Thanks to all of you that turned up to check out my Crypto Unleashed special report last week.

For those of you that caught it, I trust you walked away with some insight into the rising tide of decentralized assets currently underway.

Indeed, Crypto’s Great Leap Forward will have a tremendous impact on how business gets done.

It will shift Ethereum from a startup sandbox to a virtual superhighway. It will create an entirely new $100 trillion economic frontier populated by smart contracts.

And it will propel Bitcoin from speculative asset to money.

But the CryptoVerse will not emerge in a vacuum. Crypto will move everyone’s cheese.

And the ensuing disruption – especially the whole “Bitcoin to money” part – will heap healthy portions of both CryptoVerse creation and Fiat World destruction onto everyone’s plate.

That’s because Bitcoin possesses the dollar’s antidote. Its strengths – decentralized, permissionless, secure – assault the dollar’s weakness from all sides. It further weakens the already ebbing impact of multi-trillion-dollar stimulus packages.

In short, it’s a poison pill for an overreaching state.

And Bitcoin is just one of the many forces actively working to undermine the U.S. dollar network…

Abusing the Sovereign Gift

Number One on the list of U.S. dollar threats is, unfortunately, U.S. policy.

In 2007, the Federal deficit came in at $161 billion. In 2020, the deficit hit over $2.7 trillion.

And Congress couldn’t have ramped up spending like that without the explicit support of the Federal Reserve.

Remember, every dollar gets borrowed into existence. And as the U.S. government borrowed the Federal Reserve obliged by turning that borrowing into nearly $9 trillion in new money.

Plus, with COVID, war, and sanctions choking global supply chains, those dollars-now-counted-in-trillions are chasing far fewer goods.

Which, of course, gives us those rising consumer prices otherwise known as inflation.

At last count, those prices rose 7.9% over the last year. At least according to the “official” stats. But I hope you know as well as I do that were you to see those stats lying on the street, you’d make sure not to step in them.

A better estimate indicates inflation rising at nearly twice what the heavily massaged official 7.9% stat suggests.

And with sanctions forcing countries with massive geopolitical influence to work towards a Petro-Dollar Plan B, those 9-trillion dollars will soon be chasing even fewer goods.

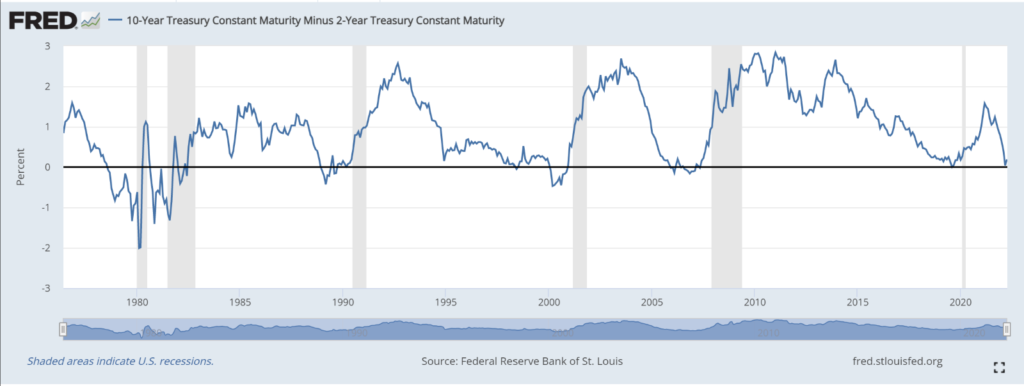

We haven’t even got to the part were the Fed crushes growth by hiking rates more than the economy can bear. Though, according to the graph below, bond yields are already flashing recession – and they just barely got started.

When 2-year treasuries yield more than 10-year treasuries, the blue line drops below the straight, black line running across the middle of this graph at 0%. The grey areas mark recession. Since the 70s, every time the blue line dips below the black, recession soon follows.

I personally doubt the FOMC has the stomach for hiking rates into a recession. They will tuck-tail and run. Which means leaves even more inflation in store.

Inflation has already transformed from the run-of-the-mill kind to “boy, this is really cramping my budget”. But once the inflation process starts to feed on itself, well…inflation will morph from budget cramping to the “dump dollars and buy anything you can” hyperinflationary kind.

And when that happens, it will feel like it morphed overnight.

Take What the Market Gives You

Of course, we’re talking about the convergence of multiple massively disruptive forces. The path I just laid out for the dollar is only one of the formerly-too-wild-to-acknowledge paths moving up the probability scale.

Every one of those paths would have seemed nuts to most bystanders just two short years ago. But the point is, with everything going on in the world, ”nuts” just got a whole lot more likely.

The S&P 500 up another neck-cracking 25% this year? Sure, that could happen – especially if the Fed tucks tail and runs. But so too could a bowel-vacating stock market drop given the fact that nuclear war is now openly discussed. Or that China, Russia, Saudi Arabia and others now seek advantage from exiting the dollar-based system. (The more the dollar’s influence wanes, the less goods each dollar fetches.)

Or, and you don’t really hear much about this yet, that soaring global food shortages will reach far beyond the borders of underdeveloped countries as early as this summer.

Whatever way the dice roll, this much is certain – the days of “only one way but up” markets are gone. At least for a while.

In its place – uncertainty-fueled volatility.

The market used to give gains. And over the past 10 years, you could take those gains by simply buying stocks.

But now, rather than reliably taking your stocks higher, year-after-year, the market will give you something different.

I want to help you take what the market is giving you now. To prove it, tune into my livestream webinar this Thursday, 11 am Eastern.

You are free to join here. Bookmark the page and mark your calendar. It’ll be you, me, and a whole lot of reasons why you can expect a reckoning for the Fiat World – and the dollar that props it all up.

Think Free. Be Free.