The bull market of the last 13 years created some phenomenal returns for equity investors.

From the October peak in 2007, just before the Great Financial Crisis got rolling, and December of last year, the Dow Jones rose 164%. The S&P 500 climbed 206%. And the Nasdaq 100 shot up 651% (mostly because tech stocks had more ground to cover from the bursting of the internet bubble of 2000).

That span included the longest and second largest bull market in history. Only the building of said internet bubble surpassed that period in terms of returns.

But I would submit that were it not for three specific tailwinds driving stock prices higher, those returns would have not been possible.

And today, those tailwinds are now headwinds. Creating the bear market we’re seeing now.

And when you place those headwinds alongside the turmoil spreading around the world, one thing becomes clear.

The stage is set for a historic collapse in global markets.

One that will make the Global Financial Crisis of 2008 look like the opening act that it was.

Tell Yourself What You Want, But…

Now, I understand it’s tempting to be Pollyannish about that turmoil. The apparent safety of a boiling frog’s perspective traps most investors. Especially when their paychecks depend on their clients staying long stocks.

But you got to be honest with yourself about what kind of market you’re in. You must take seriously what your eyes see going on in the world.

Things like a global inflationary fire feeding off 13 years of money printing and debt.

A volatile geopolitical landscape that includes:

- the consequences of that inflation

- war and rumors of more war

- the breakdown of a decades old U.S.-centric world order

- the likely break-up of Europe (I’ll take wagers with a 24-month expiration date in my public Telegram channel)

- total supply-chain reinvention

- culture wars and political polarization of unprecedented proportions

- and so on…

But even if you ignore this chaotic geopolitical backdrop…

Even if you somehow explain it away like every equity fund manager, big broker Chief Investment Officer, NGO economist, central banker, or talking head on TV, equity markets still face those headwinds.

And those headwinds would give us a bear market no matter what else was going on in the world.

Factoring It In

Beginning in 2008, Federal Reserve stimulus in the form of historic rate cuts and Quantitative Easing provided a massive and sustained boost to spending.

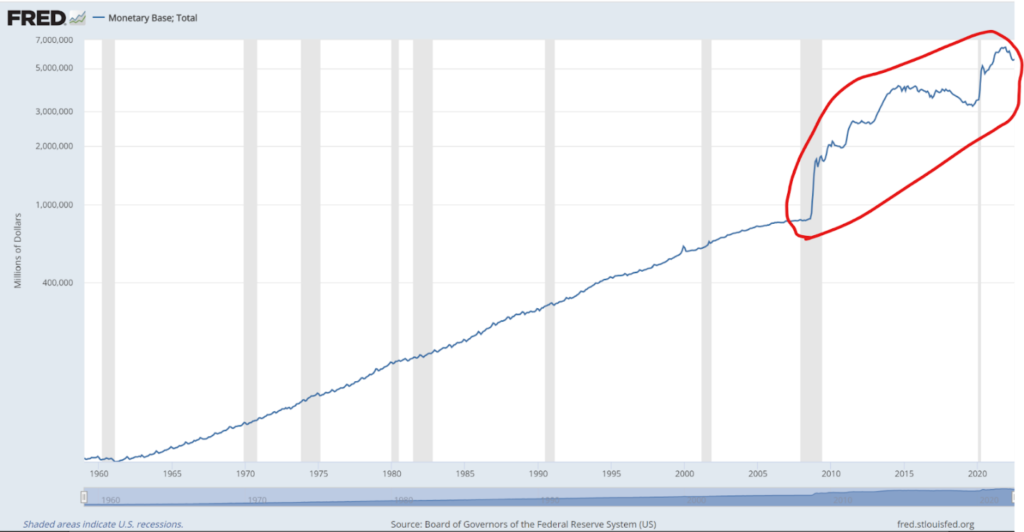

Here’s the Federal Reserve’s monetary base stretching back to before 1960 (it’s on a log scale to see the year-over-year progression on a relative basis).

That growth was basically stable for 50 years. But then the Fed hit the panic button, taking a base of $800 billion to more than $6 trillion.

That is a lot of extra money to spend.

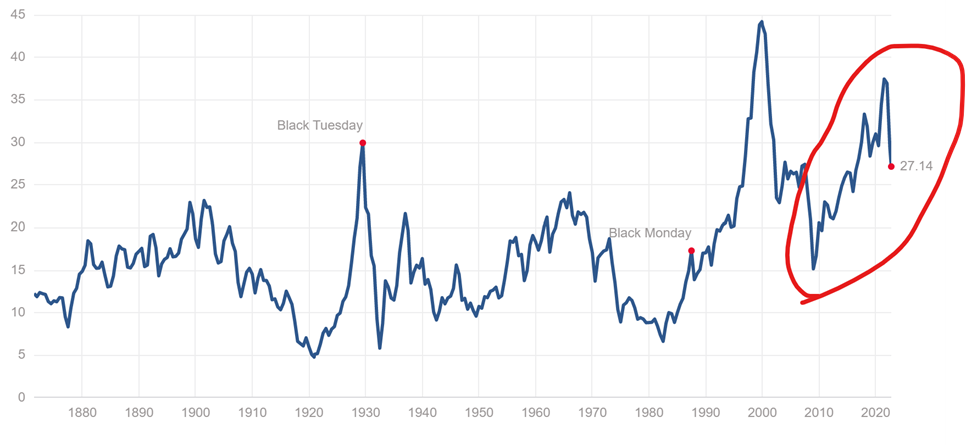

All this extra money boosted earnings and, more importantly, expectations for even more earnings growth as evidenced by the second highest P/E multiple of all time (according to the Shiller model of real earnings – https://www.multpl.com/shiller-pe ).

Only the internet bubble priced in more earnings growth.

Let’s call the first tailwind – excess growth expectations – the G-plus factor.

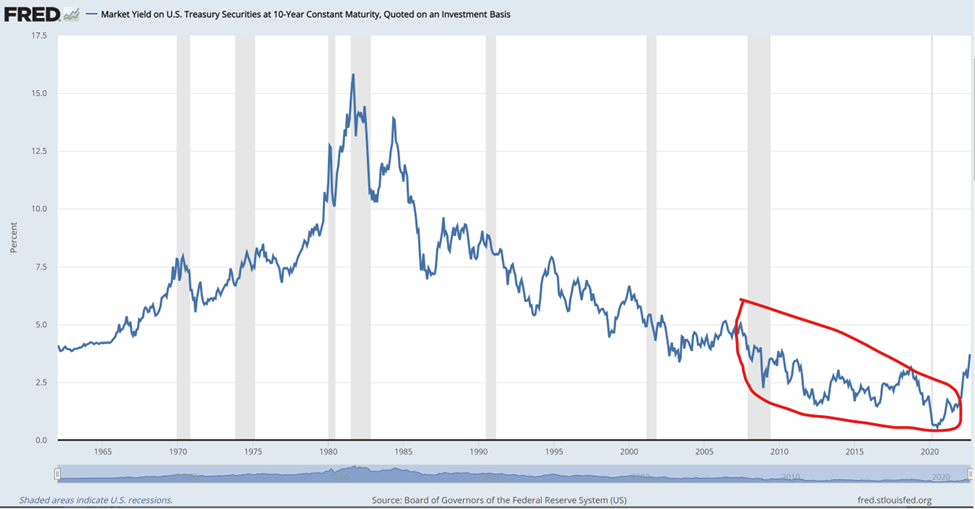

And the same stimulus that drove G-plus also lowered interest rates across the board.

And those lower interest rates made future expected earnings worth more today – present value of money and all that – creating another tailwind to stock prices.

Call that second tailwind the PV-plus factor.

All the while, inflation expectations stayed contained, as you can see by the low and stable inflation expectations built into bond prices in the chart below.

And stable, low inflation expectations increased the purchasing power of the extra money expected from those G-plus and PV-plus factors. Let’s call that I-plus.

So, for over a decade, G-plus, PV-plus, and I-plus (that is, earnings expectations, rock bottom interest rates, and minimal inflation) were the stock price tailwinds. And it all started with absurdly easy money.

But a Federal Reserve on the inflation warpath means those tailwinds are now headwinds. It’s now less consumer spending, increasing interest rates, and high inflation.

In other words, G-minus, PV-minus, and I-minus are headwinds at work against stock prices. And these headwinds are so powerful that stocks have a long way to fall before all those minuses get priced in.

In short, we’re in a bear market. And a volatile geopolitical scene only increases the risk that this bear market will morph into something far more severe.

To hear more about bear market tailwinds and how to navigate them, check out my latest presentation. And, next week, I’ll show how much bear market I think you should be budgeting in once you factor in all the chaos as well.

Take What the Markets Give You

P.S. If you want to follow along as the global financial system implodes, join my FREE Prosperity Pub Community over in Telegram. You will learn ways to make their errors work for you.