We all have plans.

The long-term kind. Plans that are equal parts financial and dream. We lean into them when days get tough. With the dream part motivating work to satisfy the financial part.

Mine involves a sailboat. A full-keel, ocean going custom-built 40-foot plus Some-Thing-Or-Other from which I can sail anywhere a sailboat can reach from an ocean.

And the name I’ve penciled in for said yacht is Willful Flea.

As in a willful flea tossed about in a sea of chaos. Windswept and rain battered, the Willful Flea isn’t really calling the shots of Destiny. But the will at the helm cares where it’s going. And by meeting wind and sea at conditions edge, onward the Flea will charge through time and circumstance.

Wind and waves will have their way. But the Willful Flea will have a say.

Well…at least that’s how the story goes in my head.

Plus, you know…cocktails.

Alas, the Flea is a way off. Two kids still to put through college and all that.

And long before I christen the Flea, I — like you — must navigate the chaos of Fringe Markets…

A Bigger Orbit

Think about what markets were like just two years ago.

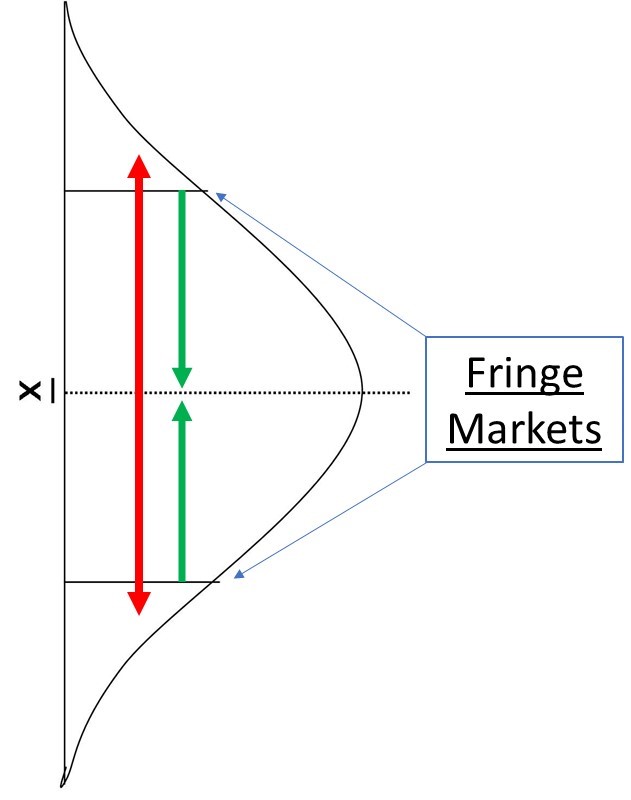

Volatility was low, stock prices advanced steadily, and even a mere 2% pullback on the S&P would spark panic in the newsroom.

And that’s not too surprising given that, over the last 10 years, 70% of all trading days witnessed stock markets moves less than 1%. That works out to annual volatility below 15% — very calm by historical standards.

But those calm markets are a thing of the past.

Daily moves have already shot up by at least 50% (The VIX Index — a measure of expected annual volatility — averaged 25% over the last year). And the trend in bigger, daily moves seems to be accelerating as the VIX spent much of this year above 30% — or 2%-plus per day.

Now, that can be frustrating for many traders and investors accustomed to a “low vol” climate. But I consider volatility a feature, not a bug.

Rather than orbiting close to the 1% center, daily price moves now routinely venture out well past the 2%-plus fringe. These are the fringe markets. And with more stocks passing back and forth from the upper fringe to the lower fringe more frequently, that opens up a massive opportunity to make volatility work for you.

And with what’s clearly coming down the pike, the volatility feature of the market is about to get a big upgrade.

When the Velocity Match Meets the Money Supply Tinder

Today’s inflation fears lead to tomorrow’s food shortages.

Farmers in Europe’s bread basket — Ukraine — will likely plant 50% less acreage this year (I can’t believe they’re planting any). Soaring natural gas prices, plus knock-on shortages from the war in Ukraine, have trebled fertilizer costs, forcing farmers to fertilize less. For rice farmers, this results in a 10% reduction this year — or more than a months’ worth of global rice consumption — in rice harvests. Similar reductions could be experienced in the U.S. for wheat and corn.

This alone makes for a fragile global food market, making the effect of any additional shocks from things like drought that much dramatic.

Food and fuel riots are already underway in developing markets. And even here in the West, where barely a person alive has any memory of unwillingly skipping a meal, we could experience missed or meagre portions before the year is out.

Maybe Jen Psaki will just rebrand the whole mess as intermittent fasting…

To make matters worse, once the price of any “one big really important thing” passes the political pain point, you can be certain that the D.C. mandarins will mandate supply crushing price caps, driving prices only that much higher as a result.

And that leads to less goods for more money to chase.

Which points out that food shortages aren’t the only inflation motivators. The wage-price spiral has begun in both Wall Street (interns now get $16,000 per month) and main street (grocery workers from San Luis Obispo to San Diego just scored big this month).

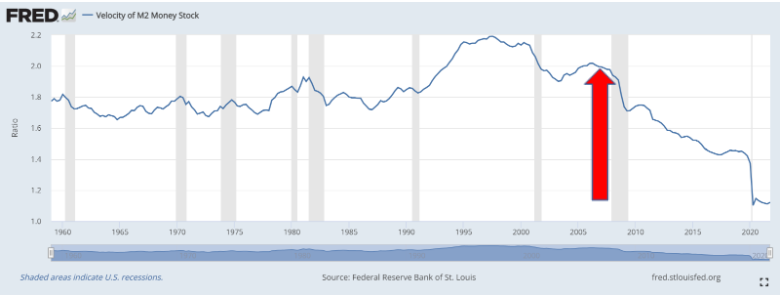

And all the dollars sloshing around ($6 trillion sit on commercial bank balance sheets as reserves) might actually end up in circulation (a little late, thank you Powell). And once the money velocity match (never been lower in 60-plus years of tracking it) hits the $6 trillion money supply tinder, all bets are off.

Velocity measures how many times the money supply turns over in a year. As economic activity increases, the same amount of dollars get spent more often, driving money velocity higher.

Once the Federal Reserve started printing money in earnest (red arrow), velocity began its collapse as money supply increased much faster than the economy. All it takes is a spark to spook people into demanding more dollars to pay for anything they can and velocity will soar and so too will inflation.

And with sanctions rending the global dollar bloc in two, decades of globalization and open markets are giving way to export bans and taking care of your geopolitical own.

Which ultimately goes way beyond food. Should we manage to only go so far as a Cold War II, we’ll still end up with regional resource wars flaring up left and right.

Custom Built for Life On the Fringe

It’s hard to make sense of it all. Even when you see something coming clearly, the mind still boggles acknowledging it.

But you want to pay attention to it.

Because then you will realize, with the slow-moving train wreck unfolding clearly before our eyes, you’ll want a Willful Flea trading strategy of your own.

Whether stock markets rise or fall is irrelevant.

A 100% rally in the S&P 500 from here is as likely as a 2,500-point drop.

And fringe markets will feel like both.

Financial markets are in for a reckoning. Investors and traders need to adapt to drastically different market conditions.

So, join me Thursday, April 21 at 7pm Eastern. I want share with you what I see coming along with the trading method I’ve developed to adapt to Fringe Markets.

You are free to register here.

Plus, there’s no reason you can’t listen in with a cocktail in your hand.

Think Free. Be Free.