I’ll be live with Jack Carter at 11:30 AM ET for Market Masters — we’ll cover current trends and trades, actionable opportunities, trading education and more

Not every trade works out the way you plan — trust me, I know that better than most.

Right now, I’m sitting on a Chipotle Mexican Grill (CMG) position that’s pretty far underwater, and I wanted to walk you through exactly how I’m managing it. Not because I’m proud of being wrong, but because this is what real trading looks like when things don’t go your way.

Here’s what happened: I thought Chipotle was bottoming out around the $49 level when I sold puts there. I was convinced this was the first move up in a retrace pattern. Classic bottom formation, right?

Well, the dip kept dipping.

Now I’m sitting at $30.56 — significantly underwater from that initial $49 entry. That’s the bad news. But here’s where it gets interesting, because I’m not just sitting here hoping for a miracle recovery.

Building a Recovery Strategy With Options and Averaging

Instead of cutting my losses and moving on, I’ve implemented a three-part strategy to work my way out of this position.

First, I’ve started selling options below my current position to generate income. Second, I’m doing some dollar-cost averaging, which has brought my average cost down from $49 to $43. That’s a meaningful improvement, even though I’m still underwater.

Third — and this is the cash flow component — I’ve sold some 35 strike calls against my additional shares. Not the whole position, mind you, just the shares I’ve added through averaging down. This generates premium income while I’m waiting for the position to recover.

If those calls get exercised at 35, I’d probably just let the shares get called out, then come back and sell more premium down at the 34 level. It’s a called out and put back strategy that keeps me in the game while collecting premium along the way.

Why I’m Staying Patient With This Position

Look, I get it — some traders would’ve cut this position a long time ago. But here’s my thinking: even on the way down, Chipotle has had these nice rips higher. The stock hasn’t had a meaningful bounce in a while, and it’s due for some kind of recovery move.

More importantly, this is a cyclical situation where restaurants aren’t doing well right now, but everything’s cyclical and this will come back around. I’m not betting on a miracle — I’m betting on mean reversion in a quality name that’s gotten beaten down with the rest of its sector.

The key here is I’m not just holding and hoping. I’m actively managing this position, generating cash flow through options, and methodically reducing my cost basis. That’s how you turn a wrong call into a manageable situation that could still work out over time.

Sometimes trading is about the setups that work perfectly. Other times, it’s about how well you manage the ones that don’t.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

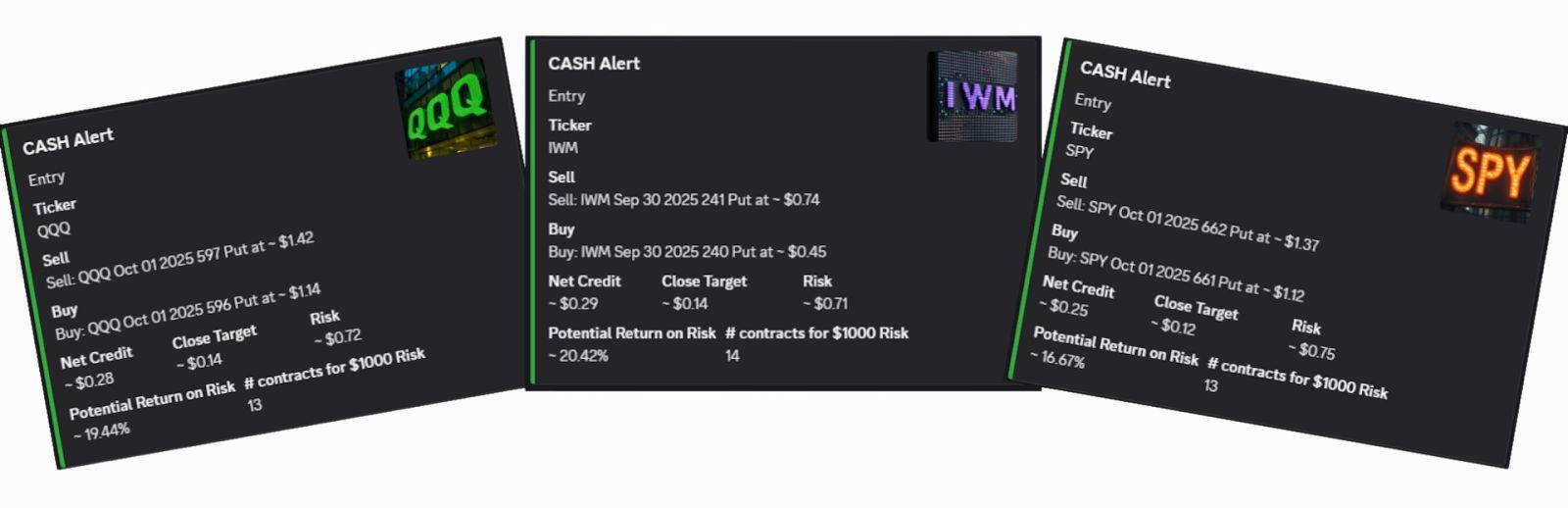

P.S. Would You Like 3 Hot Cash Opportunities per Day… Delivered on a Platter?

My CashBot is showing folks what seems to be a better approach to income trading.

With up to 3 opportunities to target cash every day, CashBot is changing the game for day traders