>>>I’ll be live with Jack Carter at 11:30 AM ET for Market Masters — we’ll cover current trends and trades, actionable opportunities, trading education and more… CLICK HERE TO JOIN US!<<<

I pulled up a trading leaderboard the other day — one where thousands of traders post their results — and the numbers told a story that most people don’t want to hear.

The top 100 traders for the month cleared about $5,000. But drop to the top 200 and you’re looking at barely $1,200 to $1,300 for the whole month. Keep scrolling past the top 300 or so and almost everyone is losing money.

Out of thousands of traders, only about 300 were profitable.

Most traders think the problem is the market, the news or the alerts they followed. But there’s a more fundamental issue at work.

The Real Reason Most Traders Lose

After nearly four decades of trading, I can tell you exactly why most traders never see consistent profits — they don’t have a system. They jump from one strategy to another, chasing whatever worked last week.

They take oversized risks. They put on trades without knowing why they’re in them or what should push them out.

It’s not that they’re incapable. It’s that they’re operating without a repeatable process. Without a system, every trade becomes an emotional decision dressed up as a strategic one.

And emotional trading is account-killing trading.

I once knew a young trader who managed to go professional for about a year. He was sharp and hungry, but he never committed to a single approach. Every time the market shifted, he shifted his plan. Eventually, he wasn’t trading anymore.

Talent doesn’t beat inconsistency.

The Traits That Separate the 300 From Everyone Else

There are three traits I see in every successful trader: patience, discipline and accountability. Patience keeps you from forcing trades. Discipline keeps you following your system even when it’s boring. Accountability keeps you from pointing fingers when things go wrong.

Accountability is the one most traders struggle with. That mindset will keep you losing forever. You must own your trades — every entry, every exit, every outcome.

When I learn a new approach, I don’t risk real money until I’ve done about 30 paper trades. I don’t copy someone else’s trades blindly. I internalize the method so it becomes mine. That’s accountability.

The data is harsh but the path forward isn’t complicated. Most traders aren’t profitable because they don’t have a system and they won’t develop the traits required to stick to one. The few who succeed? They master those three traits and stop looking for shortcuts.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

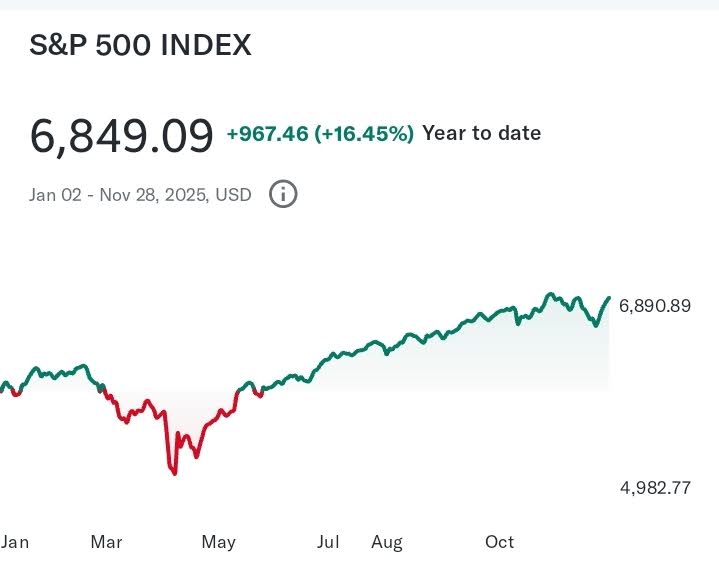

P.S. Could We See a Breakout This Month?

The S&P 500 just broke its run of seven consecutive winning months in October, and so did the Nasdaq.

We’re going to find out if this break is a temporary breather for the market as it prepares for its next move higher…

Or a signal for even more bleeding across the market.

Until then, I’m targeting quick wins on short-term setups starting today.

And thanks to my No. 1 breakout algorithm flagging stocks primed for potential breakouts…

Savvy traders have been able to get in on some of the market’s most unexpected breakouts on names you won’t even consider trading.

Right now, we’ve already seen the names ready for action and we’re geared up to go after them.

I can’t make absolute guarantees when it comes to trading…

But if you’d like a look at the stock I’ve got on my radar right now…

As well as see the algorithm flagging these interesting breakout stocks…

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading past performance is not indicative of future results. The profits and performance shown today are not typical. We make no future earnings claims, and you may lose money. From 4/17/24 – 11/24/25 the result was a 73% win rate on 2,077 trade signals with an average hold time of 3 days on the underlying stock.