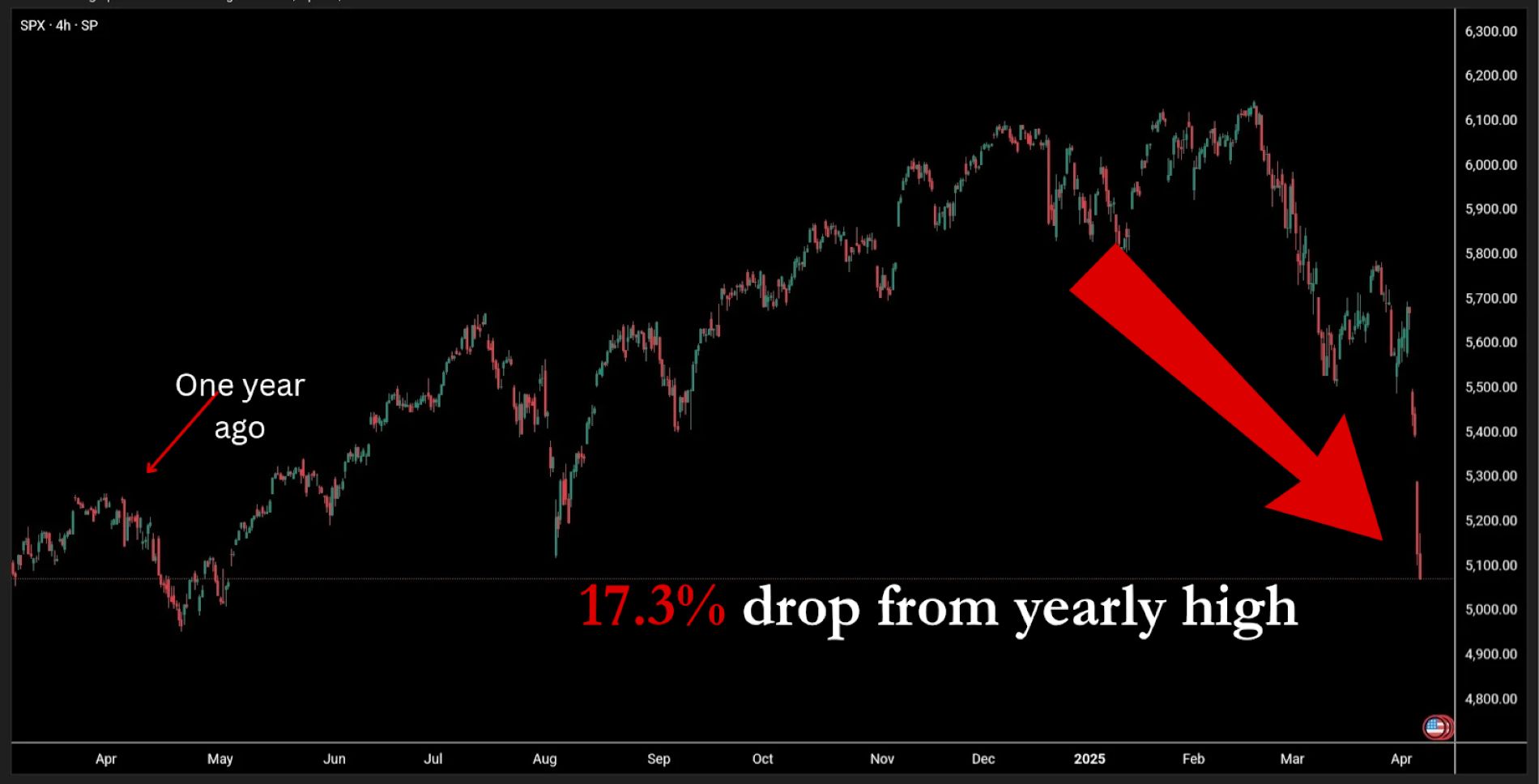

Since his announcement, the S&P 500 has fallen to hit its worst low in 2025 … erasing every gain the market had going back an entire year.

Right now, we are in a bear market.

But while others are in a panic, trying to stop the market from eating up whatever capital they have left…

You can learn how to take advantage of windfall opportunities opening up on the market every single week.

We’ve been at it for weeks now and so far, our results have been impressive.

While I cannot guarantee future results…

I can guarantee you’ll learn everything I know about these weekly opportunities – and see how to leverage them for weekly payouts.

The profits and performance shown are not typical, we make no future earnings claims and you may lose money. On live trades from 9/30/24 – 3/30/25 the win rate is 94%, the average return per trade is 11% with an 11 day hold time.