JOIN ME LIVE AT 9 AM ET FOR: TECHNICAL TUESDAYS

This is all about chart work. I’ll break down price levels, key patterns and potential trade setups. It’s where I’ll show how I’m drawing levels and setting entries and exits based on what the market gives us.

There’s serious talk about a tariff dividend that’s bothering me — it’s basically sending stimulus checks to American households funded by tariff revenue.

And while that might sound appealing on the surface, I can’t shake the feeling that we’re setting ourselves up to repeat one of the most painful market lessons from recent history.

Let me walk you through why this has me so concerned, starting with what we learned from the 2020–21 stimulus experience.

The 2020 Stimulus Playbook and What Happened Next

Back in 2020 and 2021, the government distributed three stimulus checks totaling $1,200, $600 and $1,400 to qualified households. In total, $814 billion was distributed across these programs.

The transcript highlights that a significant portion of this — approximately $100 billion — ended up flowing into the stock market. That’s about 12% of the total stimulus finding its way into equities, which is a substantial amount when you consider the overall market impact.

So what did this accomplish? It added fuel to asset prices.

It helped push markets to all-time highs. And it ultimately ended up in the hands of asset holders and the wealthy.

But here’s what really matters — what happened next. The market melted up into 2021, then turned in a 30% correction in 2022. Why?

Because the Fed started raising rates aggressively to combat the inflation that stimulus helped create, and we could see that very same scenario again…

Why This Tariff Dividend Idea Concerns Me

Now we’re talking about doing something similar with tariff revenue, and I have serious reservations about this approach.

First, the tariff revenue was originally supposed to be used to pay down U.S. deficits. Instead, if we’re going to redistribute it as dividends to households, we’re not actually addressing our fiscal challenges.

Second, what does this do for inflation? If we distribute billions of dollars in dividends, and a meaningful percentage of that flows into the stock market and assets, we’re adding fuel to an economy that’s already running hot.

Look, I understand this could be good for households in the short term. It could provide a boost to the stock market. It could lift asset prices. But I can’t think how this should go well.

The 2020-21 experience was great in the moment, with markets reaching all-time highs. But we paid the price in 2022 with that brutal correction.

My biggest concern? Are we trying to make the Fed backpedal and raise rates again? Because if this tariff dividend fuels inflation instead of helping the economy in sustainable ways, that’s exactly what could happen.

I’m watching this situation closely, and I remain deeply skeptical. The playbook from 2020-21 looked brilliant until it didn’t — and I’m not eager to run that experiment again.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. Why My #1 Weekly Setup Has Been Tagged “The Most Reliable”

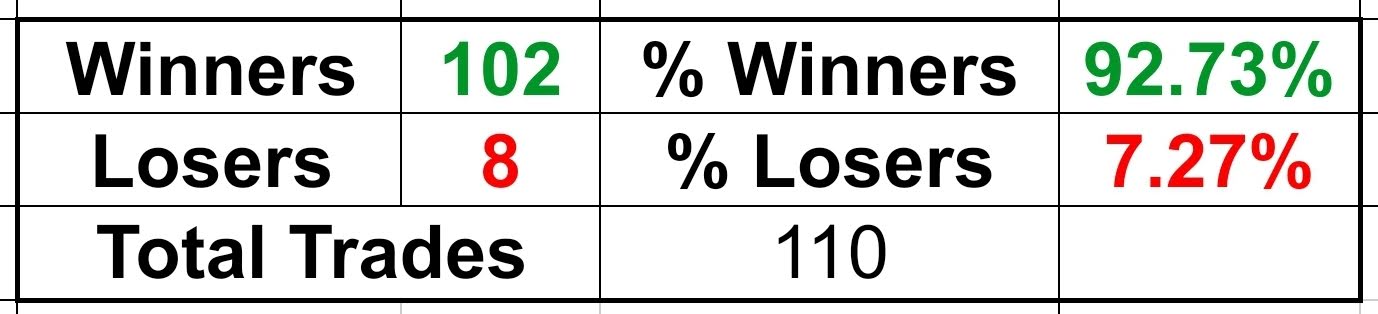

Over the years, my #1 setup for targeting decent windfalls from the market every week has gained a lot of fame.

With traders who have seen it in action calling it the most “reliable trade” in the market.

And although they’re not very far from the truth, it doesn’t mean you’re 100% guaranteed a win on every trade.

If you take a look here, you’ll see we’ve won 102 trades out of 110… Which means we’ve had a couple that didn’t go our way.

However, the fact that these setups rely on one of the market’s most consistent weekly patterns is what has shot it up the ranks to become one of the safest trades out there.

If you’d let me, I’m willing to show you how this setup came to be, as well as how you can begin deploying it on your own.

Interested?

Then Head Over Here To Get Started

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading past performance is not indicative of future results. From 9/30/24 – 11/07/25 on live trades the win rate is 92%, 16.5% average return, with an average hold time of 12 days.