Very intelligent people can build compelling logical constructs based on a fallacy.

When you’re good at it, they call you a philosopher. When you’re great at it, you get a job as a consultant.

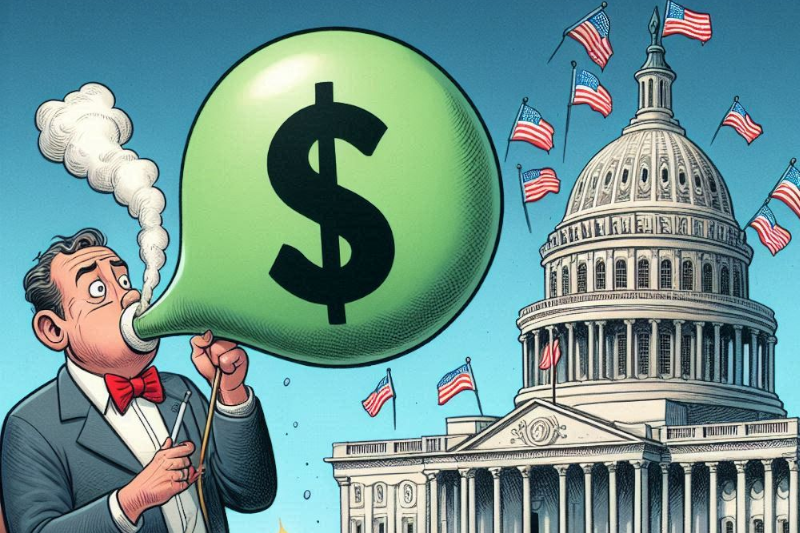

And when you create logical fallacies with money, you get to a be a central banker.

What’s the primary central banker fallacy? Centrally planned money provides more price stability than competitive markets can alone.

But the truth (and I don’t know why this still must be pointed out after being provably false for decades) is that centralized decisions fail. Whether the price of money or five-year plans, central planning only creates more problems. And they do so without solving the problem they intended to solve in the first place.

Central banking’s intellectual foundations ignore the incredible power of choice and competition to create and disseminate information through price discovery.

To ignore this power is like believing in perpetual motion machines.

Which reminds me of something Kurt Vonnegut once wrote…

Hocus Pocus

“[Professor Tarkington] was not well educated, and was more a mechanic than a scientist, and so spent his last 3 years trying to invent what anyone familiar with Newton’s Laws would have known was an impossibility, a perpetual-motion machine. He had no fewer than 27 contraptions built, which he foolishly expected to go on running, after he had given them an initial spin or whack, until Judgment Day.”

“[The school where he taught] took 10 machines we agreed were the most beguiling, and we put them on permanent exhibit in the foyer of this library underneath a sign whose words can surely be applied to this whole ruined planet nowadays:

THE COMPLICATED FUTILITY OF IGNORANCE”

Kurt Vonnegut, “Hocus Pocus”

In 2008, central bankers of the world embarked upon a massive and unprecedented easy money experiment.

They invented new monetary tools such as quantitative easing, opened portals to other central banks through swap lines, foisted a host of new metrics on banks, and branded many financial institutions as “systemically important financial institutions” all in the name of promoting economic stability and growth.

But all that whacking is futile. Rather than letting bad ideas die, they simply dampened the signal that money sends.

Artificially contrived negative interest rates boosted consumption, earnings, and asset values far beyond sustainable levels. Historically cheap financing greenlighted almost any start-up or corporate project. It papered over sloppy capital allocation mistakes. It fueled a crypto boom that gave meaningful value to some of the dumbest ideas ever presented to humanity. And the investing climate that freer-than-free money fostered made almost anyone a brilliant investor — so long as they were long.

But those days are over.

Fourteen years on, it’s time to walk it all back. And without the energy of freshly minted money, economic momentum will collapse just like physical momentum dissipates in perpetual motion machines.

Clever, but Not Wise

Arguments favoring central banking ignore the power of price just like Tarkington’s perpetual-motion machines ignored simple physics.

Even today, the Federal Reserve thinks it can give interest rates a spin or a few whacks and, presto, inflation will settle in around its 2% average inflation target without driving up unemployment too much. Meanwhile, the Bank of England, the Bank of Japan, the European Central Bank — and all other central banks — share similar delusions that exaggerate their omnipotence.

It’s not that central bankers lack intelligence. But like most intellectuals, they see the world through logic that justifies their existence. Their reasoning is untempered by the real world in which the rest of us live.

Unfortunately, these delusions, rather than simply wasting time, pose significant threats to society as central banks scramble in reaction to past spins of their perpetual motion logic.

Whether you follow them down this dangerous path is up to you.

You can continue to put faith in their imagined ability to deliver price stability without sacrificing growth. Keep buying dips hoping this time stocks have found their bottom and see where it leads.

Or you can reject their core fallacy and trade based on the knowledge that centrally planned money, like all central plans, end in failure.

Take What the Markets Give You

P.S. For those of you that reject the logic upon which central bank fallacies are built, join my Prosperity Pub Community over in Telegram. You will learn ways to make their errors work for you.

While you’re at it, join The Daily Pick. For only $9 a month you get a trade a day. As you’ll see when you join, these trades don’t depend on the Fed’s ability to centrally plan success.