We’ve all been sold the dream about artificial intelligence, right? The shiny future where AI cures diseases, solves climate change and maybe even figures out why teenagers never clean their rooms.

But here’s what nobody is really talking about: AI isn’t delivering us a Jetsons-style future — it is creating an electricity crisis that looks more like something our great-grandparents dealt with in 1905.

And I’m not kidding here. A single top-of-the-line Nvidia (NVDA) GPU — that little engine powering this AI magic — guzzles as much electricity as an entire American household. Just one.

Now picture this: A single data center can house a million of these GPUs. Do the math. That is like powering a million households from one building.

What we are witnessing isn’t just an innovation boom — it is an electricity grab of epic proportions. The U.S. is going to need to add the equivalent of 10 to 20 brand-new nuclear plants in the next few years just to keep up with the demands of ChatGPT and everything like it.

That pressure isn’t happening in the future — it is happening right now.

The Power Players

If you want to understand who is steering this massive demand for electricity, look at the new robber barons of the digital age. The hyperscalers — Google parenty Alphabet (GOOGL), Meta (META), Microsoft (MSFT) and Amazon (AMZN).

These companies are not just consuming power; they are reshaping the entire grid to feed their growing AI engines.

While everyone debates whether AI will help or hurt society, these giants are busy buying land next to major transmission lines, cutting private deals with utility companies, building proprietary power plants and even shopping for small nuclear reactors.

They are not waiting for permission — they are building the infrastructure of the next era and locking up the prime real estate along the way.

Where Smart Money Goes During a Power Grab

Here’s where things get interesting from a trading perspective. When there’s a gold rush, you don’t just bet on the guy with the gold pan — you sell the picks and shovels.

And right now, the picks and shovels of the AI revolution are all about power. Electricity is the gold mine and the hyperscalers have already taken the best claims.

But the companies that keep the lights on — literally — are positioned to benefit long before the AI hype settles. This isn’t going to be all sunshine and self-driving cars — it is going to be a bare-knuckle brawl for electricity.

The firms that build, supply and stabilize the grid are the ones worth watching.

Key Players in Energy Solutions: Constellation Energy (CEG), the largest nuclear operator in the country, recently locked in a 20-year agreement to supply power to Meta’s expanding AI data center footprint. Moves like this show where the real leverage sits — with the companies that can produce reliable, large-scale energy when the hyperscalers come calling.

So yeah, you need to be prepared and potentially make some money on this thing to help offset those rising costs. This story isn’t about AI taking your job — it is about AI taking your electricity. And for smart investors, that could be a happy ending.

Jeffry Turnmire

Jeffry Turnmire Trading

I host my “Morning Monster” livestream at 9:15 a.m. ET each weekday on YouTube, and then “30 Minutes of Awesome” at 5 p.m. ET each Tuesday!

Please check out my channel and hit that Subscribe button!

You can also follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+6TdDE7-F6GlhMmJh

Important Note: No one from the ProsperityPub team or Jeffry Turnmire Trading will ever message you directly on Telegram.

I’m just a regular dude in Knoxville, Tennessee: a husband, father, civil engineer, urban farmer, maker and trader.

I’ve been at this trading thing with real money for 20-plus years, and started paper trading over 35 years ago. I have a knack for making some epic predictions that just may very well come true. Why share them? Because I like helping other people — it’s the Eagle Scout in me.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

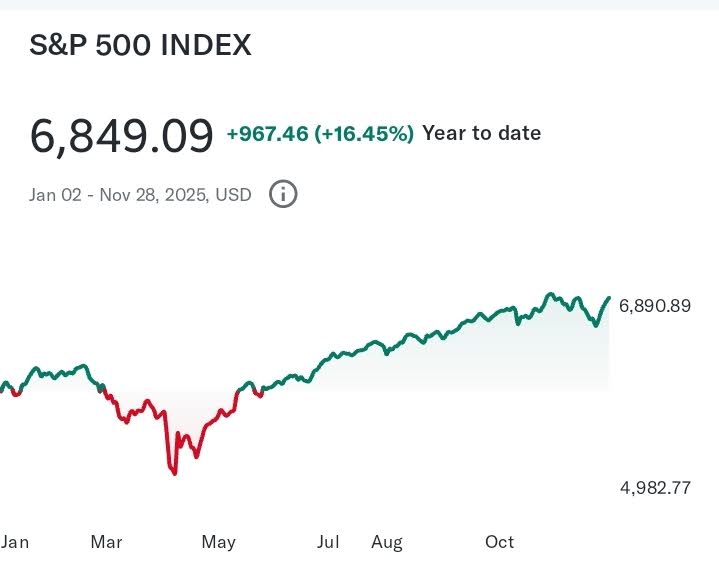

P.S. Could We See a Breakout This Month?

The S&P 500 just broke its run of seven consecutive winning months in October, and so did the Nasdaq.

We’re going to find out if this break is a temporary breather for the market as it prepares for its next move higher…

Or a signal for even more bleeding across the market.

Until then, I’m targeting quick wins on short-term setups starting today.

And thanks to my No. 1 breakout algorithm flagging stocks primed for potential breakouts…

Savvy traders have been able to get in on some of the market’s most unexpected breakouts on names you won’t even consider trading.

Right now, we’ve already seen the names ready for action and we’re geared up to go after them.

I can’t make absolute guarantees when it comes to trading…

But if you’d like a look at the stock I’ve got on my radar right now…

As well as see the algorithm flagging these interesting breakout stocks…

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading past performance is not indicative of future results. The profits and performance shown today are not typical. We make no future earnings claims, and you may lose money. From 4/17/24 – 11/24/25 the result was a 73% win rate on 2,077 trade signals with an average hold time of 3 days on the underlying stock.