JOIN ME LIVE AT 9 AM ET FOR: WATCHLIST WEDNESDAYS

Let me share something with you that completely changed how I approach options trading.

Most traders don’t realize they’re playing a losing game from the start. Between 75% and 95% of all options expire worthless if you’re holding them to expiration without proper management.

And it’s not just the statistics — most people don’t manage long options the right way, which means most people don’t get the payout they want when they buy options.

The deck is stacked before they even place a trade.

I learned this the hard way, so I want to walk you through exactly why option buying is stacked against you and what I did to flip the odds in my favor.

The Nvidia Example That Says It All

Look at what happened with Nvidia (NVDA) earnings recently. The stock had an average historical earnings move of about 5.66%, which translates to roughly a $10.50 move. Market makers priced in a $12 expected move, but here’s where it gets painful for buyers.

If you bought a long straddle on NVDA, you paid between $13.30 and $13.50 a contract. Think about that — you’re paying more than both the historical average move and what market makers expect.

You’re already in the hole before the stock even moves.

And the results? Even with Thursday’s gap up and Friday’s recovery, both long and short straddle traders lost everything unless they protected profits early Thursday morning when the market gapped up before selling off.

The call side collapsed, and if you held puts thinking you’d be right, you probably lost everything by Friday.

This is what I mean when I say option buying is the riskiest part of trading. Buy a 0DTE option for a dollar and watch it turn to zero within three hours if you don’t get immediate directional movement.

Time decay is ruthless.

Why I Switched to Selling Options With Defined Risk

Here’s the insight that changed everything for me: Naked options are a zero-sum game. When an option buyer loses, there’s a liquidity provider on the other side gladly taking that premium.

It’s the same principle behind every casino in America — the house has a built-in edge. The American casino has a house edge of 56%, which means if you play long enough, you will lose your money. The longer you’re in the game as a buyer, the more the math works against you.

But when you switch to selling options, something powerful happens. You become the casino, the house, the bank — collecting money from almost every transaction.

You stop relying on luck or perfect timing and start relying on probability, consistency and defined outcomes.

And I’m not talking about selling naked options and taking on unlimited risk. I’m talking about defined-risk strategies like spreads that let you collect premium while capping your downside.

These setups allow you to finally take the statistical edge that buyers give up and put it in your own corner.

When you buy a call option, your technical break-even is the cost of that premium. If price doesn’t move fast enough, far enough and quickly enough, you won’t make money.

But when you sell with defined risk, you’re letting probability work for you instead of against you.

Most of my put options for hedging this year have expired worthless — and that’s exactly the point. I rarely trade call options outright anymore. I structure them as spreads because I want to be on the side that wins 75-95% of the time, not the side that loses.

This isn’t about getting lucky on one big directional bet. It’s about understanding the mathematical reality of options and positioning yourself on the right side of the equation. Stop being the slot machine player. Start being the casino.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Why My No. 1 Weekly Setup Has Been Tagged ‘The Most Reliable’

Over the years, my No. 1 setup for targeting decent windfalls from the market every week has gained a lot of fame.

With traders who have seen it in action calling it the most “reliable trade” in the market.

And although they’re not very far from the truth, it doesn’t mean you’re 100% guaranteed a win on every trade.

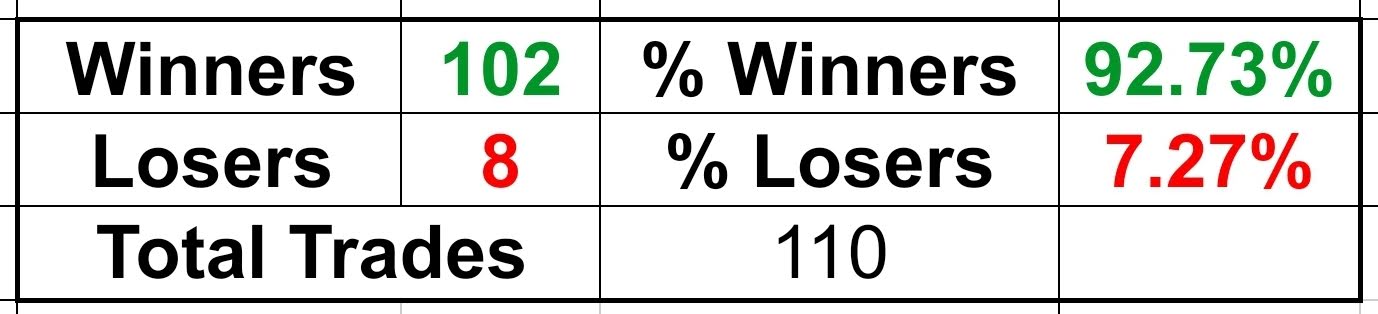

If you take a look here, you’ll see we’ve won 102 trades out of 110… Which means we’ve had a couple that didn’t go our way.

However, the fact that these setups rely on one of the market’s most consistent weekly patterns is what has shot it up the ranks to become one of the safest trades out there.

If you’d let me, I’m willing to show you how this setup came to be, as well as how you can begin deploying it on your own.

Interested?

Then Head Over Here To Get Started

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading past performance is not indicative of future results. From 9/30/24 – 11/07/25 on live trades the win rate is 92%, 16.5% average return, with an average hold time of 12 days.