JOIN ME LIVE AT 9 AM ET FOR: FAST MONEY FRIDAYS

Apple’s massive move this week has really caught my attention — and honestly, it’s got me thinking about more than just the obvious headline.

Apple (AAPL) surged 5.4% Wednesday on news of a $100 billion U.S. manufacturing pledge, with investors expecting major announcements on factory expansions and job creation.

The catalyst came from CEO Tim Cook and President Donald Trump’s announcement regarding Apple’s plans to onshore some manufacturing.

Here’s what’s interesting though…

I’m not entirely convinced this manufacturing move is the job creation story that some are making it out to be. If you’re bringing manufacturing stateside, it’s likely going to be light on the job side.

Let’s be honest, Apple wouldn’t do this out of the kindness of its heart…

A company’s main objective is to make money as efficiently as possible, so there has to be some type of tax benefit or subsidies involved.

Technical Levels to Watch

From a trading perspective, Apple’s sitting at some critical levels right now. We’re looking at a $3.26 trillion market cap, making Apple one of the top three or four companies globally, yet it’s still way behind the other Mag 7 stocks — until yesterday’s move, anyway.

The stock also popped another 3% on Thursday.

The key levels I’m watching are pretty straightforward. If Apple breaks below $190, that’s not a good spot. For this range to maintain its integrity, we need to see Apple continue working its way into the $220s, though there’s significant resistance around $225.

The AI Factor Nobody’s Talking About

What really stands out to me is the contrast between Apple and the broader tech narrative. Apple’s up over 8% in two days despite having zero progress in the AI space — and frankly, I don’t think that’s a bad thing.

Everything AI feels a little hype-y, a little bubbly right now, and Apple’s not participating in that language. Sometimes staying out of the hype cycle is exactly what you want to see from a mature company with Apple’s market position.

The manufacturing announcement gives Apple a different growth narrative — one that’s perhaps more sustainable than the AI fervor we’re seeing elsewhere in tech.

It’s worth keeping an eye on how this plays out, especially around those key resistance levels.

I’ll see you in the markets.

Chris Pulver

Chris Pulver Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram:https://t.me/+av20QmeKC5VjOTc5

- YouTube:https://www.youtube.com/@FinancialWars

- Twitter:https://x.com/realchrispulver

- Facebook: https://facebook.com/therealchrispulver

Important Note: No one from the ProsperityPub team or Chris Pulver Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

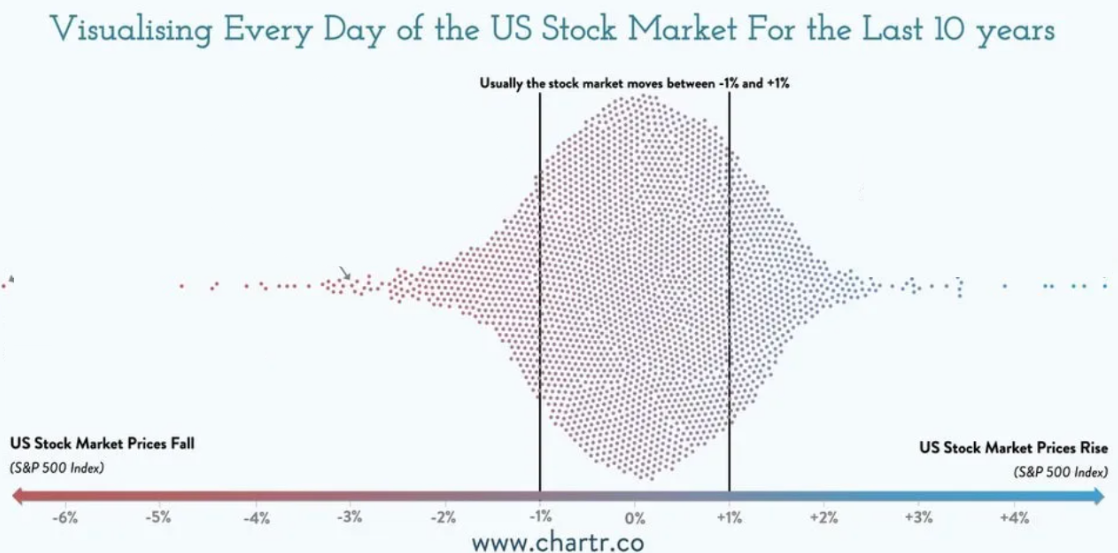

P.S. Stop Chasing Big Moves That Rarely Pay Off

Most trading days are dead flat…

But a new type of setup by the CBOE means that’s a GOOD thing.