Nothing better represents the perils of narrow-minded ideology than a cult.

Jim Jones and his socialist utopia in Jonestown. David Koresh at Waco. Marshall Applewhite and Heaven’s Gate. They drove themselves and others off the cliff to see their one-dimensional ideas through.

You could argue that they at least had belief. But belief absent respect for the unknown yield’s extreme arrogance. And extreme arrogance got them, and their followers, killed.

Well, Central Bankers have a cult.

They reject epistemic humility – a respect for the unknown and unknowable – by presuming the ability to balance the needs and wants of billions of individuals.

After all, they are the high priests and priestesses of money. By secret knowledge gained through sacred texts, they are shown the true price of money.

Duty bound to shepherd money towards Nirvana, the Money Mandarins presume themselves adept at ushering in a more prosperous, stable world.

Unfortunately, that extreme arrogance is about to lead the rest of the world over an ideological cliff…

Don’t Let Experience Get in the Way

For over 30 years, the Bank of Japan (BOJ) has clung desperately to the idea that inflation creates growth and, for 30 years, have failed at creating either.

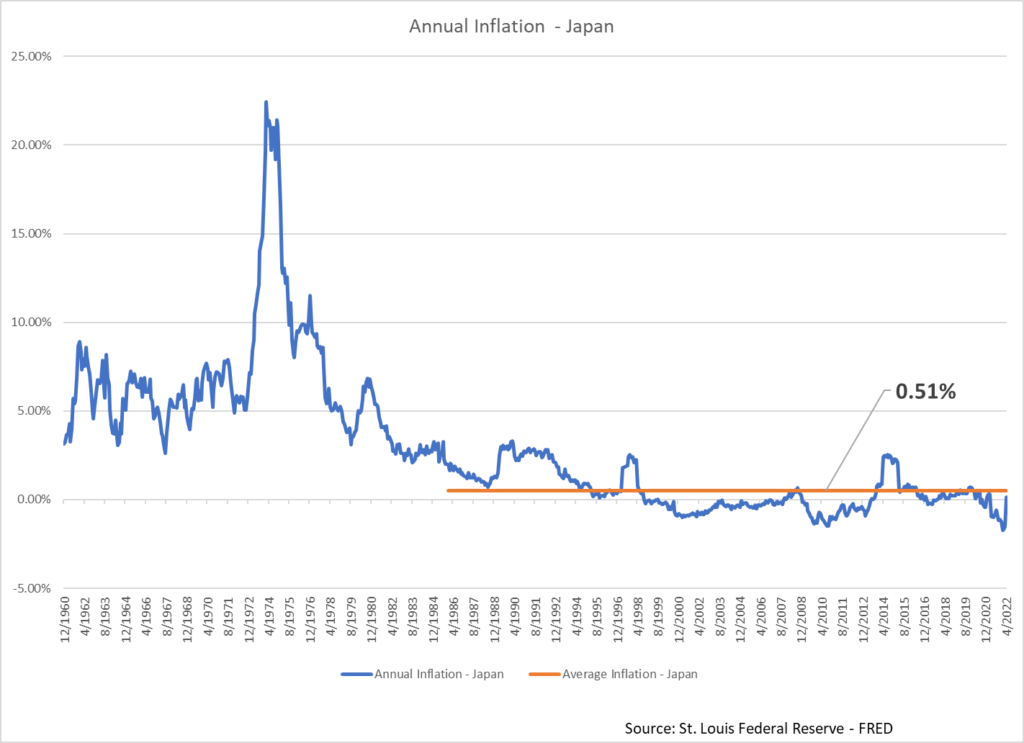

Since 1985, inflation in Japan has averaged a meager 0.51% (the orange line in the chart below).

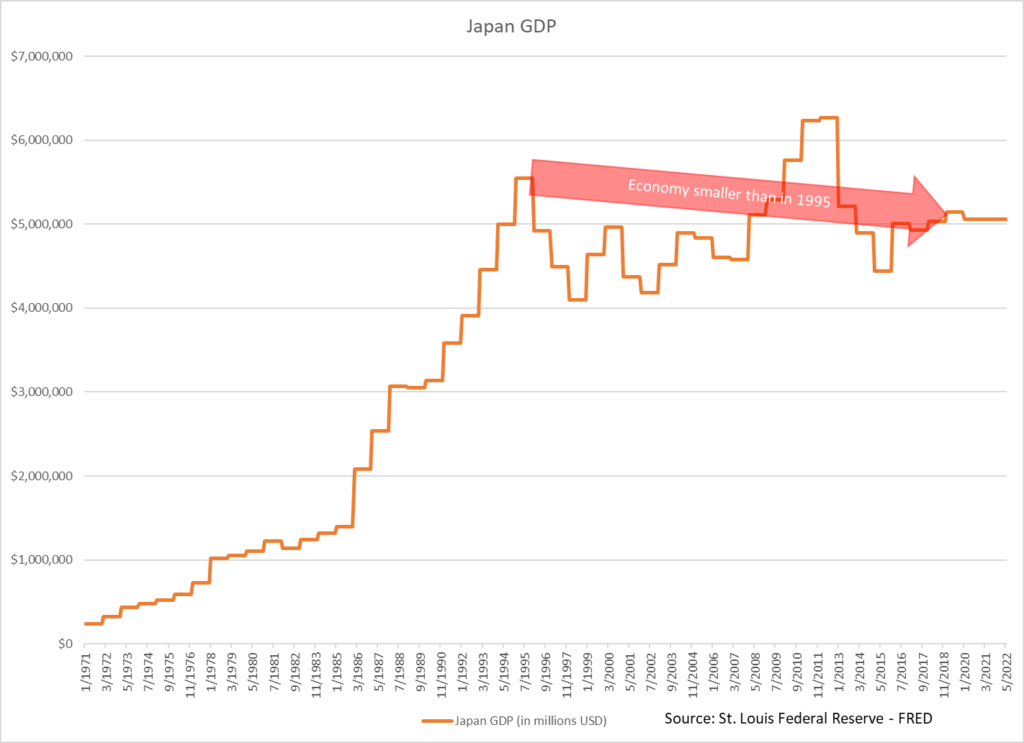

And Japan’s economy is smaller than it was in 1995.

Even in a world of 8 to 9% inflation rates, Japan has only yet managed 2.5%.

But, like any good cult, the BOJ is committed to the inflationary ideology.

And, to paraphrase H.L. Mencken, I think they’re about to get exactly what they want, good and hard.

Cheaper Saki for Me

There are two basic paths for inflation. The first of which is bond prices.

When inflation rises, investors demand higher bond yields to compensate. The result is lower bond prices.

But higher yields crimp economic growth. And as evidence of how aggressively the BOJ will resist growth crimping higher rates, it recently bought 1.5 trillion-yen worth of JGBs in a single day — a truly phenomenal pace. Plus, on Friday it backed up its commitment by promising to buy as many 10-yr Japanese Government Bonds (JGBs) as it takes to keep bond yields at or below 0.25%.

Which leaves us with the second path — a falling exchange rate.

When inflation increases in a country, the value of its currency falls because who wants to hold onto a currency that will buy less in the future. And since the central bank is buying up as many bonds as they can to keep yields low, holders of the currency can’t lend it at a higher rate.

With no other option, holders dump their currency therefore driving the exchange rate (FX) lower.

And, when it comes to falling FX, ancient central banking wisdom has some very important things to say.

According to Holy Writ:

“A lower Yen exchange rate means Japanese goods look cheaper to foreign markets. Cheaper goods drive export demand higher. As workers strive to meet that higher demand, exports become the primary engine driving economic growth — So mote it be.”

And with inflation fires cropping up the world over, the BOJ finds itself presented with an opportunity to get the inflation it so desperately seeks.

Both Timely and Unique

Most countries are eager to rid themselves of the inflation under which they currently suffer.

By letting the Yen fall, the BOJ can import that inflation by forcing Japanese consumers to pay more for imported goods and drive economic growth by selling cheap goods (i.e., exporting deflation) to the world.

This alignment of incentives to drive the Yen lower presents not only a timely and unique opportunity for the BOJ to generate inflation it also presents a timely and unique opportunity for traders to short the Yen.

How far will it fall?

Many hedge funds seem to think that the BOJ can’t defend the 0.25% line in the sand. And just like George Soros and Jim Rogers went after the Bank of England in 1992 (and got fabulously wealthy in the process), hedge funds are selling JGBs hoping the BOJ will relent.

If they surrender soon, the Yen will strengthen and the hedge funds win.

However, I think the BOJ is a committed central bank cultist. Inflation will fail to generate meaningful growth for the Japanese economy because it is fundamentally broken. Thus, the BOJ will persist down the falling FX path.

This stubborn pursuit of a failed ideology could spark a hyperinflationary decline in the Yen. A truly stupendous fiat supernova.

And once they pass that cliffs edge, other central banking cultists could soon follow.

PS> On Monday I’ll tell you how my group and I are playing what I believe to be the coming crash of the Yen. To trade the play alongside us, you can join our trading group. Anyone can with a brokerage account can put it on.

If you want to get more up-to-the-minute thoughts about the Yen crash, you are free to join my Telegram group any time you’d like.