First, if you missed me on “Opening Playbook” on Thursday, you can catch the replay up top!

And don’t forget to join me at 10 a.m. ET every Tuesday and Thursday!

I’ve mentioned before that seasonality tells us the real action is coming in March, April and May — three consecutive months where every sector historically finishes positive.

That lines up perfectly with the presidential cycle and could create some of the best trading opportunities of the year.

But despite late February’s usual bearish trend, something interesting has been happening with hedge funds.

They’ve turned around and become net buyers of U.S. equities for five straight days — the fastest pace we’ve seen since November 2024. This is a stark reversal after five straight weeks of selling.

According to Goldman Sachs, U.S. single stocks recorded their biggest net purchase in over three years. Long positions outpaced shorts by almost 10 to 1, a strong signal that big money is betting on a rebound.

It looks like bullish momentum for March might be arriving a bit earlier than expected, so keep your eyes open for potential opportunities — which of course I’ll share in this newsletter, on my “Opening Playbook” livestreams at 10 a.m. ET on Tuesdays and Thursdays, and during my special events!

Markets Diverge Heading Into Monthly OPEX

U.S. stocks have a split personality this morning. The S&P 500 and Nasdaq were mostly flat, while the Dow was down big ahead of the open and has fallen even further.

UnitedHealth (UNH) is a real drag on the Dow, plunging 11% in early trading after reports surfaced that the Department of Justice is probing its Medicare billing practices for fraud.

Adding to the mix, Donald Trump’s tariffs are continuing to stir up uncertainty among retailers and consumers alike. Walmart’s warning about its 2025 outlook, driven by tariff uncertainty, sparked a market downturn on Thursday and that’s bled over slightly into today.

In short, concerns over tariffs and regulatory probes seem to be possible bearish catalysts. However, we’re still seeing individual stocks like Celsius Holdings (CELH) making dramatic bullish moves.

It’s a mixed bag out there, so keep your eyes peeled for any sudden shifts.

Apex Indicator: PGR

Last week, we sent out a signal on Apple (AAPL)…

AAPL surged and we now have a blue entry signal.

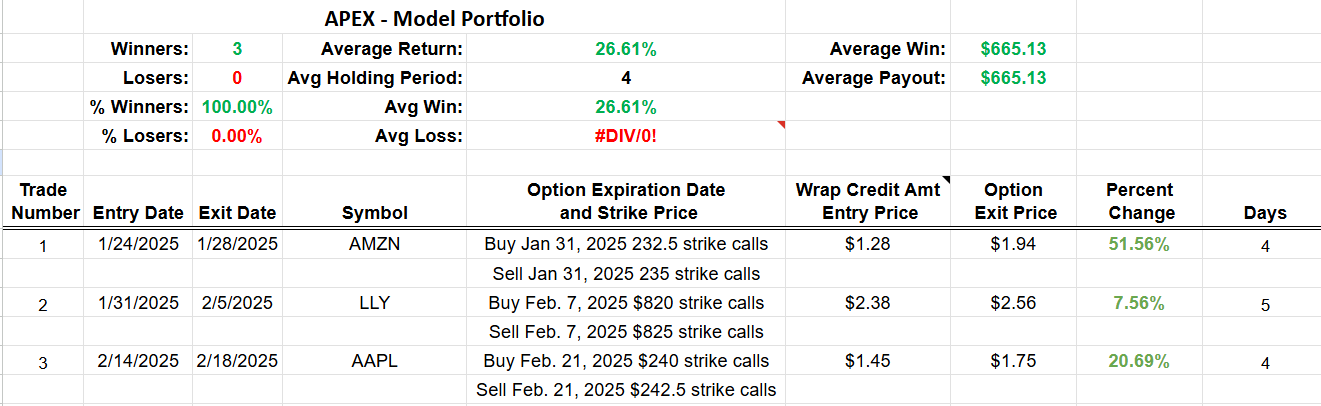

First, here’s our model portfolio for these free signals I share each week:

That 100% win rate won’t last forever, of course, but it’s great to see that when we’re just out of the gate! Nothing is ever guaranteed in trading so trade at your own risk. But we’ll keep these signals coming because I want to show off the power of my Apex Indicator.

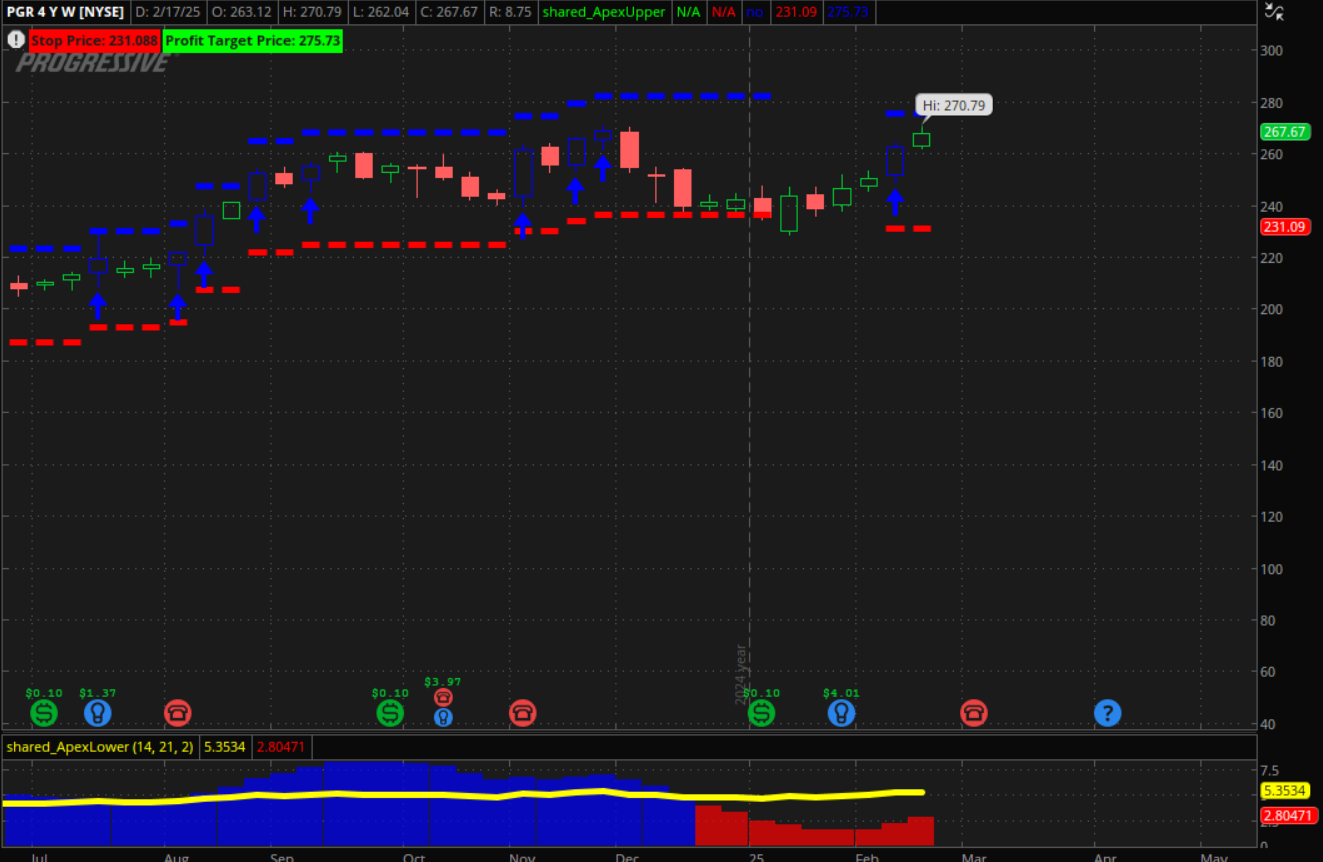

And here’s the new Apex signal on PGR.

And here’s a Wrap Order to play this signal.

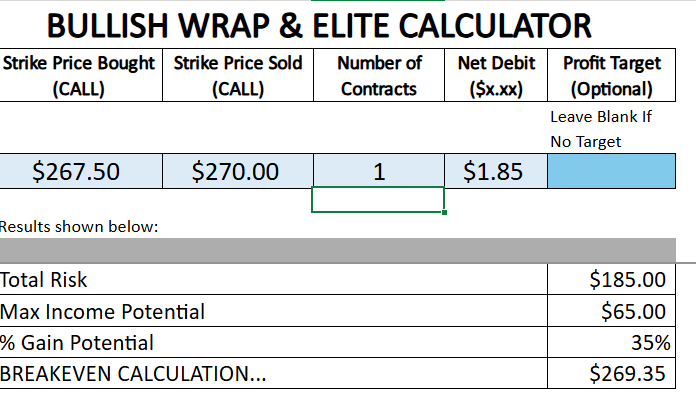

Ticker: PGR

- 28 FEB 25 EXP.

- Buy to Open $267.5 Call.

- Sell to Open $270 Call.

This should give you a net debit around $1.85 (as of 10:12 a.m. ET)! Our target on the chart is $275.73 and our stop loss level is $231.09.

Keep in mind that the underlying stock will move by the time you read this, so you may need to adjust your strikes, the idea of a “Wrap Order” being to wrap the two strikes around the current price of the stock.

For more training on how to place wraps… go here!

Also from Thursday’s “Opening Playbook” livestream…

The Monthly Breakout — Times 2!

Yes, I have not one but TWO Monthly Breakout trades for you — same goes for the trade above, your entries will likely differ slightly because stocks don’t stop moving.

T-Mobile (TMUS) and Meta Platforms (META) are my top picks for monthly breakout trades right now, and I’m putting my money where my mouth is.

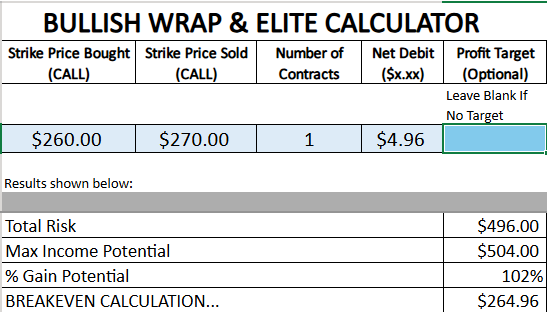

Ticker: TMUS

- Options: 21 MAR 25 EXP.

- BUY $260 CALL.

- SELL $270 CALL.

Price: Net Debit $4.96 debit

T-Mobile has been grinding higher, and even in a choppy market, it’s showing relative strength. We need it above $270 over the next month to double our money on this trade, which is only about a 2% move from here.

That’s a bet I like. It’s a low-bar setup, and given the sector strength and momentum, I’m willing to size up a little on this one. I grabbed two of these positions because I like the risk-reward—T-Mobile just needs to do what it’s already doing, and we cash in.

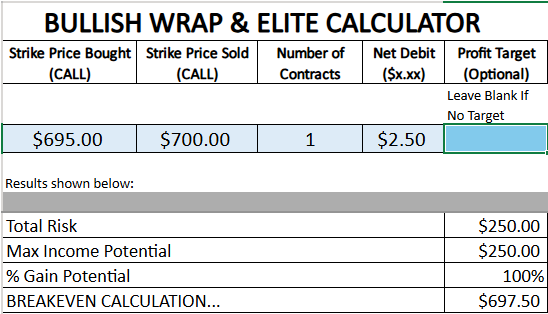

Ticker: META

- Options: 21 MAR 25 EXP.

- BUY $695 CALL.

- SELL $700 CALL.

Price: $2.50 debit

Meta is the other one I’m rolling with, and I love it here. It’s down three days in a row, which is a textbook setup for a bounce. The communication sector is my top pick right now, and Meta is the leader — if the market keeps grinding, this stock is going to be a top performer.

I’m taking a shot with a March expiration, targeting $700.

If Meta just goes flat for a month and gains a couple of bucks, we double up. I threw a thousand bucks at this one because I have conviction, and I like that the risk-reward is clear.

If you like the trade, take it. If not, pass. But I’m in.

That’s all for this week, but we’ll be right back at it on Monday!

Graham Lindman

Graham Lindman Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the ProsperityPub team or Graham Lindman Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

My $300K Options Play — Get the Details

Don’t miss this…

Next week, I’m revealing the stock I just put $300k into — a high-conviction play that’s risen on these same dates for an entire decade!

Unlock a 30-day pass to join On The Clock Stocks today for just $97 — normally $1,997 — and get:

✅ Trade details on my $300k move.

✅ 6-8 new options trades over the next month.

✅ February & March full calendar.

✅ Steer Clear signals.

✅ And so much more!