With Gulfstreams lining the runway in Jackson Hole, the money engineers and central planners got their annual boondoggle underway yesterday.

The math. The linear models shoehorned to fit a non-linear world. The presumption of control…what’s not to like?

Plus, it’s prime time for the Ivory Tower types to show off finance lingo like “non-accelerating inflation rate of unemployment” (NAIRU), “equilibrium” of all kinds, and a new one — “rational inattention.”

Unfortunately, the Ivory Tower is the only view the wonks in Wyoming have ever had. Besides trading based on inside-the-Fed information, none have a lick of Nassim Taleb’s skin-in-the-game.

Whether the models work or not is beside the point. The point is perception. And the perception among the J-Hole crowd is they can always hatch a new plan.

But because we live in the real world, let’s look at how their plan is going so far…

Unstable Foot Work

Central to the Federal Reserve’s central planning is price stability.

For the uninitiated, that translates into “I can be confident that the cost of stuff today is a good approximation of the cost of stuff next year.”

Well, I think we all know how that panned out. Consumer prices up 9%. Producer prices up 17%. Few among us penciled that into our plans. Even fewer retain any confidence that price stability returns anytime soon.

And here’s something the Fed didn’t plan on — a bare knuckle inflation fight.

Time to Get Real

In finance lingo, there are two types of rates — nominal and real.

Nominal rates ignore the impact of inflation. Real rates do not. But nominal rates are the ones we see traded in markets (with the only exception being inflation-indexed bonds).

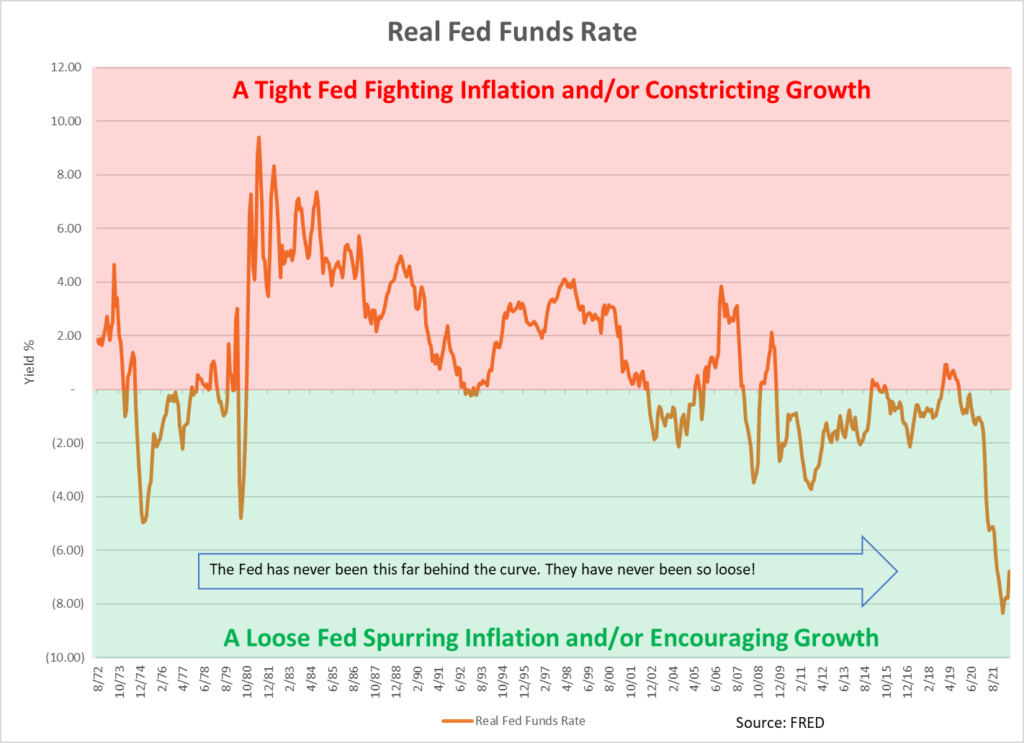

To view nominal rates in real terms you need to subtract inflation from them. There are lots of ways to do this. Some are forward-looking. Others look to the past. But to give you a sense of the real Fed Funds rate without being unnecessarily complex, I subtracted the 12-month change in the Consumer Price Index or CPI (the most common measure of inflation) from the Fed Funds rate in the chart below.

When the real rate is positive (in the red zone), you can say the Fed is fighting inflation. Yet, despite a 150-basis point increase in the nominal Fed Funds rates so far in this tightening cycle, it’s clear that the Fed hasn’t even stepped in the ring.

The Fed spent the better part of this year planning for (and selling the perception of) transitory inflation while the more permanent kind began beating away at long-term price stability.

And given how badly the market reacted to a Fed still in the locker room getting its knuckles wrapped, ask yourself how the market will respond when the Fed starts taking the 100 to 200 basis point rate hike swings needed to get into the inflation fight.

The Fed is hopelessly, hilariously behind the ball. The inflation brute they unleashed looms large in the corner. And the Fed must go through the economy to get to it.

Unfortunately, two decades of easy money and bailouts created a frail, stimulus-addicted economy that can’t take a punch.

As I said last week, the rope-a-dope rally of July and August is dead. And since the Ivory Tower types at the Fed have plenty of plans and no real skin in the game, equity markets have a long way to fall before pricing in the inflation fight to come.

Think Free. Be Free.