JOIN ME LIVE AT 9 AM ET FOR: TECHNICAL TUESDAYS

Earnings season is where traders either make their quarter or get chewed up and spit out. Volatility spikes, stocks make massive overnight moves, and expectations can turn on a dime. But trading earnings isn’t just about predicting a beat or a miss — it’s about understanding the expected move, managing risk and knowing when to take profits.

Too many traders get caught up in whether a company “beat” or “missed” expectations. That’s a mistake. What really matters is how the stock moves relative to what the market priced in.

Take AMD (AMD), for example.

Heading into its report last quarter, the expected move was around $12, but the stock barely moved $5 or $6. That’s a dead trade. If you’re playing volatility, you need stocks that exceed their expected move — not ones that limp along.

The same thing happened with Chipotle (CMG). It went absolutely nowhere after earnings. If you’re holding options that need a big move and the stock doesn’t give it to you, those contracts are going to decay fast.

When to Take Profits Early

Sometimes, the best earnings trade is the one you exit early. That was the case with PayPal (PYPL). It tanked after reporting weak results, and it actually dropped more than the expected move.

If I had held the full position until expiration, I could have squeezed out every last dollar of profit. But I took my gain early instead.

Why? Because I was already sitting on a 30% to 40% profit. Waiting for the last 10% to 15% wasn’t worth the risk of a reversal.

In earnings trading, taking profits early is usually the right move.

When to Let a Winner Ride

On the flip side, sometimes you have a trade that’s working exactly as planned, and you just let it run. Palantir (PLTR) was one of those.

It blew past expectations and kept running. I had a bunch of ratio spreads and leaps on it, and there was no reason to rush an exit.

When you’ve got a high-probability trade that’s printing money, patience is key.

At the end of the day, trading earnings isn’t about predicting the future. It’s about positioning for the right kinds of moves and managing risk along the way. If a stock moves less than expected, you cut your losses.

If it moves big, you take profits strategically.

Most importantly, you never let one bad trade wreck your account. Earnings season gives traders plenty of opportunities — but only if you survive long enough to take them.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

-

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

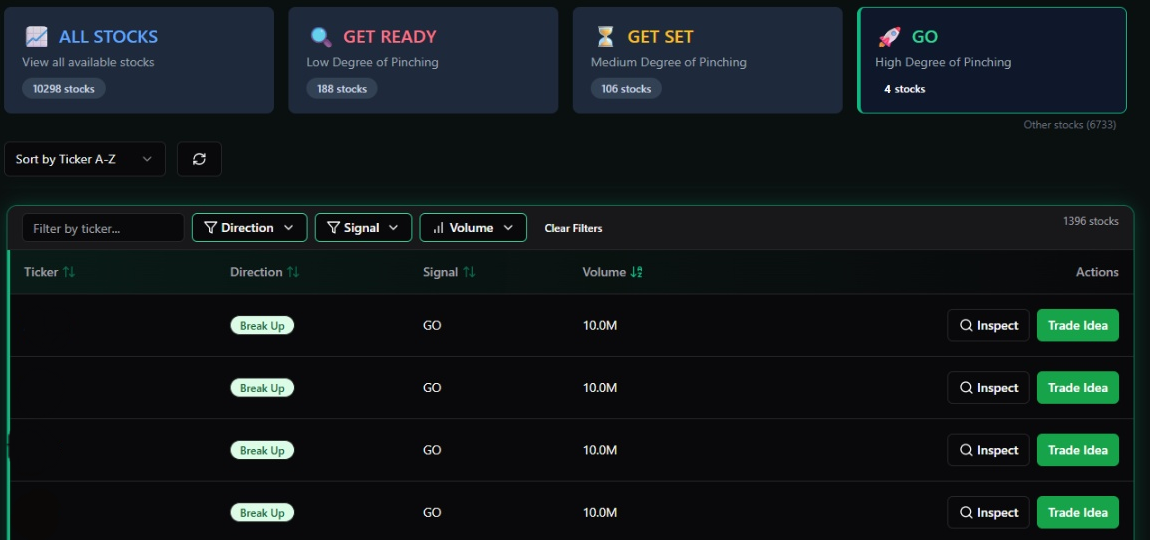

P.S. I’ll Be Surprised If You Find These Stocks Being Paraded on the News

But they are, however, flashing signs I love to see…

And one of them is already priming for a potential parabolic move!

If you’d like to see what they are and how I’ll go after them…

Go Here to Get the Full Details